Question: client letter, tax file memorandum note:tax code section,statutory provisions or court case that supports conclusions Review the tax research material in Chapter 2. Your solution

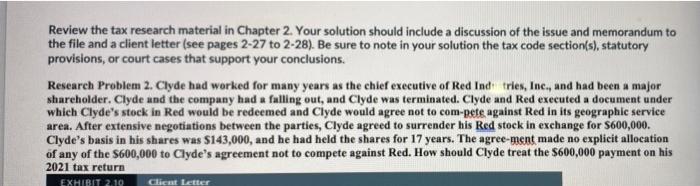

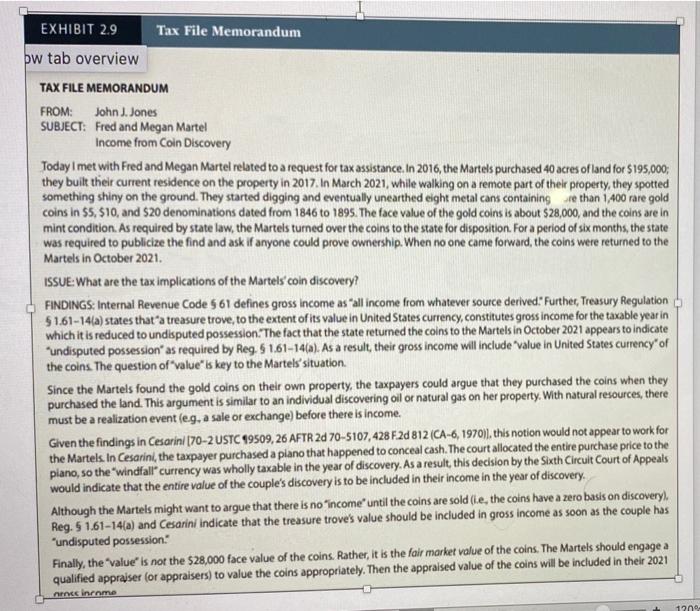

Review the tax research material in Chapter 2. Your solution should include a discussion of the issue and memorandum to the file and a client letter (see pages 2-27 to 2-28). Be sure to note in your solution the tax code section(s), statutory provisions, or court cases that support your conclusions. Research Problem 2. Clyde had worked for many years as the chief executive of Red Industries, Inc., and had been a major shareholder. Clyde and the company had a falling out, and Clyde was terminated. Clyde and Red executed a document under which Clyde's stock in Red would be redeemed and Clyde would agree not to com-pete against Red in its geographic service area. After extensive negotiations between the parties, Clyde agreed to surrender his Red stock in exchange for $600,000. Clyde's basis in his shares was $143,000, and he had held the shares for 17 years. The agree-ment made no explicit allocation of any of the $600,000 to Clyde's agreement not to compete against Red. How should Clyde treat the $600,000 payment on his 2021 tax return HIBIT 2.10 Client Letter SWFT,LLP 5191 Natorp Boulevard Mason, OH 45040 November 18, 2021 Mr. and Mrs. Fred Martel 111 Saddle Ridge Road Williamsburg, VA 23185 Dear Mr and Mrs. Martel This letter is in response to your request for advice related to your discovery of gold coins on your property in March 2021. Our conclu sions are based on the facts discussed during our meeting with you on November 11, 2021. Any change in the facts may affect our conclusions In general, the fair market value of the coins you discovered must be included in your 2021 gross income. This conclusion is based on your undisputed possession of the coins (as of October 2021) and opinions expressed in US Treasury Department Regulations and court cases Onduding one from the Sixth Circuit Court of Appeal) Given the potential value of your discovery I would encourage you to seek a competent appraiser for appraisers) to assess the value of the coins. Once a determination of value is made, we can work on a plan to pay the related Federal and state income taxes. Should you need more information or want to clarify our conclusions, do not hesitate to contact me Sincerely yours John & Jones, CPA Partner EXHIBIT 2.9 Tax File Memorandum w tab overview TAX FILE MEMORANDUM John & Jones FROM SUBIECT Fred and Megan Martel Income from Coin Discovery day I met Fred and Megan Martal plated to t they built their residence on the property in 2017.1 something shing on the ground. They started digging and eventually con in 55, 510, and 520 denominations dated from 1945 to 1895. The mint condition As required by state lase, the Martels tumed over the was required to publicise the find and ask if anyone could prove Martels in October 201 asta in 2016, the Martels punchased 40 acres of land for $195.000 2021, while walking on a remote part of their property they spotted might metal cans containing more than 1,400 god the gold coins is about $28,000, and the care dp For a period of six months, the s med to the ISSUE What are the tes implications of the Mar com discovery! FINDINGS bal Revenue Code $61 defines gros $14 which me saliname from whatever source derived Further Temury Regulate that's rebrove to the extent of value in United States cuency con undisputed porsion The fact that the income for the table to the Mar 2021 appears to ed by $141-14 As a the con The c w key to the Marte Since the Martels found pushed the land This taxpayers could argue that they purchased t their own propert hange beure there they Where realisation event ton a findings in C-2 USTC Sos the Martels in Cesarin the r plan to the windfall 12 CA-41 cash The court allocated the s edion by the Sh Martes might wan Althe Pay , the cains hve and Cesa indi Shat Prand the con are c discovery appear Appea Review the tax research material in Chapter 2. Your solution should include a discussion of the issue and memorandum to the file and a client letter (see pages 2-27 to 2-28). Be sure to note in your solution the tax code section(s), statutory provisions, or court cases that support your conclusions. Research Problem 2. Clyde had worked for many years as the chief executive of Red Ind tries, Inc., and had been a major shareholder. Clyde and the company had a falling out, and Clyde was terminated. Clyde and Red executed a document under which Clyde's stock in Red would be redeemed and Clyde would agree not to com-pete against Red in its geographic service area. After extensive negotiations between the parties, Clyde agreed to surrender his Red stock in exchange for $600,000. Clyde's basis in his shares was $143,000, and he had held the shares for 17 years. The agree-ment made no explicit allocation of any of the $600,000 to Clyde's agreement not to compete against Red. How should Clyde treat the $600,000 payment on his 2021 tax return EXHIBIT 2.10 Client Letter EXHIBIT 2.9 ow tab overview Tax File Memorandum TAX FILE MEMORANDUM FROM: John J. Jones SUBJECT: Fred and Megan Martel Income from Coin Discovery Today I met with Fred and Megan Martel related to a request for tax assistance. In 2016, the Martels purchased 40 acres of land for $195,000; they built their current residence on the property in 2017. In March 2021, while walking on a remote part of their property, they spotted something shiny on the ground. They started digging and eventually unearthed eight metal cans containing re than 1,400 rare gold coins in $5, $10, and $20 denominations dated from 1846 to 1895. The face value of the gold coins is about $28,000, and the coins are in mint condition. As required by state law, the Martels turned over the coins to the state for disposition. For a period of six months, the state was required to publicize the find and ask if anyone could prove ownership. When no one came forward, the coins were returned to the Martels in October 2021. ISSUE: What are the tax implications of the Martels' coin discovery? FINDINGS: Internal Revenue Code 561 defines gross income as "all income from whatever source derived." Further, Treasury Regulation 51.61-14(a) states that "a treasure trove, to the extent of its value in United States currency, constitutes gross income for the taxable year in which it is reduced to undisputed possession. The fact that the state returned the coins to the Martels in October 2021 appears to indicate "undisputed possession" as required by Reg. 5 1.61-14(a). As a result, their gross income will include "value in United States currency" of the coins. The question of "value" is key to the Martels' situation. Since the Martels found the gold coins on their own property, the taxpayers could argue that they purchased the coins when they purchased the land. This argument is similar to an individual discovering oil or natural gas on her property. With natural resources, there must be a realization event (eg, a sale or exchange) before there is income. Given the findings in Cesarini [70-2 USTC 19509, 26 AFTR 2d 70-5107, 428 F.2d 812 (CA-6, 1970)], this notion would not appear to work for the Martels. In Cesarini, the taxpayer purchased a piano that happened to conceal cash. The court allocated the entire purchase price to the piano, so the "windfall' currency was wholly taxable in the year of discovery. As a result, this decision by the Sixth Circuit Court of Appeals would indicate that the entire value of the couple's discovery is to be included in their income in the year of discovery. Although the Martels might want to argue that there is no "income until the coins are sold (ie, the coins have a zero basis on discovery), Reg. 5 1.61-14(a) and Cesarini indicate that the treasure trove's value should be included in gross income as soon as the couple has "undisputed possession." Finally, the "value" is not the $28,000 face value of the coins. Rather, it is the fair market value of the coins. The Martels should engage a qualified appraiser (or appraisers) to value the coins appropriately. Then the appraised value of the coins will be included in their 2021 nross income 120% Client Letter EXHIBIT 2.10 SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 18, 2021 Mr. and Mrs. Fred Martel 111 Saddle Ridge Road Williamsburg, VA 23185 Dear Mr. and Mrs. Martel This letter is in response to your request for advice related to your discovery of gold coins on your property in March 2021. Our conclu sions are based on the facts discussed during our meeting with you on November 11, 2021. Any change in the facts may affect our conclusions. In general, the fair market value of the coins you discovered must be included in your 2021 gross income. This conclusion is based on your "undisputed possession of the coins (as of October 2021) and opinions expressed in US. Treasury Department Regulations and court cases (including one from the Sixth Circuit Court of Appeals). Given the potential value of your discovery, I would encourage you to seek a competent appraiser (or appraisers) to assess the value of the coins. Once a determination of value is made, we can work on a plan to pay the related Federal and state income taxes Should you need more information or want to clarify our conclusions, do not hesitate to contact me. Sincerely yours, John J. Jones, CPA Partner Review the tax research material in Chapter 2. Your solution should include a discussion of the issue and memorandum to the file and a client letter (see pages 2-27 to 2-28). Be sure to note in your solution the tax code section(s), statutory provisions, or court cases that support your conclusions. Research Problem 2. Clyde had worked for many years as the chief executive of Red Industries, Inc., and had been a major shareholder. Clyde and the company had a falling out, and Clyde was terminated. Clyde and Red executed a document under which Clyde's stock in Red would be redeemed and Clyde would agree not to com-pete against Red in its geographic service area. After extensive negotiations between the parties, Clyde agreed to surrender his Red stock in exchange for $600,000. Clyde's basis in his shares was $143,000, and he had held the shares for 17 years. The agree-ment made no explicit allocation of any of the $600,000 to Clyde's agreement not to compete against Red. How should Clyde treat the $600,000 payment on his 2021 tax return HIBIT 2.10 Client Letter SWFT,LLP 5191 Natorp Boulevard Mason, OH 45040 November 18, 2021 Mr. and Mrs. Fred Martel 111 Saddle Ridge Road Williamsburg, VA 23185 Dear Mr and Mrs. Martel This letter is in response to your request for advice related to your discovery of gold coins on your property in March 2021. Our conclu sions are based on the facts discussed during our meeting with you on November 11, 2021. Any change in the facts may affect our conclusions In general, the fair market value of the coins you discovered must be included in your 2021 gross income. This conclusion is based on your undisputed possession of the coins (as of October 2021) and opinions expressed in US Treasury Department Regulations and court cases Onduding one from the Sixth Circuit Court of Appeal) Given the potential value of your discovery I would encourage you to seek a competent appraiser for appraisers) to assess the value of the coins. Once a determination of value is made, we can work on a plan to pay the related Federal and state income taxes. Should you need more information or want to clarify our conclusions, do not hesitate to contact me Sincerely yours John & Jones, CPA Partner EXHIBIT 2.9 Tax File Memorandum w tab overview TAX FILE MEMORANDUM John & Jones FROM SUBIECT Fred and Megan Martel Income from Coin Discovery day I met Fred and Megan Martal plated to t they built their residence on the property in 2017.1 something shing on the ground. They started digging and eventually con in 55, 510, and 520 denominations dated from 1945 to 1895. The mint condition As required by state lase, the Martels tumed over the was required to publicise the find and ask if anyone could prove Martels in October 201 asta in 2016, the Martels punchased 40 acres of land for $195.000 2021, while walking on a remote part of their property they spotted might metal cans containing more than 1,400 god the gold coins is about $28,000, and the care dp For a period of six months, the s med to the ISSUE What are the tes implications of the Mar com discovery! FINDINGS bal Revenue Code $61 defines gros $14 which me saliname from whatever source derived Further Temury Regulate that's rebrove to the extent of value in United States cuency con undisputed porsion The fact that the income for the table to the Mar 2021 appears to ed by $141-14 As a the con The c w key to the Marte Since the Martels found pushed the land This taxpayers could argue that they purchased t their own propert hange beure there they Where realisation event ton a findings in C-2 USTC Sos the Martels in Cesarin the r plan to the windfall 12 CA-41 cash The court allocated the s edion by the Sh Martes might wan Althe Pay , the cains hve and Cesa indi Shat Prand the con are c discovery appear Appea Review the tax research material in Chapter 2. Your solution should include a discussion of the issue and memorandum to the file and a client letter (see pages 2-27 to 2-28). Be sure to note in your solution the tax code section(s), statutory provisions, or court cases that support your conclusions. Research Problem 2. Clyde had worked for many years as the chief executive of Red Ind tries, Inc., and had been a major shareholder. Clyde and the company had a falling out, and Clyde was terminated. Clyde and Red executed a document under which Clyde's stock in Red would be redeemed and Clyde would agree not to com-pete against Red in its geographic service area. After extensive negotiations between the parties, Clyde agreed to surrender his Red stock in exchange for $600,000. Clyde's basis in his shares was $143,000, and he had held the shares for 17 years. The agree-ment made no explicit allocation of any of the $600,000 to Clyde's agreement not to compete against Red. How should Clyde treat the $600,000 payment on his 2021 tax return EXHIBIT 2.10 Client Letter EXHIBIT 2.9 ow tab overview Tax File Memorandum TAX FILE MEMORANDUM FROM: John J. Jones SUBJECT: Fred and Megan Martel Income from Coin Discovery Today I met with Fred and Megan Martel related to a request for tax assistance. In 2016, the Martels purchased 40 acres of land for $195,000; they built their current residence on the property in 2017. In March 2021, while walking on a remote part of their property, they spotted something shiny on the ground. They started digging and eventually unearthed eight metal cans containing re than 1,400 rare gold coins in $5, $10, and $20 denominations dated from 1846 to 1895. The face value of the gold coins is about $28,000, and the coins are in mint condition. As required by state law, the Martels turned over the coins to the state for disposition. For a period of six months, the state was required to publicize the find and ask if anyone could prove ownership. When no one came forward, the coins were returned to the Martels in October 2021. ISSUE: What are the tax implications of the Martels' coin discovery? FINDINGS: Internal Revenue Code 561 defines gross income as "all income from whatever source derived." Further, Treasury Regulation 51.61-14(a) states that "a treasure trove, to the extent of its value in United States currency, constitutes gross income for the taxable year in which it is reduced to undisputed possession. The fact that the state returned the coins to the Martels in October 2021 appears to indicate "undisputed possession" as required by Reg. 5 1.61-14(a). As a result, their gross income will include "value in United States currency" of the coins. The question of "value" is key to the Martels' situation. Since the Martels found the gold coins on their own property, the taxpayers could argue that they purchased the coins when they purchased the land. This argument is similar to an individual discovering oil or natural gas on her property. With natural resources, there must be a realization event (eg, a sale or exchange) before there is income. Given the findings in Cesarini [70-2 USTC 19509, 26 AFTR 2d 70-5107, 428 F.2d 812 (CA-6, 1970)], this notion would not appear to work for the Martels. In Cesarini, the taxpayer purchased a piano that happened to conceal cash. The court allocated the entire purchase price to the piano, so the "windfall' currency was wholly taxable in the year of discovery. As a result, this decision by the Sixth Circuit Court of Appeals would indicate that the entire value of the couple's discovery is to be included in their income in the year of discovery. Although the Martels might want to argue that there is no "income until the coins are sold (ie, the coins have a zero basis on discovery), Reg. 5 1.61-14(a) and Cesarini indicate that the treasure trove's value should be included in gross income as soon as the couple has "undisputed possession." Finally, the "value" is not the $28,000 face value of the coins. Rather, it is the fair market value of the coins. The Martels should engage a qualified appraiser (or appraisers) to value the coins appropriately. Then the appraised value of the coins will be included in their 2021 nross income 120% Client Letter EXHIBIT 2.10 SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 18, 2021 Mr. and Mrs. Fred Martel 111 Saddle Ridge Road Williamsburg, VA 23185 Dear Mr. and Mrs. Martel This letter is in response to your request for advice related to your discovery of gold coins on your property in March 2021. Our conclu sions are based on the facts discussed during our meeting with you on November 11, 2021. Any change in the facts may affect our conclusions. In general, the fair market value of the coins you discovered must be included in your 2021 gross income. This conclusion is based on your "undisputed possession of the coins (as of October 2021) and opinions expressed in US. Treasury Department Regulations and court cases (including one from the Sixth Circuit Court of Appeals). Given the potential value of your discovery, I would encourage you to seek a competent appraiser (or appraisers) to assess the value of the coins. Once a determination of value is made, we can work on a plan to pay the related Federal and state income taxes Should you need more information or want to clarify our conclusions, do not hesitate to contact me. Sincerely yours, John J. Jones, CPA Partner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts