Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 1 Partially correct Mark 5.65 out of 24.00 F Flag question Ratios from Comparative and Common-Size Data Consider

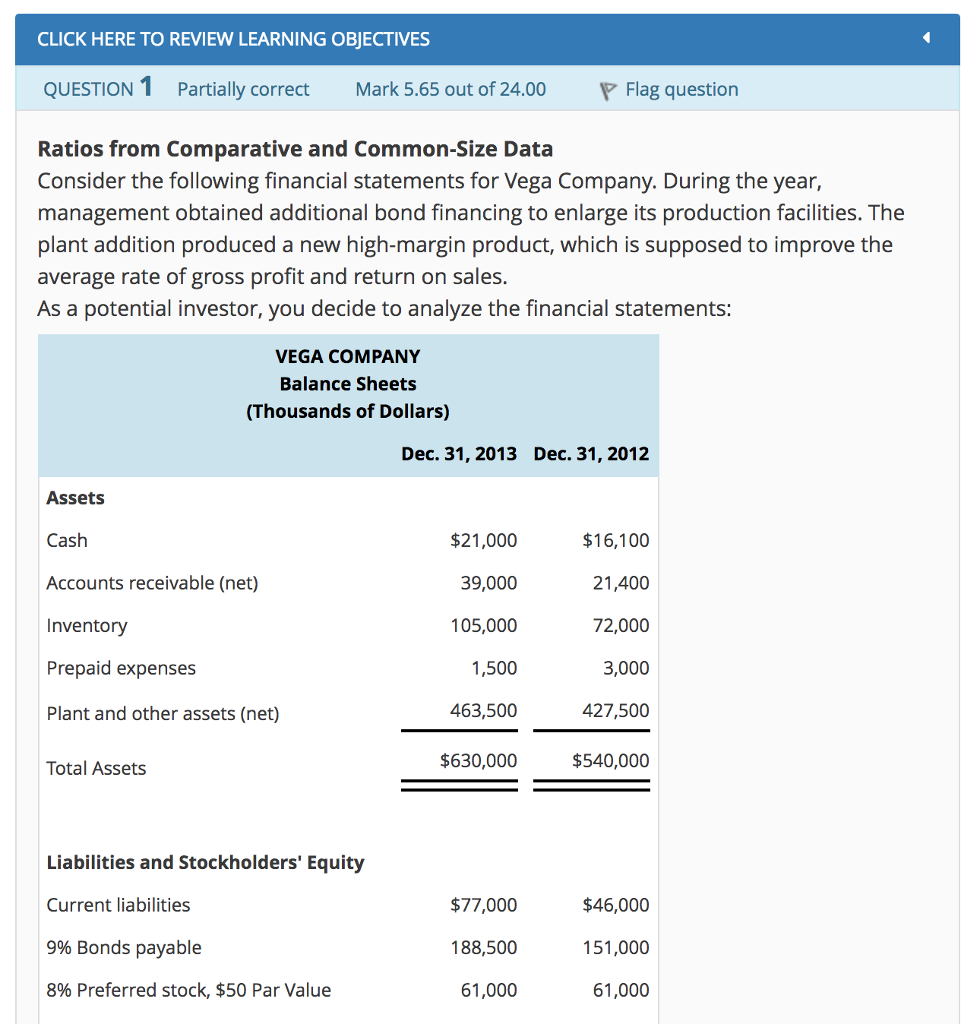

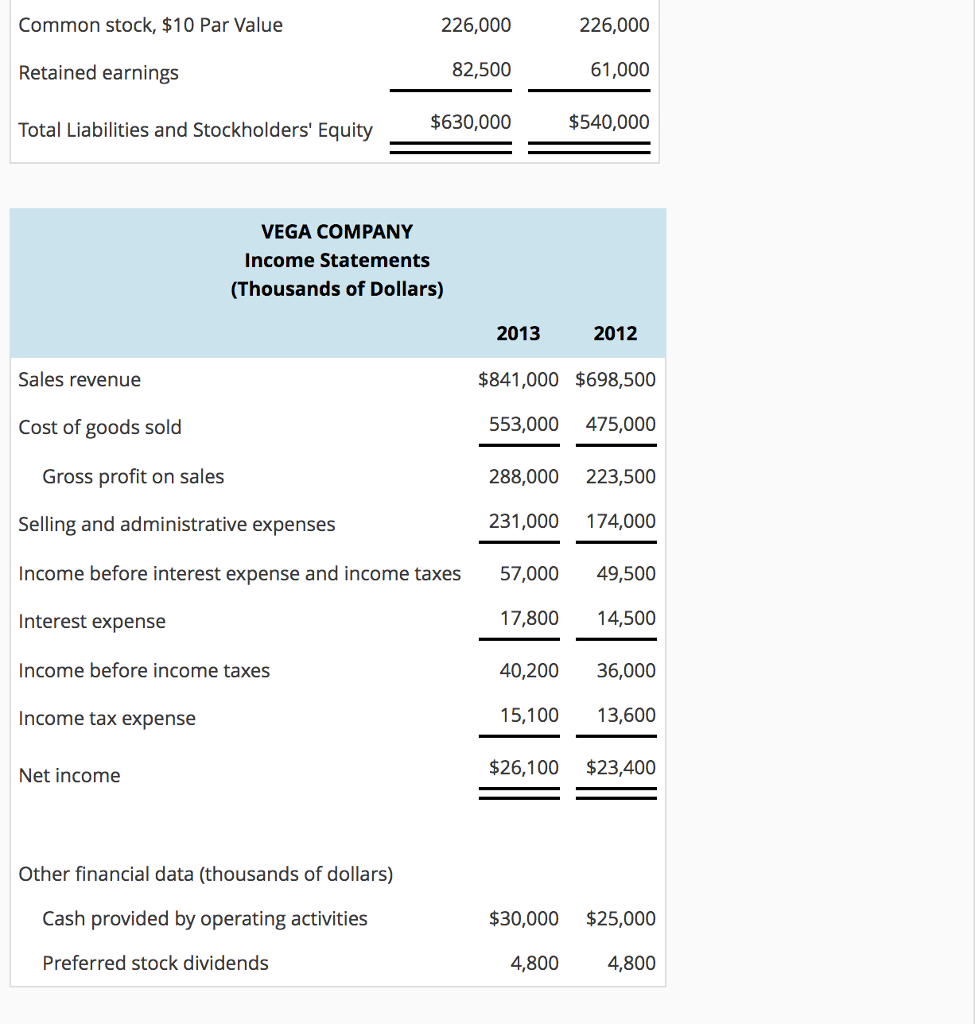

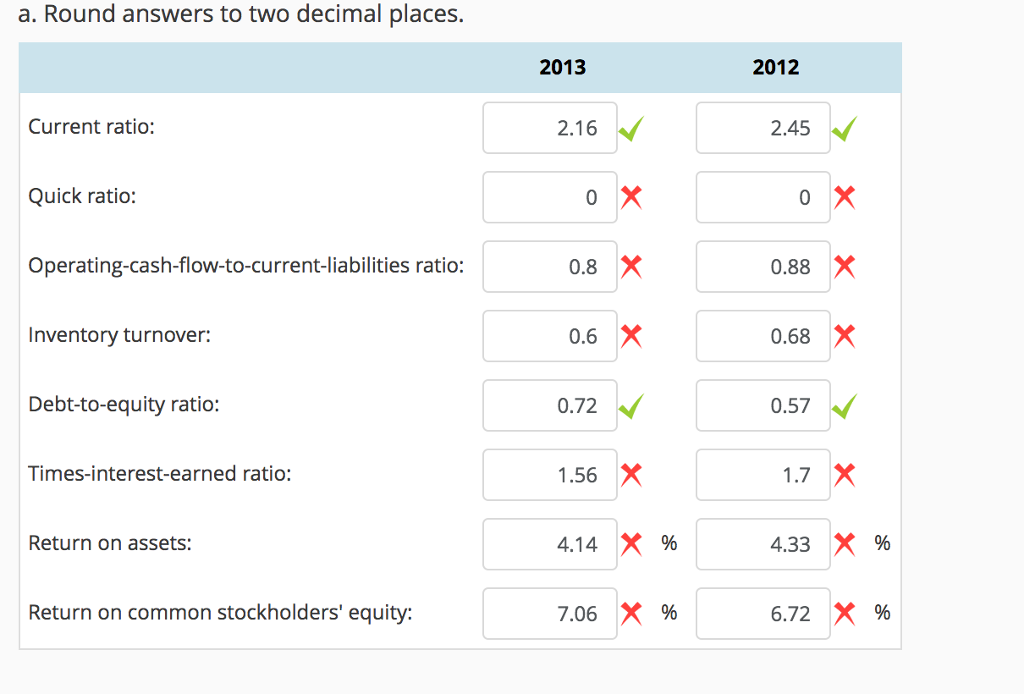

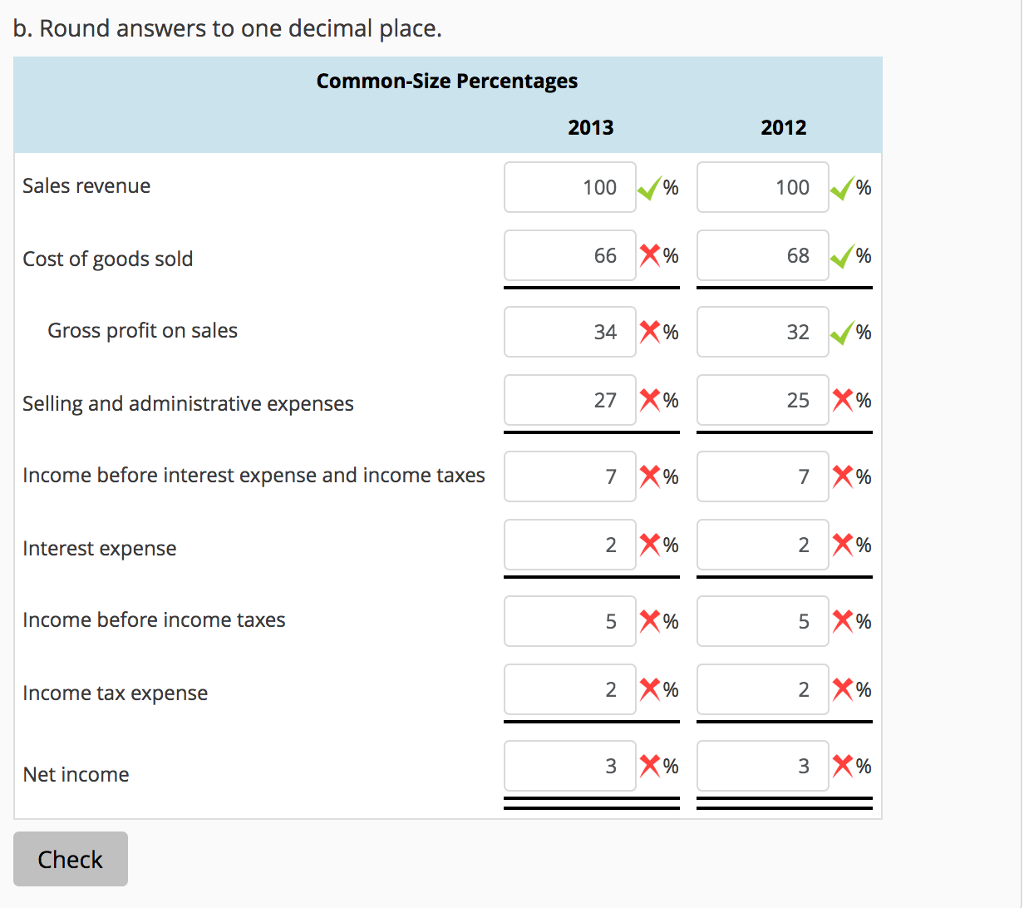

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 1 Partially correct Mark 5.65 out of 24.00 F Flag question Ratios from Comparative and Common-Size Data Consider the following financial statements for Vega Company. During the year, management obtained additional bond financing to enlarge its production facilities. The plant addition produced a new high-margin product, which is supposed to improve the average rate of gross profit and return on sales. As a potential investor, you decide to analyze the financial statements: VEGA COMPANY Balance Sheets (Thousands of Dollars) Dec. 31, 2013 Dec. 31, 2012 Assets $21,000 $16,100 Cash 21,400 Accounts receivable (net) 39,000 72,000 Inventory 105,000 Prepaid expenses 3,000 1,500 463,500 427,500 Plant and other assets (net) $630,000 $540,000 Total Assets Liabilities and Stockholders' Equity Current liabilities $77,000 $46,000 151,000 188,500 9% Bonds payable 8% Preferred stock, $50 Par Value 61,000 61,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts