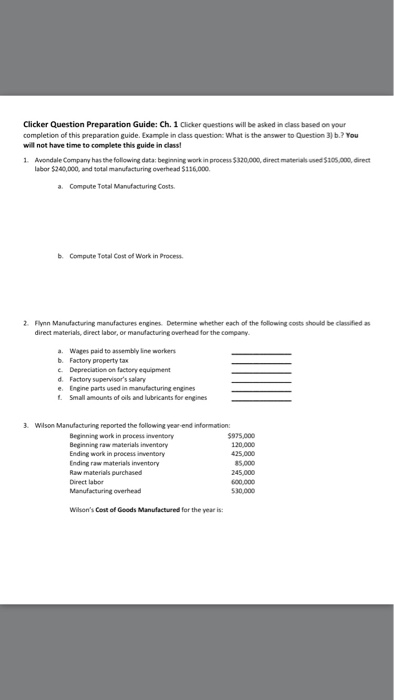

Question: Clicker Question Preparation Guide: Ch. 1 Clicker questions will be asked in class based on your completion of this preparation guide. Example in dlass questionc

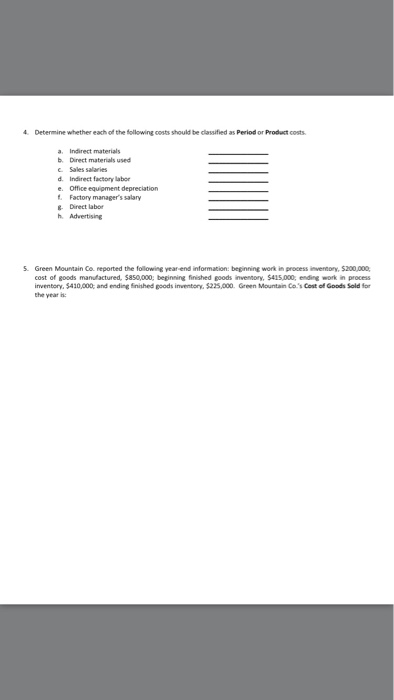

Clicker Question Preparation Guide: Ch. 1 Clicker questions will be asked in class based on your completion of this preparation guide. Example in dlass questionc What is the answer to Question 3) b.? You wil not have time to complete this guide in class Avondale Company has the following data: beginning work in process $320,000, direct materaised $105,000, direct labor $240,000, and total manufacturing overhead $116,000. 1 a. Compute Total Manufacturing Costs b Compute Total Cost of Work in Process 2 Fynn Manufacturing manufactures engines. Determine whether each of the folowing costs should be classified as direct materials, direct labor, or manufacturing overhead for the company. a. Wages paid to assembly ine workers b. Factory property tax e Depreciation on factory equipment d. Factory supervisor's salary e. Engine parts used in manufacturing engines Small amounts of oils and lubricants for engines 3. Wilson Manufacturing reported the following year end information: Beginning work in process inventory Beginning raw materials inventory Ending work in precess inventory Ending raw materials inventory Raw materials purchased 600,000 530,000 Manufacturing overhead Wihon's Coit of Goods Manufactured for the year is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts