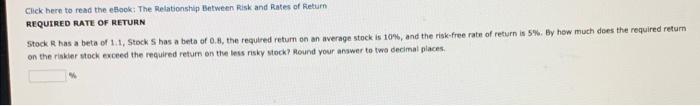

Question: Click here to read the book: The Relationship between Risk and Rates of Return REQUIRED RATE OF RETURN Stock R has a beta of 1.1,

Click here to read the book: The Relationship between Risk and Rates of Return REQUIRED RATE OF RETURN Stock R has a beta of 1.1, Stock S has a beta of 0.8, the required return on an average stock is 10%, and the risk-free rate of return is 5%. By how much does the required return on the risker stock exceed the required return on the less risky Mock? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts