Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 3 Partially correct Mark 2.57 out of 3.00 Flag question Make or Buy Eastside Company incurs a total

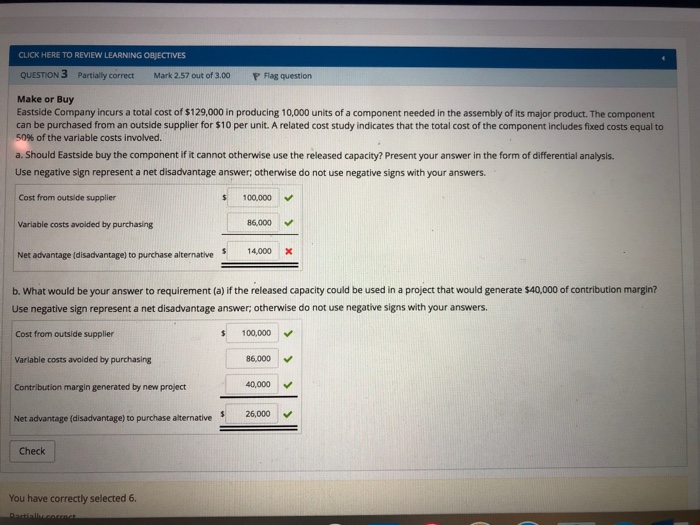

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 3 Partially correct Mark 2.57 out of 3.00 Flag question Make or Buy Eastside Company incurs a total cost of $129,000 in producing 10,000 units of a component needed in the assembly of its major product. The component can be purchased from an outside supplier for $10 per unit. A related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. Should Eastside buy the component if it cannot otherwise use the released capacity? Present your answer in the form of differential analysis. Use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. Cost from outside supplier $100,000 Variable costs avoided by purchasing 86,000 Net advantage (disadvantage) to purchase alternative alternative 14000 b. What would be your answer to requirement (a) if the released capacity could be used in a project that would generate $40,000 of contribution margin? Use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. Cost from outside supplier Variable costs avoided by purchasing Contribution margin generated by new project $ 100,000 86,000 40,000 $26,000 Net advantage (disadvantage) to purchase alternative Check You have correctly selected 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts