Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 1 Not complete Marked out of 37.00 P Flag question Consolidation at date of acquisition (purchase price greater

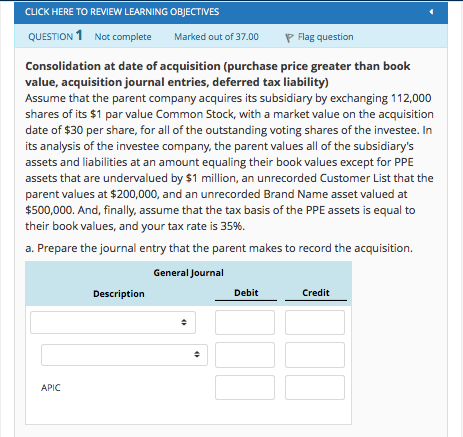

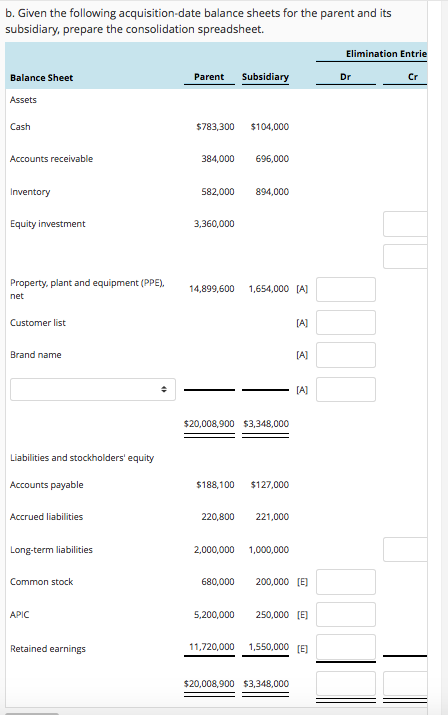

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 1 Not complete Marked out of 37.00 P Flag question Consolidation at date of acquisition (purchase price greater than book value, acquisition journal entries, deferred tax liability) Assume that the parent company acquires its subsidiary by exchanging 112,000 shares of its $1 par value Common Stock, with a market value on the acquisition date of $30 per share, for all of the outstanding voting shares of the investee. In its analysis of the investee company, the parent values all of the subsidiary's assets and liabilities at an amount equaling their book values except for PPE assets that are undervalued by $1 million, an unrecorded Customer List that the parent values at $200,000, and an unrecorded Brand Name asset valued at $500,000. And, finally, assume that the tax basis of the PPE assets is equal to their book values, and your tax rate is 35%. a. Prepare the journal entry that the parent makes to record the acquisition. General Journal Description Debit Credit APIC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts