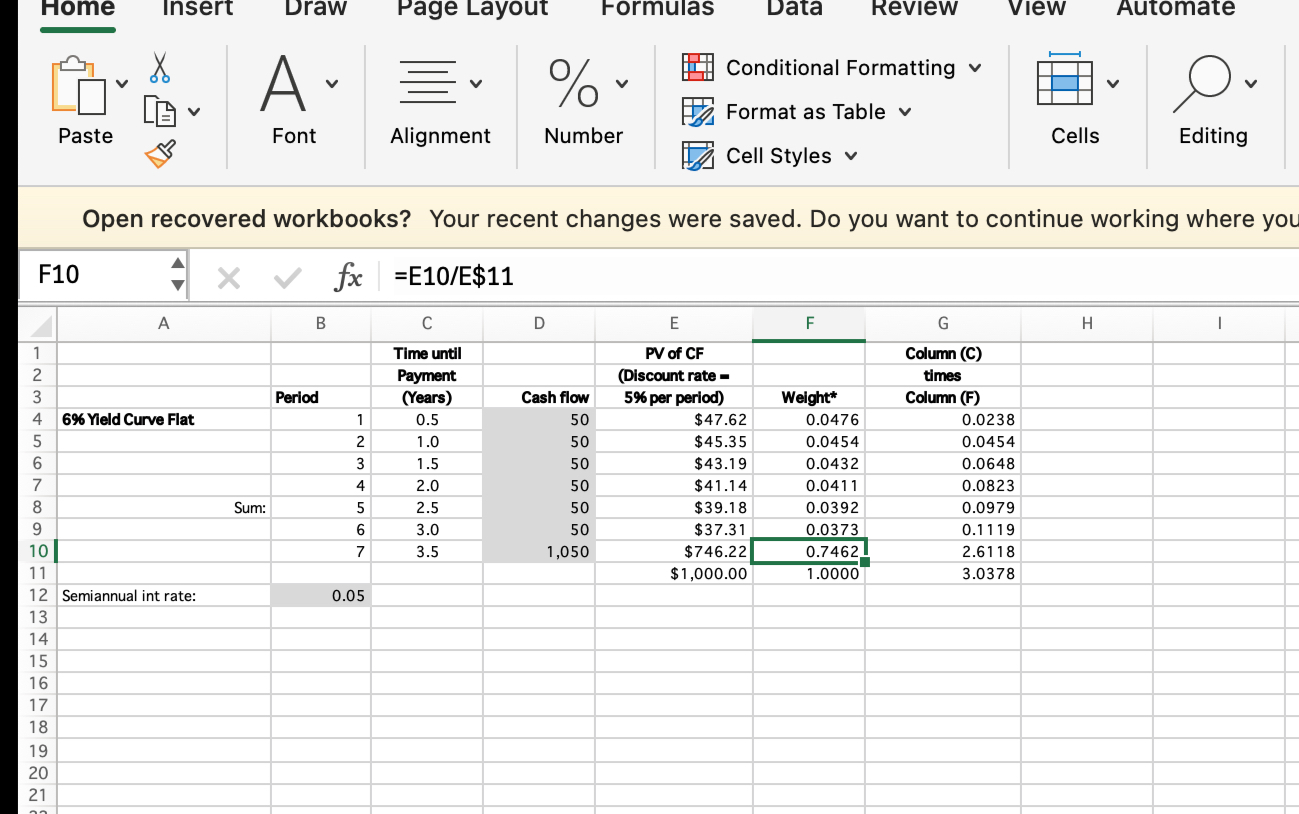

Question: Client Billy Mack Co . wants to immunize its pension obligations ( present value = $ 1 5 0 million with a duration of 2

Client Billy Mack Co wants to immunize its pension obligations present value $ million with a duration of years with two $ face value bonds. The first bond is a year annual coupon bond issued by Jaime Corp. The second bond issuer, Kari Ltd has issued a consol bond paying a annual coupon perpetually. Ms Thompson wants you to calculate the money Billy Mack should allocate to each of these bonds to immunize its pension against interest rate risk. The yield curve is flat at

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock