Question: Click here to read the eBook Profitability Ratios Problem Walk-Through RETURN ON EQUITY Pacific Packaging's Roe last year was only 5%; but its management has

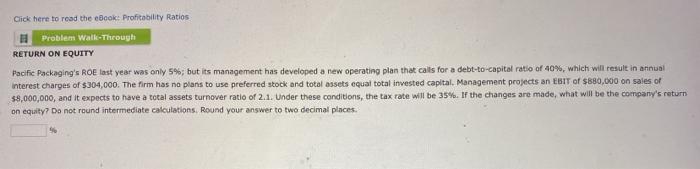

Click here to read the eBook Profitability Ratios Problem Walk-Through RETURN ON EQUITY Pacific Packaging's Roe last year was only 5%; but its management has developed a new operating plan that calls for a debt-to-capital ratio of 40%, which will result in annual interest charges of $304,000. The firm has no plans to use preferred stock and total assets equal total invested capital Management projects an EBIT of $880,000 on sales of 59,000,000, and it expects to have a total assets turnover ratio of 2.1. Under these conditions, the tax rate will be 35%. If the changes are made, what will be the company's return on equity? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts