Question: Click to see additional instructions Consider the previous question with the following new information: Fixed costs are assumed to be $420,000 per year. The company

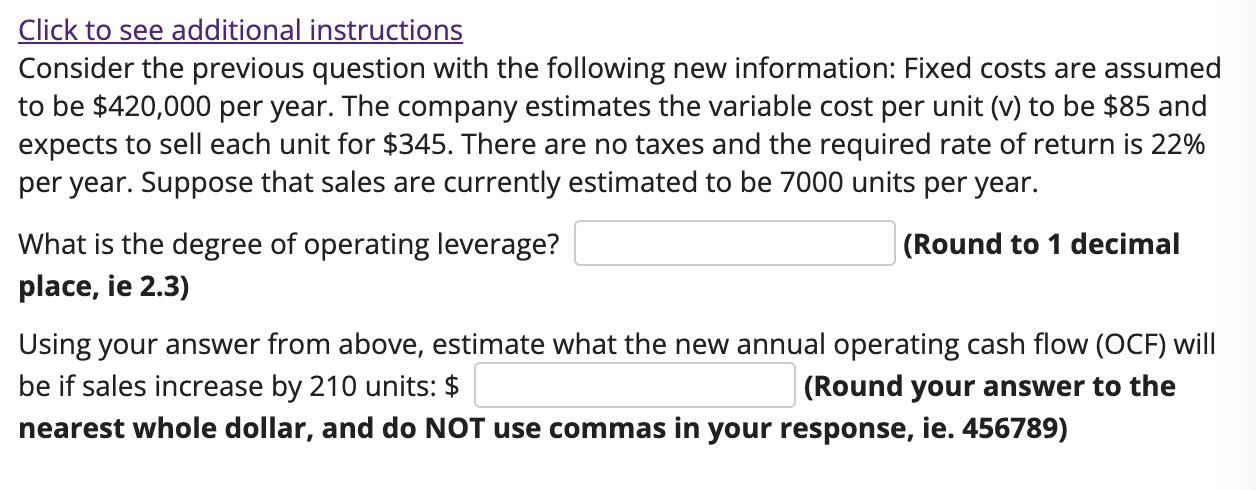

Click to see additional instructions Consider the previous question with the following new information: Fixed costs are assumed to be $420,000 per year. The company estimates the variable cost per unit (v) to be $85 and expects to sell each unit for $345. There are no taxes and the required rate of return is 22% per year. Suppose that sales are currently estimated to be 7000 units per year. (Round to 1 decimal What is the degree of operating leverage? place, ie 2.3) Using your answer from above, estimate what the new annual operating cash flow (OCF) will be if sales increase by 210 units: $ (Round your answer to the nearest whole dollar, and do NOT use commas in your response, ie. 456789)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts