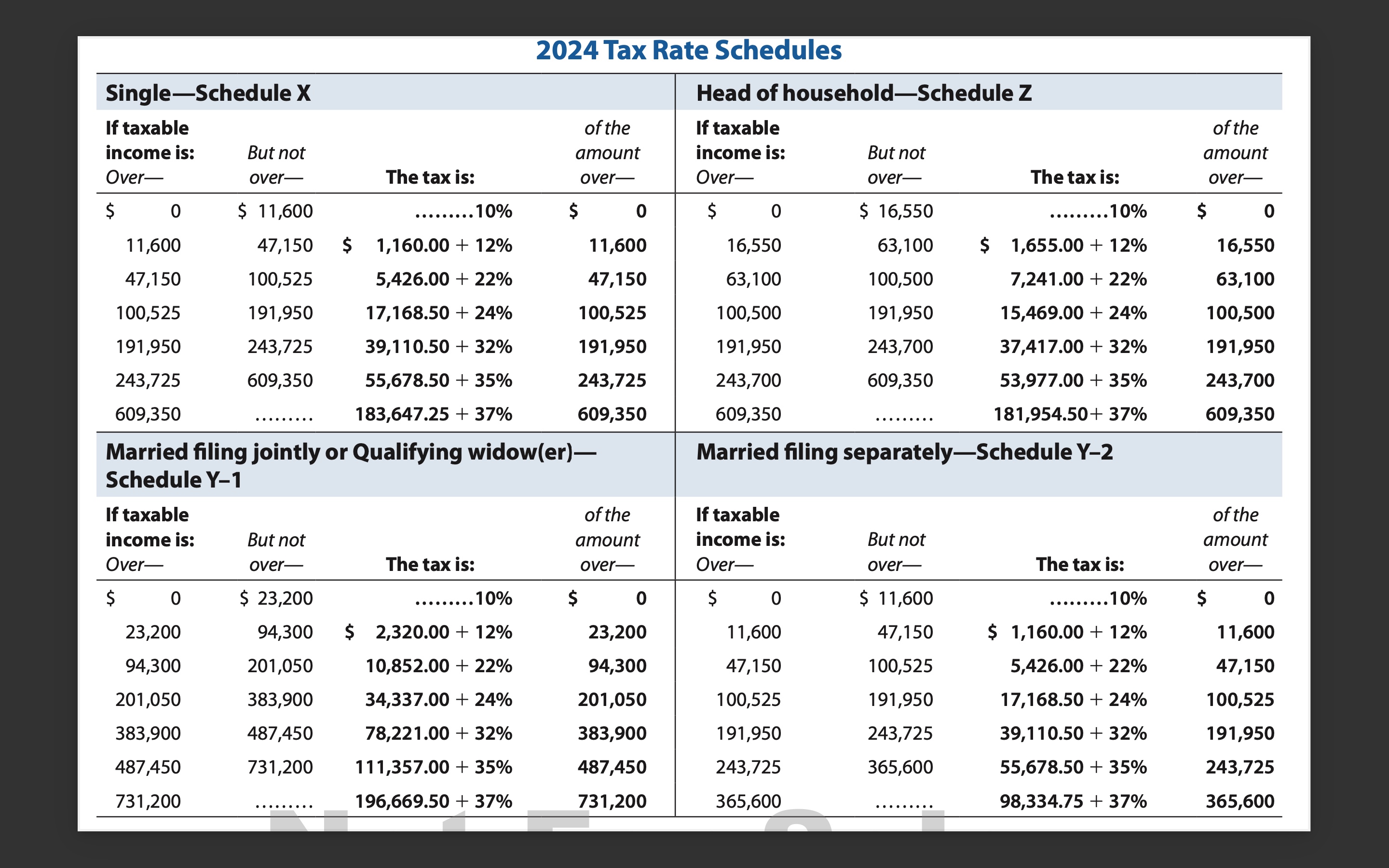

Question: Click here to access the 2 0 2 4 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round

Click here to access the tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage ie would be rounded to and entered as

a Chandler, who files as a single taxpayer, has taxable income of $

Tax liability: $fill in the blank

Marginal rate: fill in the blank

Average rate: fill in the blank

b Lazare, who files as a head of household, has taxable income of $

Tax liability: $fill in the blank

Marginal rate: fill in the blank

Average rate: fill in the blank Tax Rate Schedules

tableSingleSchedule XHead of householdSchedule ZtableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountovertableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountover$ $ $ $ $ $ $ $tableMarried filing jointly or Qualifying widowerSchedule YMarried filing separatelySchedule YtableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountovertableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountover$ $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock