Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 26 Not yet anwredMarked out of 3.00PFlag question Net Income Planning Planning Holland Corporation earned an after-tax net

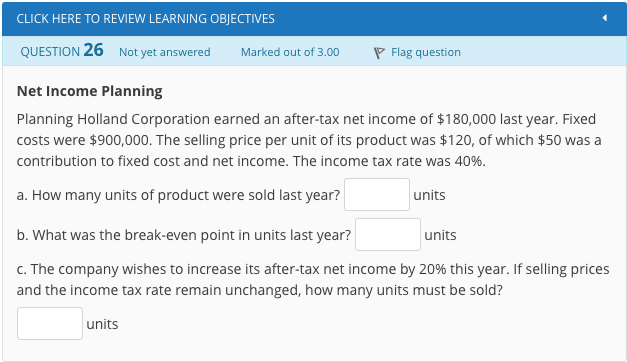

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 26 Not yet anwredMarked out of 3.00PFlag question Net Income Planning Planning Holland Corporation earned an after-tax net income of $180,000 last year. Fixed costs were $900,000. The selling price per unit of its product was $120, of which $50 was a contribution to fixed cost and net income. The income tax rate was 40%. a. How many units of product were sold last year? units b. What was the break-even point in units last year? units C. The company wishes to increase its after-tax net income by 20% this year. If selling prices and the income tax rate remain unchanged, how many units must be sold? units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts