Question: Click Submit to complete this assessment Question 8 1 points A retail shopping center is sold for $1 million and its purchase is financed with

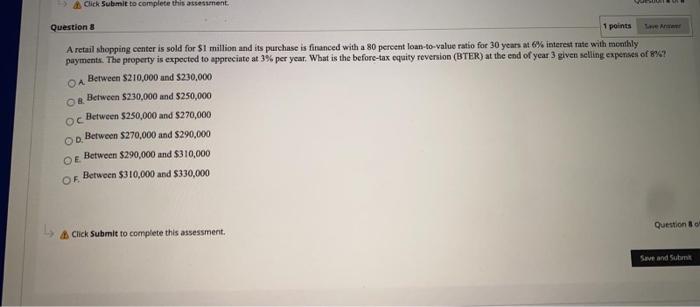

Click Submit to complete this assessment Question 8 1 points A retail shopping center is sold for $1 million and its purchase is financed with a 80 percent loan-to-value ratio for 30 years at 6% interest rate with monthly payments. The property is expected to appreciate at 3% per year. What is the before-tax equity reversion (BTER) at the end of year 3 given selling expenses of 8%! OA Between $210,000 and $230,000 o Between $230,000 and $250,000 Between $250,000 and $270,000 OD Between $270,000 and $290,000 Between $290,000 and $310,000 OF Between $310,000 and $330,000 oc Question 8 1) A Click Submit to complete this assessment. Save and Sub

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts