Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 2 Partially correct Mark 26.00 out of 46.00P Flag question Flexible Budget Application The polishing department of Taylor

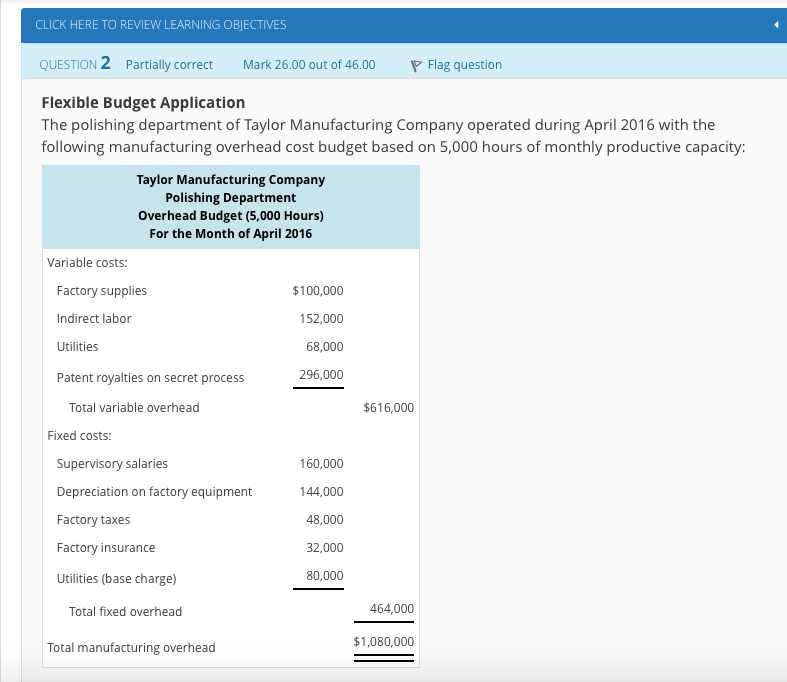

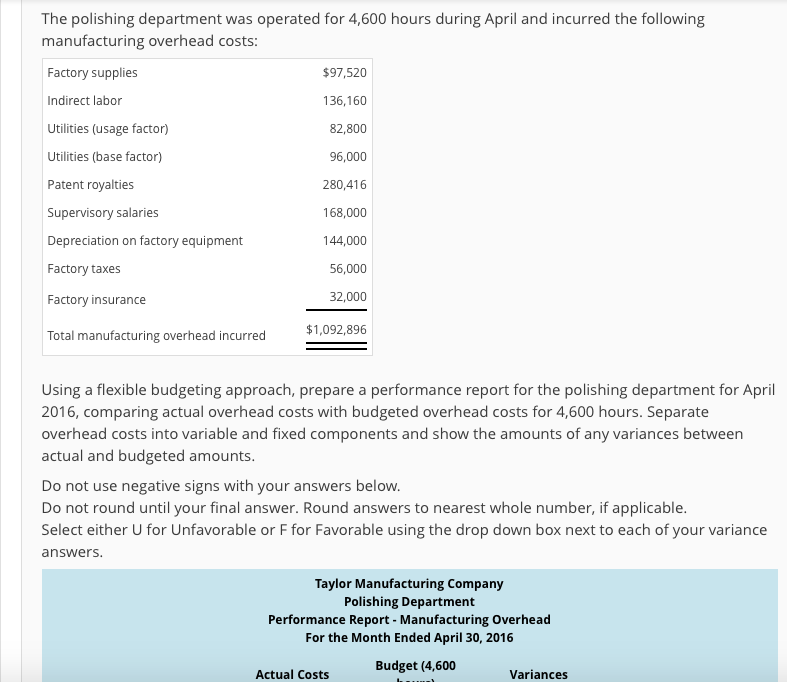

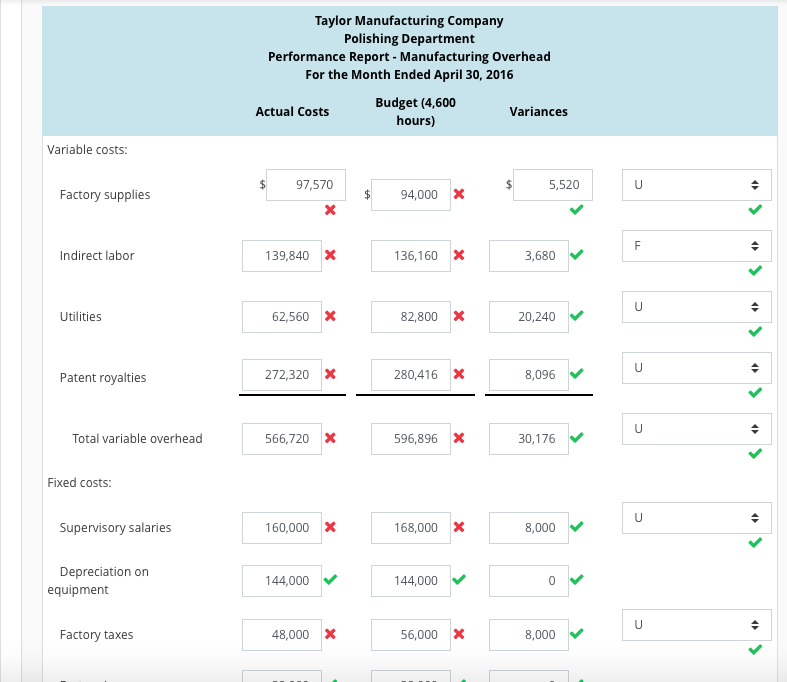

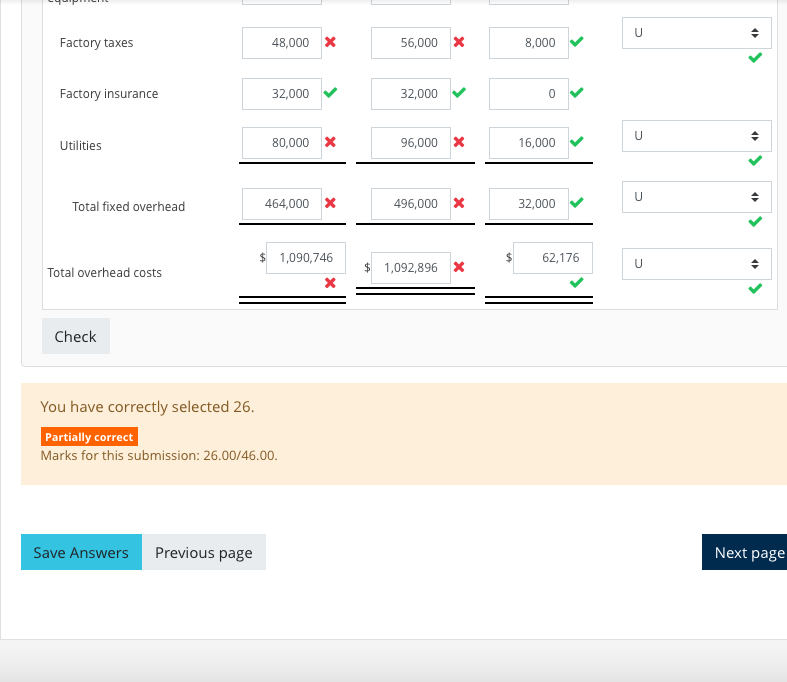

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 2 Partially correct Mark 26.00 out of 46.00P Flag question Flexible Budget Application The polishing department of Taylor Manufacturing Company operated during April 2016 with the following manufacturing overhead cost budget based on 5,000 hours of monthly productive capacity Taylor Manufacturing Company Polishing Department Overhead Budget (5,000 Hours) For the Month of April 2016 Variable costs: Factory supplies Indirect labor Utilities Patent royalties on secret process $100,000 152,000 68,000 296,000 Total variable overhead $616,000 Fixed costs: Supervisory salaries Depreciation on factory equipment Factory taxes Factory insurance Utilities (base charge) 160,000 144,000 48,000 32,000 80,000 Total fixed overhead 464,000 $1,080,000 Total manufacturing overhead The polishing department was operated for 4,600 hours during April and incurred the following manufacturing overhead costs Factory supplies Indirect labor Utilities (usage factor) Utilities (base factor) Patent royalties Supervisory salaries Depreciation on factory equipment Factory taxes Factory insurance Total manufacturing overhead incurred $97,520 136,160 82,800 96,000 280,416 168,000 144,000 56,000 32,000 $1,092,896 Using a flexible budgeting approach, prepare a performance report for the polishing department for April 2016, comparing actual overhead costs with budgeted overhead costs for 4,600 hours. Separate overhead costs into variable and fixed components and show the amounts of any variances between actual and budgeted amounts Do not use negative signs with your answers below Do not round until your final answer. Round answers to nearest whole number, if applicable Select either U for Unfavorable or F for Favorable using the drop down box next to each of your variance answers Taylor Manufacturing Company Polishing Department Performance Report - Manufacturing Overhead For the Month Ended April 30, 2016 Budget (4,600 Actual Costs Variances Taylor Manufacturing Company Polishing Department Performance Report - Manufacturing Overhead For the Month Ended April 30, 2016 Budget (4,600 Actual Costs Variances hours) Variable costs 97,570 5,520 Factory supplies 94,000X Indirect labor 139,840 X 136,160 x 3,680 Utilities 62,560 82,800 20,240 Patent royalties 272,320 X 280,416 x 8,096 Total variable overhead 566,720 X 596,896 X 0,176 Fixed costs Supervisory salaries 160,000 X 168,000 X 8,000 Depreciation on equipment 144,000 144,000 Factory taxes 48,000 56,000 X 8,000 Factory taxes 48,000 56,000 8,000 Factory insurance 32,000 32,000 Utilities 80,000 96,000 X 16,000 Total fixed overhead 464,000X 496,000 32,000 1,090,746 62,176 1,092,896 x Total overhead costs Check You have correctly selected 26 Partially correct Marks for this submission: 26.00/46.00 Save Answers Previous page Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts