Question: Client case: Two weeks ago, you met with new clients Mary and Thomas Bishop. They had never seen a financial planner before as they were

Client case:

Two weeks ago, you met with new clients Mary and Thomas Bishop. They had never seen a financial planner before as they were always comfortable managing their own financial affairs. However, from recent discussions with their retiree friends, they have realised that they are unfamiliar with products and strategies relating to retirement planning. They plan to retire in approximately May 2020 and are seeking your advice on the different strategies that they could employ to fund their retirement lifestyle. After reviewing the clients completed fact find, you have prepared the following summary: Mary (born 9 January 1955) and Thomas (born 11 February 1955) Bishop both work fulltime at the University of Western Australia where Mary is an Associate Professor of Chemistry (earning gross income of $120,000 p.a. plus 9.5% superannuation) and Thomas is an office manager (earning gross income of $70,000 p.a. plus 9.5% superannuation). In retirement, they would like to continue living their modest and quiet lifestyle and they plan to stay in their current home. Their house in Nedlands is worth $800,000 and it is fully paid off. They also have $30,000 in household contents, another $40,000 in personal effects, Marys car (worth $20,000) and Thomas car (worth $10,000). They currently owe $5,000 on their credit cards. Their joint living expenses are approximately $30,000 p.a. They have a self-managed superannuation fund currently valued at $645,000. Assets in this SMSF are invested with approximately 50% in dividend -paying shares and 50% in cash. They have 3 adult children none of which are financially dependent on Mary and Thomas. They prepared a will in 1998 which lists their second child Sally, as their power of attorney. If possible, they would like to leave some inheritance for their children. Mary and Thomas completed a risk profile questionnaire which identified Mary as a growth investor and Thomas as a conservative investor.

QUESTION:

(a) Explain how an account based pension could be used as a retirement income drawdown strategy.

(b) Calculate the amount that could be received in each of the first 10 years of their retirement.

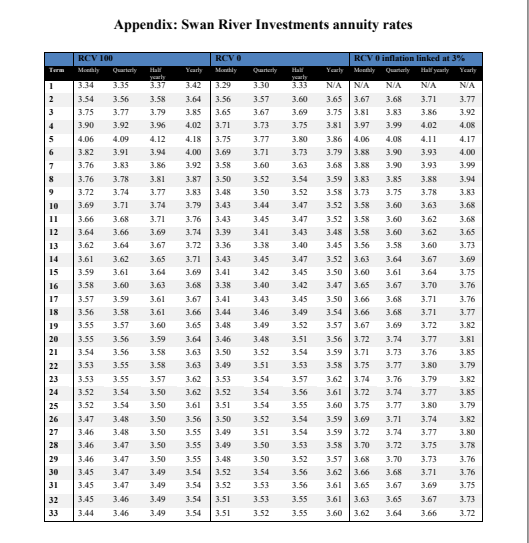

Appendix: Swan River Investments annuity rates RCVO RCV 100 Methy Quarterly Hall Yearly Hall yearly 3.33 1 3.34 2 3.37 3.58 3.79 3.96 329 3.56 3.65 3 3.86 3.92 4 3.71 5 6 4.00 4.12 3.94 3.86 3.81 3.77 3.74 3.71 3.69 3.67 3.75 3.69 3.58 3.50 3.48 7 Quarterly 330 3.57 3.67 3.73 3.77 3.71 3.60 3.52 3.50 3.44 3.45 3.41 3.38 3.60 3.69 3.75 3.80 3.73 3.63 3.54 3.52 3.47 3.47 3.78 8 9 10 11 3.83 3.42 3.64 3.85 4.02 4.18 4.00 3.92 3.87 3.83 3.79 3.76 3.74 3.72 3.71 3.69 3.68 3.67 3.66 3.65 3.43 12 3.40 13 14 3.56 3.77 3.92 4.09 3.91 3.83 3.78 3.74 3.71 3.68 3.66 3.64 3.62 3.61 3.60 3.59 3.58 3.57 3.56 3.56 3.55 3.55 3.54 3.54 3.48 3.43 3.39 3.36 3.43 3.41 3.38 3.54 3.75 3.90 4.06 3.82 3.76 3.76 3.72 3.69 3.66 3.64 3.62 3.61 3.59 3.58 3.57 3.56 3.55 3.55 3.54 3.53 3.53 3.52 3.52 3.47 3.46 3.46 3.46 3.45 3.45 3.45 3.44 3.65 3.64 3.63 3.61 3.45 3.42 3.40 3.43 3.46 3.49 3.47 3.45 3.42 3.45 3.49 RCV inflation linked at 3% Mandaly y Yearly N/A NA N/A NA NA 3.65 3.67 3.68 3.71 3.77 3.75 3.81 3.83 3.81 3.97 3.99 4.02 4.08 3.86 4.06 4.08 4.11 4.17 3.79 3.88 3.90 3.93 3.68 3.90 3.93 3.99 3.59 3.83 3.85 3.88 3.94 3.58 3.73 3.75 3.52 3.58 3.60 3.63 3.68 3.52 3.58 3.60 3.62 3.68 3.48 3.58 3.60 3.62 3.65 3.45 3.56 3.58 3.60 3.73 3.52 3.63 3.64 3.67 3.69 3.50 3.60 3.61 3.64 3.75 3.47 3.65 3.67 3.70 3.76 3.50 3.66 3.68 3.71 3.76 3.54 3.66 3.68 3.71 3.77 3.57 3.67 3.69 3.72 3.56 3.72 3.74 3.77 3.81 3.59 3.71 3.73 3.76 3.85 3.58 3.75 3.77 3.80 3.79 3.62 3.74 3.76 3.79 3.82 3.61 3.72 3.74 3.77 3.85 3.60 3.75 3.77 3.80 3.79 3.59 3.69 3.71 3.74 3.82 3.59 3.72 3.74 3.77 3.80 3.58 3.70 3.72 3.75 3.78 3.57 3.68 3.70 3.73 3.76 3.66 3.68 3.71 3.61 3.65 3.67 3.69 3.75 3.61 3.63 3.65 3.67 3.73 3.60 3.62 3.64 3.66 3.72 3.61 3.60 3.52 3.59 3.58 3.58 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 3.64 3.63 3.63 3.48 3.52 3.51 3.41 3.44 3.48 3.46 3.50 3.49 3.53 3.52 3.51 3.50 3.49 3.49 3.51 3.54 3.53 3.57 3.56 3.55 3.57 3.50 3.50 3.54 3.54 3.54 3.62 3.62 3.61 3.56 3.55 3.55 3.50 3.50 3.50 3.50 3.52 3.51 3.50 3.54 3.54 3.53 3.47 3.47 3.48 3.50 3.52 3.49 3.55 3.54 3.54 3.52 3.54 3.76 3.52 3.53 3.56 3.47 3.46 3.49 3.54 3.51 3.53 3.55 32 33 3.46 3.49 3.54 3.51 3.52 3.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts