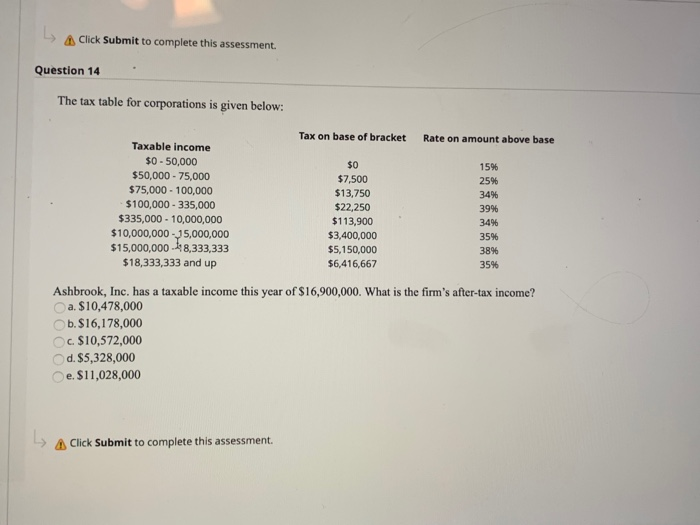

Question: > Click Submit to complete this assessment. Question 14 The tax table for corporations is given below: Tax on base of bracket Rate on amount

> Click Submit to complete this assessment. Question 14 The tax table for corporations is given below: Tax on base of bracket Rate on amount above base 1596 25% 34% Taxable income $0 - 50,000 $50,000 - 75,000 $75,000 - 100,000 $100,000 - 335,000 $335,000 - 10,000,000 $10,000,000 - 25,000,000 $15,000,000 $8,333,333 $18,333,333 and up $0 $7,500 $13,750 $22,250 $113,900 $3,400,000 $5,150,000 $6,416,667 39% 34% 35% 38% 3596 Ashbrook, Inc. has a taxable income this year of $16,900,000. What is the firm's after-tax income? a $10,478,000 b. $16,178,000 $10,572,000 d. $5,328,000 e. $11,028,000 > Click Submit to complete this assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts