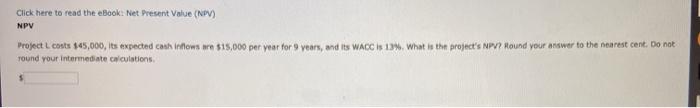

Question: Click here to read the eBook: Net Present Value (NPV) NPV Project L costs $45,000, its expected cash inflows are $15,000 per year for 9

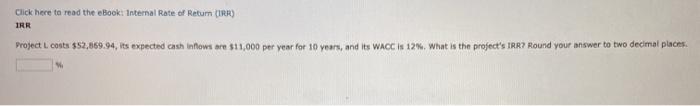

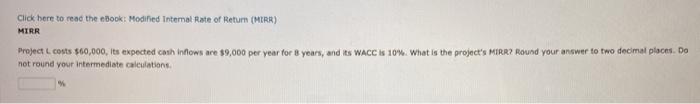

Click here to read the eBook: Net Present Value (NPV) NPV Project L costs $45,000, its expected cash inflows are $15,000 per year for 9 years, and its WACC is 13% What is the project's NP? Hound your answer to the nearest cent. Do not round your intermediate calculations Click here to read the eBook: Internal Rate of Retum (IRR) IRR Project.. costs $52,869.94, its expected cash innows are $11,000 per year for 10 years, and its WACC is 12%, what is the project's IRR? Round your answer to two decimal places Click here to read the eBook Modified Intermat Rate of Return (MTRR) MIRR Project L costs 500,000, its expected cash inflows are $9,000 per year for 3 years, and its WACC is 10%. What is the project's MIRR? Round your answer to two decimal places. De not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts