Question: ( Click the icon to view the future value annuity table. ) ( Click the icon to view the future value table. ) Read the

Click the icon to view the future value annuity table.

Click the icon to view the future value table.

Read the requirements.

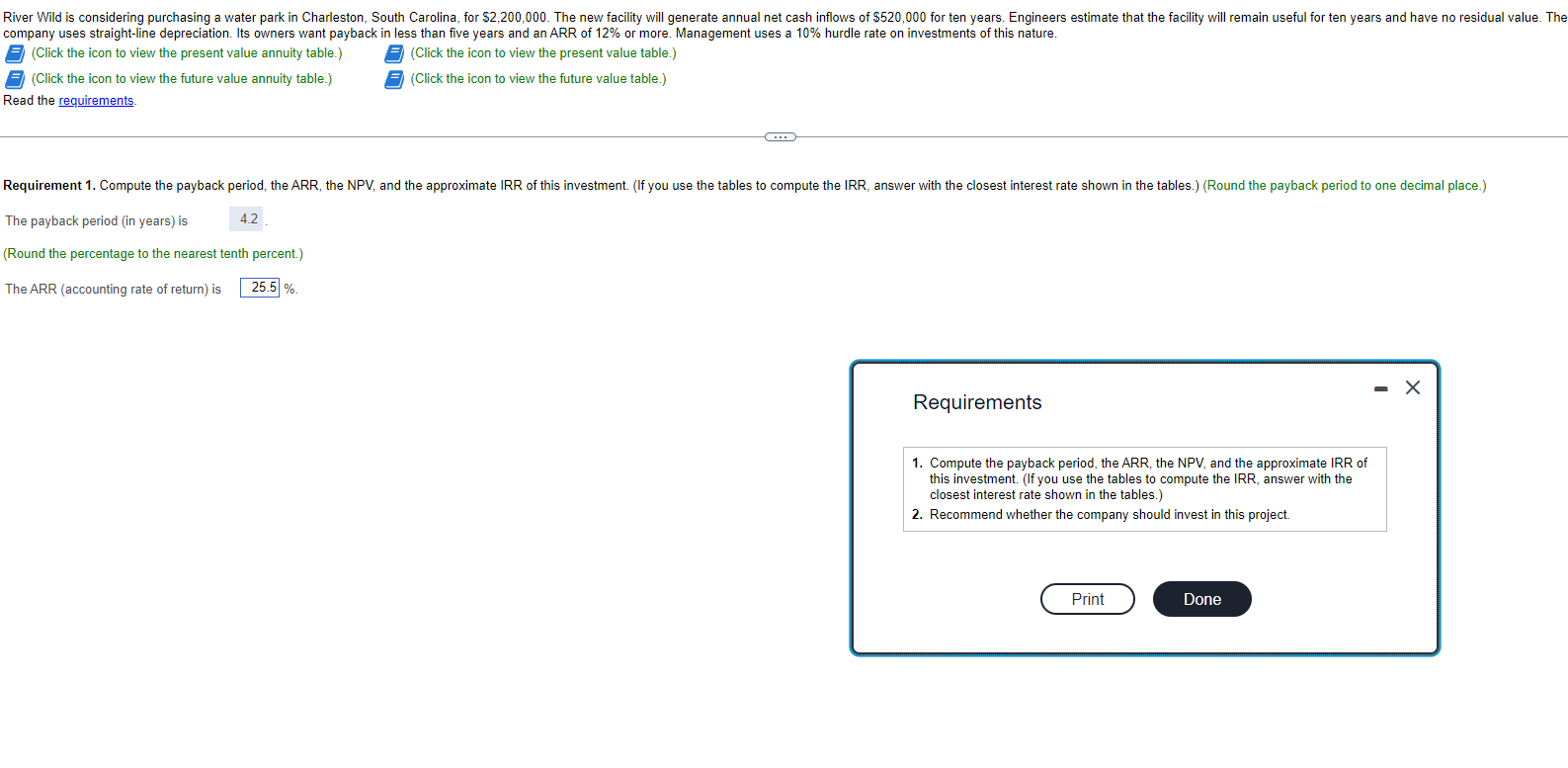

The payback period in years is

Round the percentage to the nearest tenth percent.

The ARR accounting rate of return is

Requirements

Compute the payback period, the ARR, the NPV and the approximate IRR of

this investment. If you use the tables to compute the IRR, answer with the

closest interest rate shown in the tables.

Recommend whether the company should invest in this project.River Wild is considering purchasing a water park in Charleston comma South Carolina for $ comma comma The new facility will generate annual net cash inflows of $ comma for ten years. Engineers estimate that the facility will remain useful for ten years and have no residual value. The company uses straightline depreciation. Its owners want payback in less than five years and an ARR of or more. Management uses a hurdle rate on investments of this nature.

LOADING... Click the icon to view the present value annuity table. LOADING... Click the icon to view the present value table.

LOADING... Click the icon to view the future value annuity table. LOADING... Click the icon to view the future value table.

Read the requirementsLOADING....

Question content area bottom

Part

Requirement Compute the payback period, the ARR, the NPV and the approximate IRR of this investment.If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.Round the payback period to one decimal place.

The payback period in years is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock