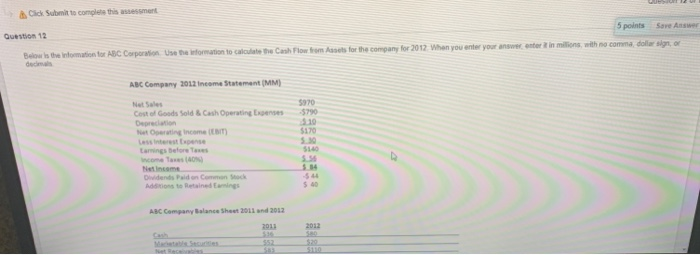

Question: Click Submit to complete this assessment 5 points Save Answer Question 12 Below is the information for ABC Corporation Use the formation to calculate the

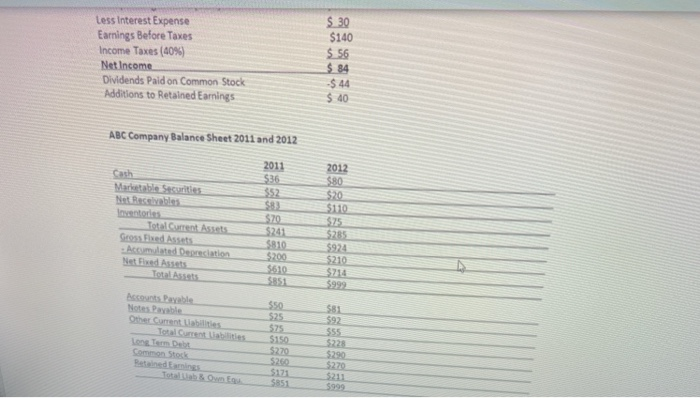

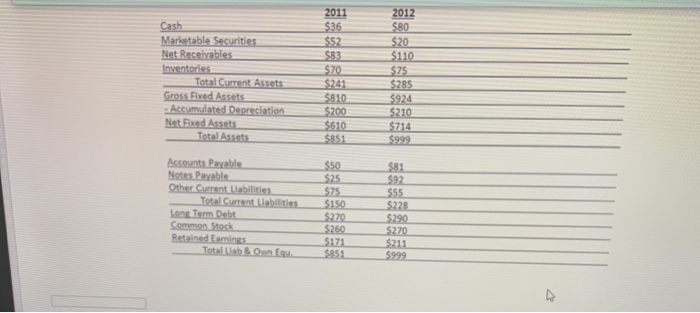

Click Submit to complete this assessment 5 points Save Answer Question 12 Below is the information for ABC Corporation Use the formation to calculate the Cash Flow from fasts for the company for 2012. When you enter your answer enterin millions with no comma, dollar sign, or decis ABC Company 2012 Income Statement (MM) 5970 -5790 Net Sales Cost of Goods Sold & Cash Operating one Depreciation Operating income Larings before wome Netcome Dividends Paiden Common Stock Additions to Retained Earnings $170 5.30 5140 SIS 5. $40 ABC Company Balance Sheet 2011 und 2012 2011 2012 Matable Secure $52 Less Interest Expense Earnings Before Taxes Income Taxes (40%) Net Income Dividends Paid on Common Stock Additions to Retained Earnings $ 30 $140 $ 56 $ 84 -$ 44 $ 40 ABC Company Balance Sheet 2011 and 2012 Cath Marketable Securities Net Receivables Total Current Assets 2011 $36 $52 $8 520 $241 $810 $200 5510 $851 2012 $80 $20 $110 $75 $285 $924 5210 $214 5999 Accumulated Depreciation Need Assets Accounts Notes able Other Currentes $81 $92 955 $50 525 575 $150 $270 $260 5171 $851 Common Stock $270 $999 Click Submit to complete this assessment 5 points Save Answer Question 12 Below is the information for ABC Corporation Use the formation to calculate the Cash Flow from fasts for the company for 2012. When you enter your answer enterin millions with no comma, dollar sign, or decis ABC Company 2012 Income Statement (MM) 5970 -5790 Net Sales Cost of Goods Sold & Cash Operating one Depreciation Operating income Larings before wome Netcome Dividends Paiden Common Stock Additions to Retained Earnings $170 5.30 5140 SIS 5. $40 ABC Company Balance Sheet 2011 und 2012 2011 2012 Matable Secure $52 Less Interest Expense Earnings Before Taxes Income Taxes (40%) Net Income Dividends Paid on Common Stock Additions to Retained Earnings $ 30 $140 $ 56 $ 84 -$ 44 $ 40 ABC Company Balance Sheet 2011 and 2012 Cath Marketable Securities Net Receivables Total Current Assets 2011 $36 $52 $8 520 $241 $810 $200 5510 $851 2012 $80 $20 $110 $75 $285 $924 5210 $214 5999 Accumulated Depreciation Need Assets Accounts Notes able Other Currentes $81 $92 955 $50 525 575 $150 $270 $260 5171 $851 Common Stock $270 $999

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts