Question: Click to see additional instructions Consider the previous question: A company is considering an investment in a new product with a 10-year horizon (product will

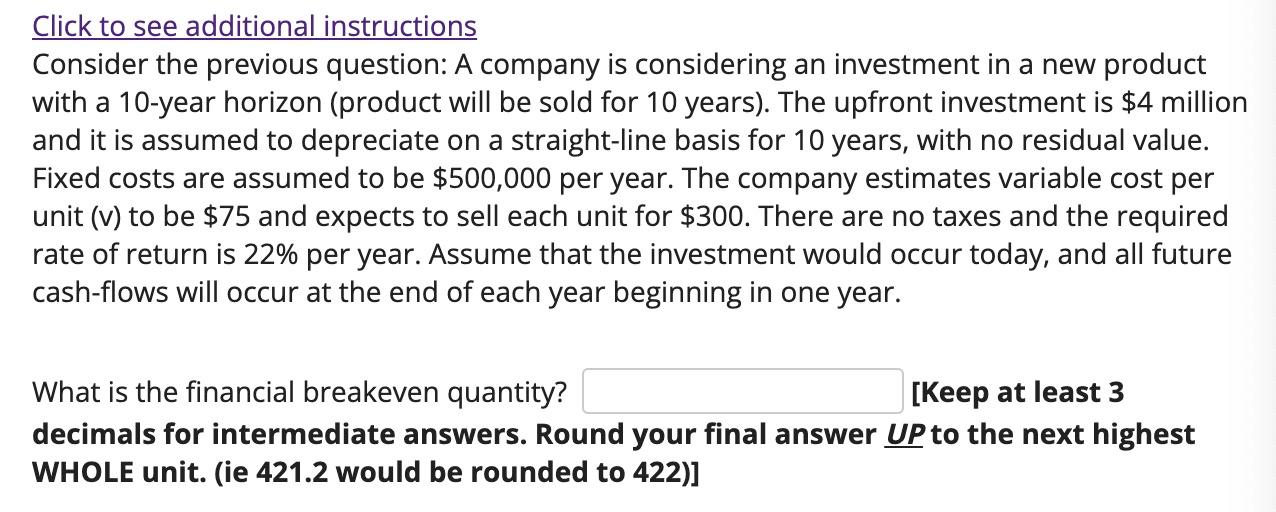

Click to see additional instructions Consider the previous question: A company is considering an investment in a new product with a 10-year horizon (product will be sold for 10 years). The upfront investment is $4 million and it is assumed to depreciate on a straight-line basis for 10 years, with no residual value. Fixed costs are assumed to be $500,000 per year. The company estimates variable cost per unit (v) to be $75 and expects to sell each unit for $300. There are no taxes and the required rate of return is 22% per year. Assume that the investment would occur today, and all future cash-flows will occur at the end of each year beginning in one year. What is the financial breakeven quantity? [Keep at least 3 decimals for intermediate answers. Round your final answer UP to the next highest WHOLE unit. (ie 421.2 would be rounded to 422)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts