Question: Client Data - Scotty & Casey Young You recently met with your new clients, Scotty & Casey Young. It was your first formal meeting; however,

Client DataScotty & Casey Young

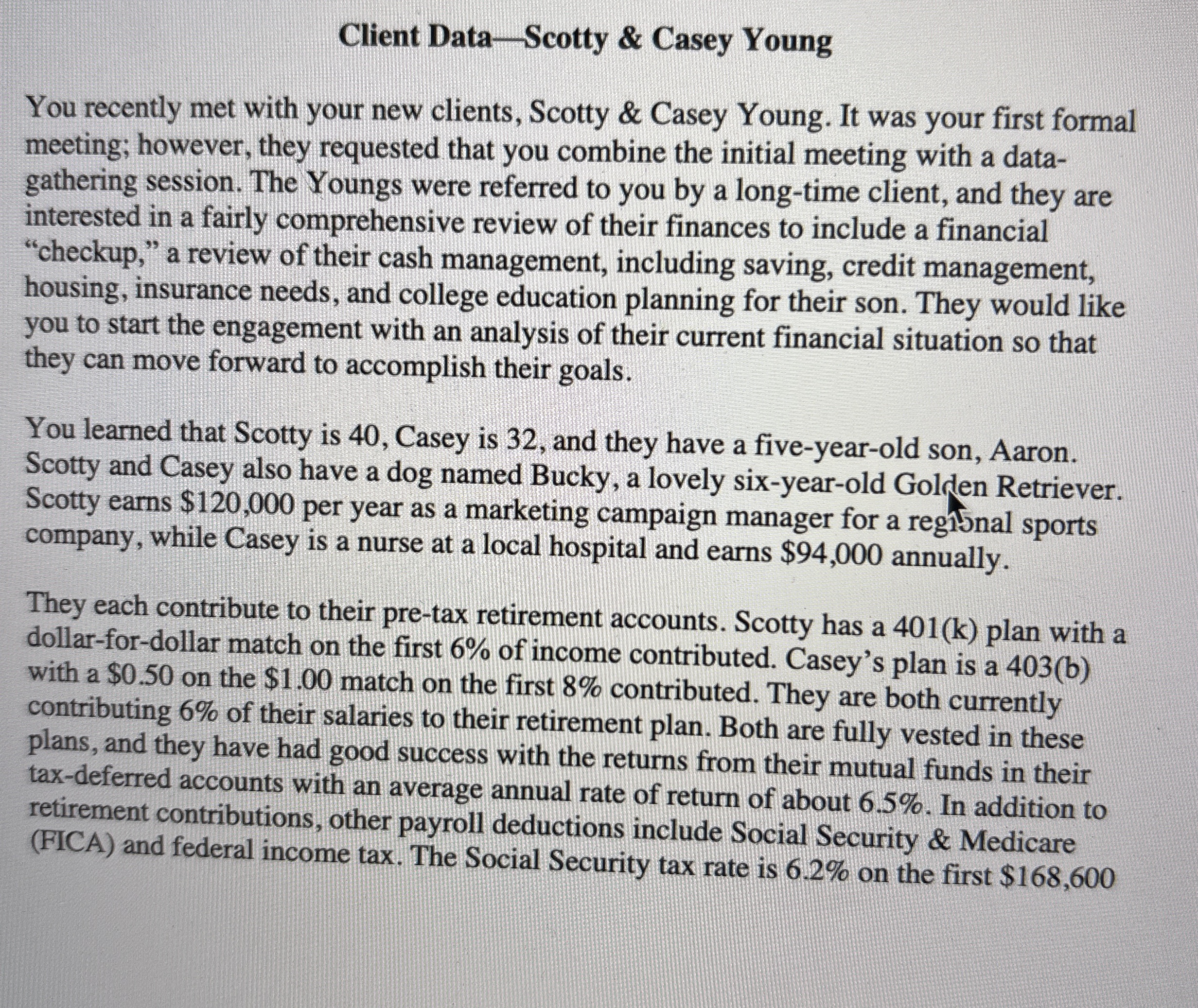

You recently met with your new clients, Scotty & Casey Young. It was your first formal

meeting; however, they requested that you combine the initial meeting with a data

gathering session. The Youngs were referred to you by a longtime client, and they are

interested in a fairly comprehensive review of their finances to include a financial

"checkup," a review of their cash management, including saving, credit management,

housing, insurance needs, and college education planning for their son. They would like

you to start the engagement with an analysis of their current financial situation so that

they can move forward to accomplish their goals.

You learned that Scotty is Casey is and they have a fiveyearold son, Aaron.

Scotty and Casey also have a dog named Bucky, a lovely sixyearold Golden Retriever.

Scotty earns $ per year as a marketing campaign manager for a regt nal sports

company, while Casey is a nurse at a local hospital and earns $ annually.

They each contribute to their pretax retirement accounts. Scotty has a k plan with a

dollarfordollar match on the first of income contributed. Casey's plan is a b

with a $ on the $ match on the first contributed. They are both currently

contributing of their salaries to their retirement plan. Both are fully vested in these

plans, and they have had good success with the returns from their mutual funds in their

taxdeferred accounts with an average annual rate of return of about In addition to

retirement contributions, other payroll deductions include Social Security & Medicare

FICA and federal income tax. The Social Security tax rate is on the first $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock