Question: Click here to read the eBook: Net Present Value (NPV) Click here to read the eBook: Internal Rate of Return (IRR) NPV AND IRR A

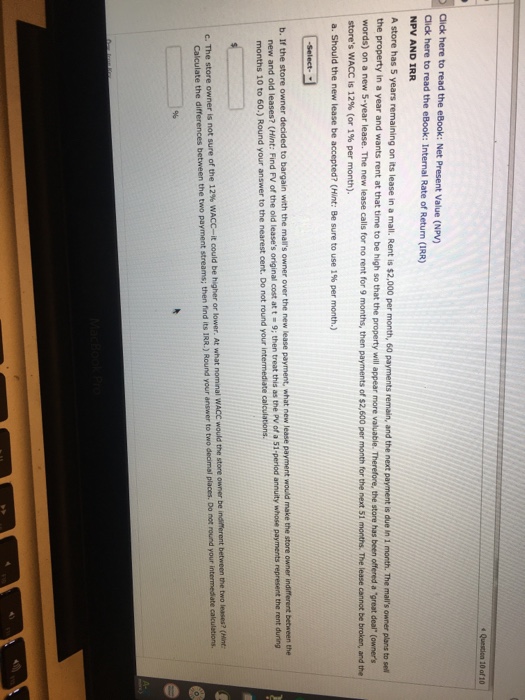

Click here to read the eBook: Net Present Value (NPV) Click here to read the eBook: Internal Rate of Return (IRR) NPV AND IRR A store has 5 years remaining on its lease in a mall the property in a year and wants rent at that time to be high so that the property will appear more valuable. Therefore, the store has been offered a "great deal" (owners words) on a new 5-year lease. The new lease calls for no rent for 9 months, then payments of $2,600 per month for the next 51 months. The lease cannot be broken, and the store's WACC is 12% (or 1% per month). . Rent is $2,000 per month, 60 payments remain, and the next payment is due in 1 month. The malr's owner plans to sel Should the new lease be accepted? (Hint: Be sure to use 1% per month.) b. If the store owner decided to bargain with the mali's owner over the new lease payment, what new lease payment would make the store owner indifferent between the and old leases? (Hint: Find FV of the old lease's original cost at t 9; then treat this as the PV of a 51-period annuity whose payments represent the rent during months 10 to 60.) Round your answer to the nearest cent. Do not round your intermediate calculations two leases? (Mint: wAcc-it could be higher or lower. At what nominal WACC would the store owner be indifferent between the places. Do nor Calculate the differences between the two payment streams; then find its IRR.) Round your answer to two decimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts