Question: Click here to read the eBook: Ratio Analysis Click here to read the eBook: Liquidity Ratios Click here to read the eBook: Asset Management Ratios

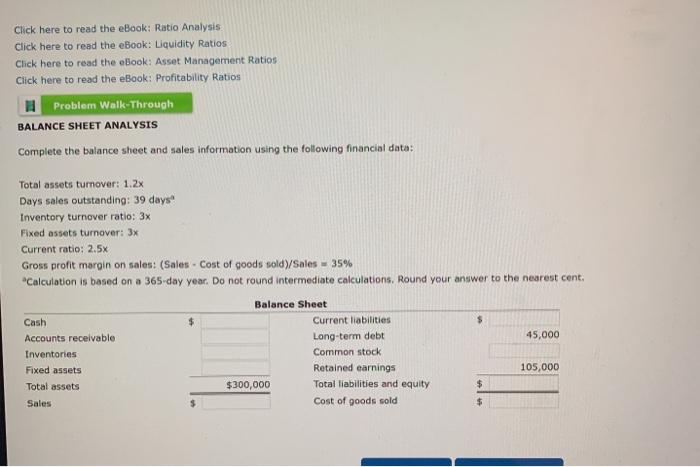

Click here to read the eBook: Ratio Analysis Click here to read the eBook: Liquidity Ratios Click here to read the eBook: Asset Management Ratios Click here to read the eBook: Profitability Ratios Problem Walk-Through BALANCE SHEET ANALYSIS Complete the balance sheet and sales information using the following financial data: Total assets turnover: 1.2x Days sales outstanding: 39 days Inventory turnover ratio: 3x Fixed assets turnover: 3x Current ratio: 2.5% Gross profit margin on sales: (Sales - Cost of goods sold/Sales - 35% "Calculation is based on a 365-day year. Do not round intermediate calculations, Round your answer to the nearest cent. Balance Sheet Cash Current liabilities $ Accounts receivable Long-term debt 45,000 Inventories Common stock Fixed assets Retained earnings 105,000 Total assets $300,000 Total liabilities and equity $ Sales Cost of goods sold $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts