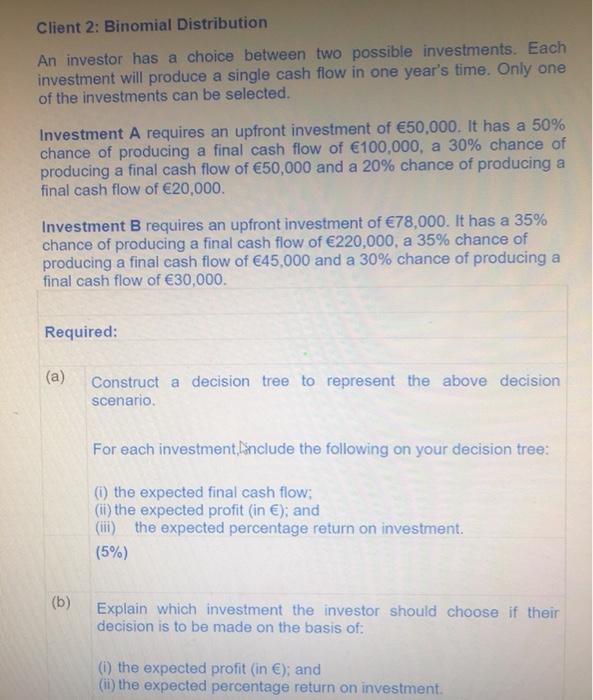

Question: Client 2: Binomial Distribution An investor has a choice between two possible investments. Each investment will produce a single cash flow in one year's time.

Client 2: Binomial Distribution An investor has a choice between two possible investments. Each investment will produce a single cash flow in one year's time. Only one of the investments can be selected. Investment A requires an upfront investment of 50,000. It has a 50% chance of producing a final cash flow of 100,000, a 30% chance of producing a final cash flow of 50,000 and a 20% chance of producing a final cash flow of 20,000 Investment B requires an upfront investment of 78,000. It has a 35% chance of producing a final cash flow of 220,000, a 35% chance of producing a final cash flow of 45.000 and a 30% chance of producing a final cash flow of 30,000. Required: (a) Construct a decision tree to represent the above decision scenario. For each investment Include the following on your decision tree: (1) the expected final cash flow; (ii) the expected profit (in ); and (ii) the expected percentage return on investment. (5%) (b) Explain which investment the investor should choose if their decision is to be made on the basis of: (i) the expected profit (in ); and (ii) the expected percentage return on investment. (c) In order to provide a fairer comparison between the two investments, the investor decides to take into account the fact that the total amount available for investment is 100,000 and that the remainder of these funds, after the upfront investment has been made into Investment A or Investment B, will be placed in a one year deposit account at a rate of 4.00%. Does this additional information change the conclusions you reached in part (b)? Provide a revised calculation to support your argument. (3%) (Total 10% of the Module)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts