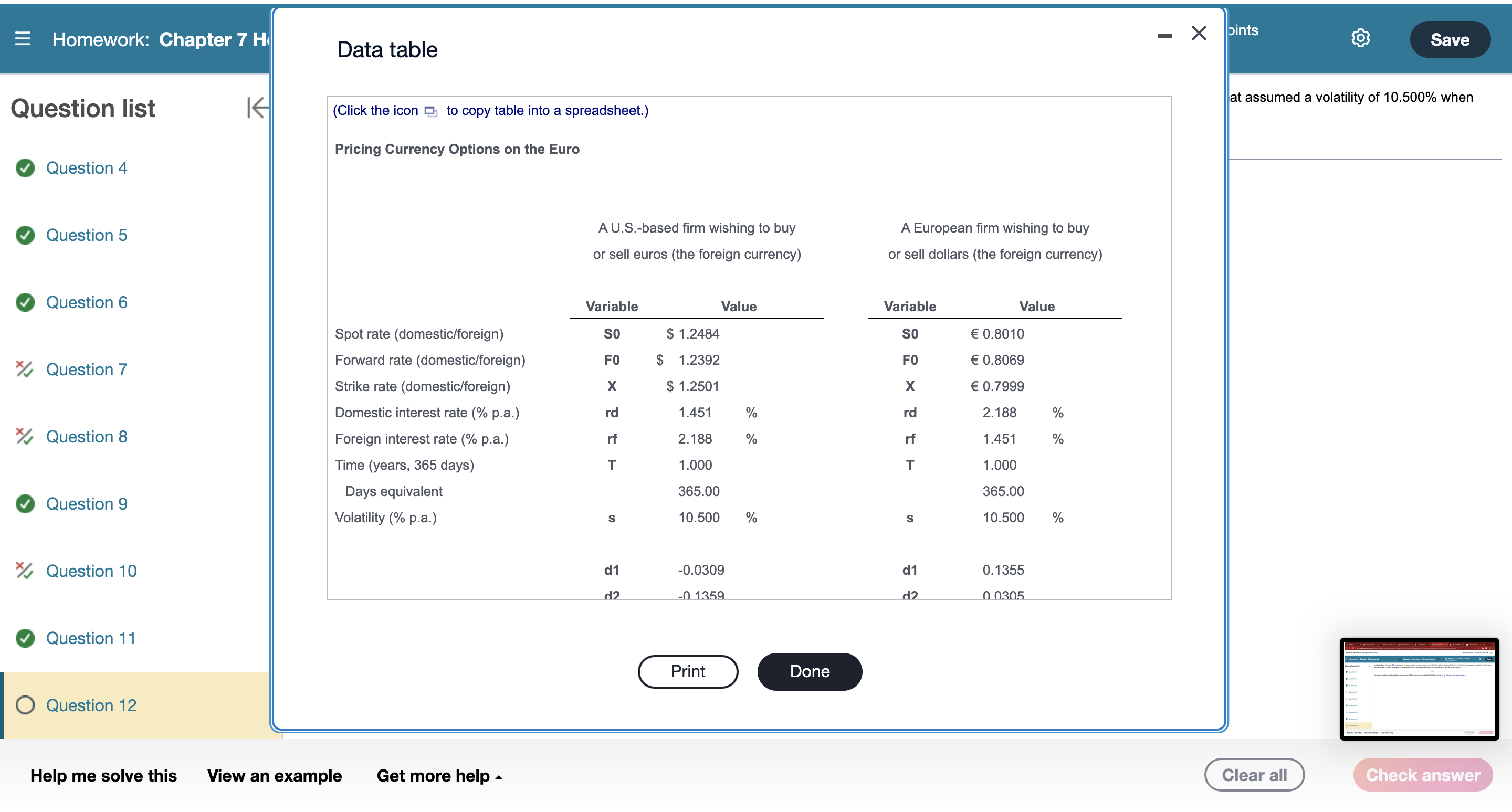

Question: (Click the icon to copy table into a spreadsheet.) Pricing Currency Options on the Euro at assumed a volatility of 10.500% when A European firm

(Click the icon to copy table into a spreadsheet.) Pricing Currency Options on the Euro at assumed a volatility of 10.500% when A European firm wishing to buy U.S. Dollar/Euro. The table, , indicates that a 1 -year call option on euros at a strike rate of $1.2501/ will cost the buyer $0.0461/, or 3.69%. But that assumed a volatility of 10.500% when the spot rate was $1.2484/. What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2482/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts