Question: Click here to read the eBook: Using the Vield Curve to Estimate Future Interest Rates EXPECTATIONS THEORY Interest rates on 4-year Treasury securities are currently

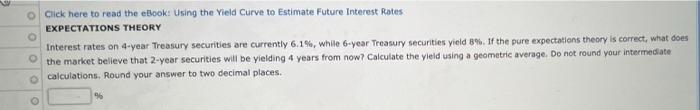

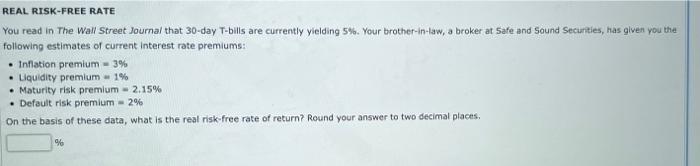

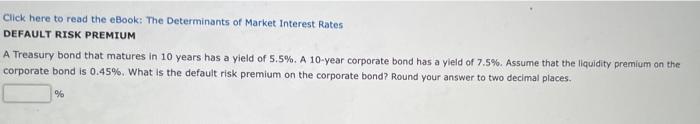

Click here to read the eBook: Using the Vield Curve to Estimate Future Interest Rates EXPECTATIONS THEORY Interest rates on 4-year Treasury securities are currently 6.1%, while 6-year Treasury securities yield 8%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal places. o REAL RISK-FREE RATE You read In The Wall Street Journal that 30-day T-bills are currently yielding 5%. Your brother-in-law, a broker at Safe and Sound Securities, has given you the following estimates of current interest rate premiums: Inflation premium - 3% Liquidity premium - 1% Maturity risk premium - 2.15% Default risk premium - 2% On the basis of these data, what is the real risk-free rate of return? Round your answer to two decimal places % Click here to read the eBook: The Determinants of Market Interest Rates DEFAULT RISK PREMIUM A Treasury bond that matures in 10 years has a yield of 5.5%. A 10-year corporate bond has a yield of 7.5%. Assume that the liquidity premium on the corporate bond is 0.45%. What is the default risk premium on the corporate bond? Round your answer to two decimal places %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts