Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 4 Tries remaining: Marked out of 16.67 Flag question Accounting for fair value hedge of inventory (no ineffectiveness

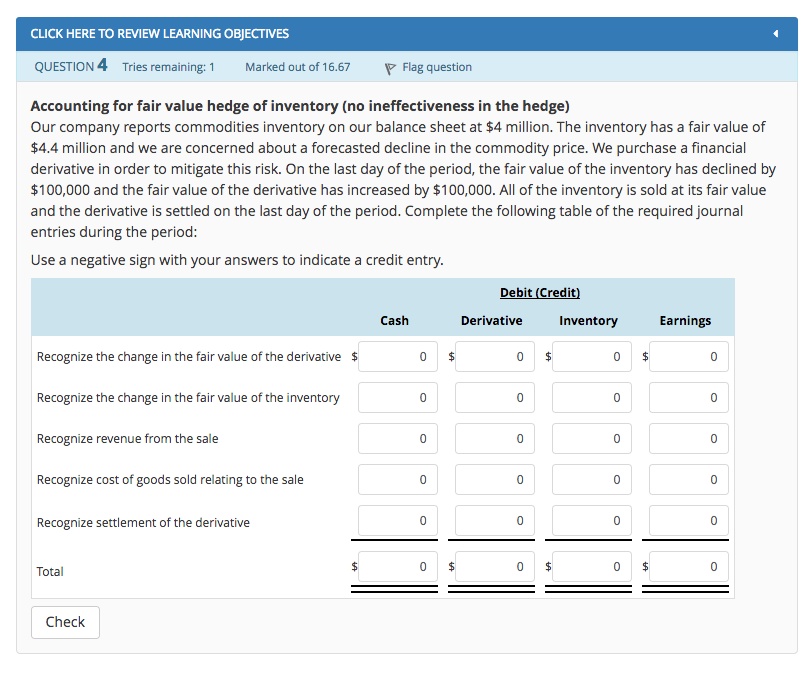

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 4 Tries remaining: Marked out of 16.67 Flag question Accounting for fair value hedge of inventory (no ineffectiveness in the hedge) Our company reports commodities inventory on our balance sheet at $4 million. The inventory has a fair value of $4.4 million and we are concerned about a forecasted decline in the commodity price. We purchase a financial derivative in order to mitigate this risk. On the last day of the period, the fair value of the inventory has declined by $100,000 and the fair value of the derivative has increased by $100,000. All of the inventory is sold at its fair value and the derivative is settled on the last day of the period. Complete the following table of the required journal tries during the period Use a negative sign with your answers to indicate a credit entry. Debit (Credit Cash Derivative Inventory Earnings Recognize the change in the fair value of the derivative Recognize the change in the fair value of the inventory Recognize revenue from the sale Recognize cost of goods sold relating to the sale Recognize settlement of the derivative Total Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts