Question: Click here to read the ellook: Bond Yields Click here to read the eBook: Changes in Bend Valurs over Time BOND RETURNS Last year Janet

Click here to read the ellook: Bond Yields

Click here to read the eBook: Changes in Bend Valurs over Time

BOND RETURNS

Last year Janet purchased a $ tace value corporate bond with an annual coupon rate and a year maturity, At the time of the purchase, it had an expected yleld to matarily of If Janet sold the bond today for $ what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places.

Hide Feedback

Incorreet

Click here to read the ebook: Bond Yields

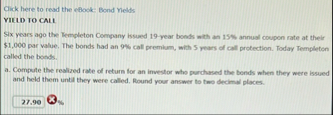

YILLD TO CAL

Six years ago the Templeton Company lssued year boods with an annual coupon rate at their $ par walae. The bonds had an call premlum, with $ years of call protection. Today Templetion called the bonds.

a Compute the realized rate of return for an lirvestor whe purchaned the bonds when they were lssued and held them until they were called. Round your answer to two decimal places.

Cick here to read the eflook: Bond Velds

VIKD TO CALI

Six years ago the Kempleton Company issued year bonds with an annual coupon rate at their $ par value. The bonds had an call premium, with pars of call protection. Today Templetion called the bosis.

a Compete the realired rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Bound your answer to twe decimal places.

Suppose you are the money manager of a $ million investment fund. The fund conslsts of four stocks with the following investments and betas:

tableStockImvestment,BetaA$B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock