Question: Clipboard Font 5 Alignment Number Styles C29 fac A B D E F F G H 1 J K Question 15 Directions: Credit analysis Loan

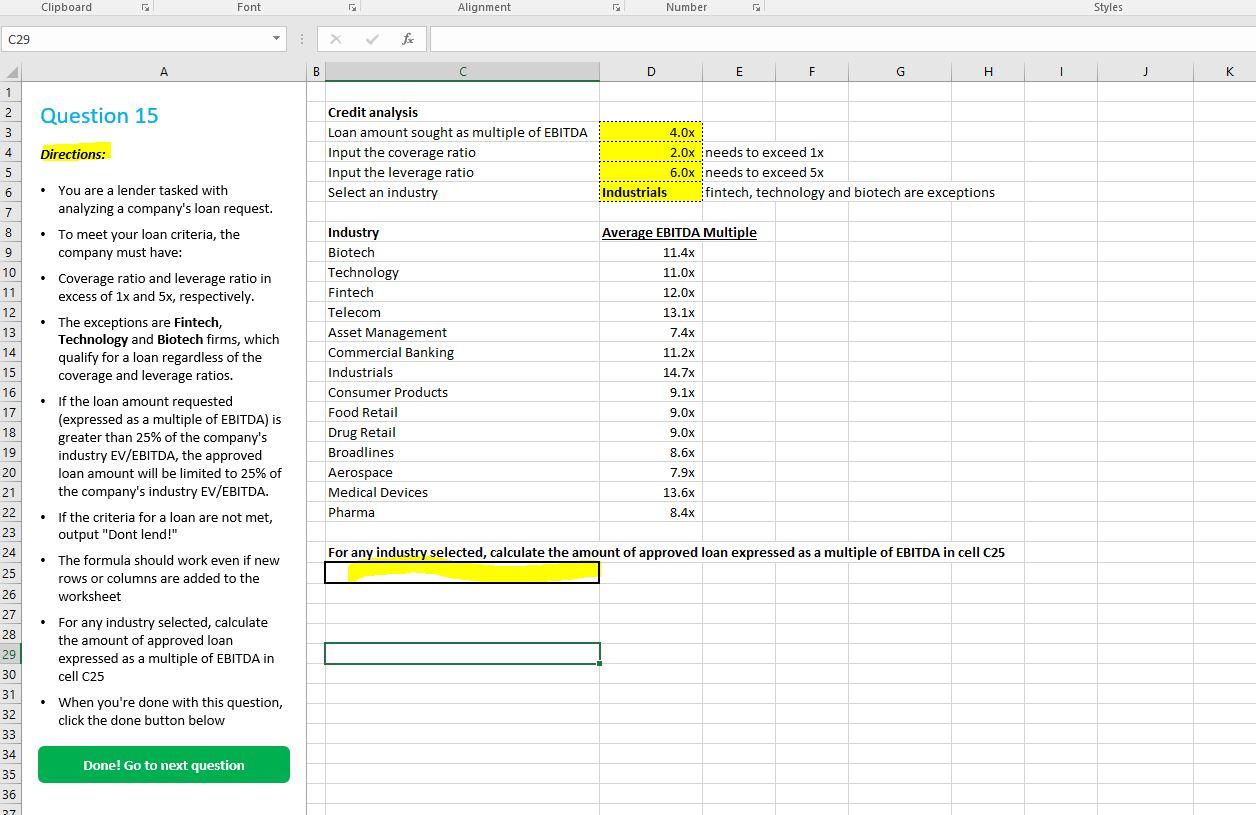

Clipboard Font 5 Alignment Number Styles C29 fac A B D E F F G H 1 J K Question 15 Directions: Credit analysis Loan amount sought as multiple of EBITDA Input the coverage ratio Input the leverage ratio Select an industry 4.0x ... 2.0x needs to exceed 1x 6.0x needs to exceed 5x Industrials fintech, technology and biotech are exceptions . Average EBITDA Multiple 11.4x 11.0x 12.0x 13.1x 7.4x 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Industry Biotech Technology Fintech Telecom Asset Management Commercial Banking Industrials Consumer Products Food Retail Drug Retail Broadlines Aerospace Medical Devices Pharma 11.2x 14.7x You are a lender tasked with analyzing a company's loan request. To meet your loan criteria, the company must have: Coverage ratio and leverage ratio in excess of 1x and 5x, respectively. The exceptions are Fintech, Technology and Biotech firms, which qualify for a loan regardless of the coverage and leverage ratios. If the loan amount requested (expressed as a multiple of EBITDA) is greater than 25% of the company's industry EV/EBITDA, the approved loan amount will be limited to 25% of the company's industry EV/EBITDA. If the criteria for a loan are not met, output "Dont lend!" The formula should work even if new rows or columns are added to the worksheet . For any industry selected, calculate the amount of approved loan expressed as a multiple of EBITDA in cell C25 When you're done with this question, click the done button below . 9.1x 9.Ox 9.0x 8.6x 7.9x 13.6x 8.4x For any industry selected, calculate the amount of approved loan expressed as a multiple of EBITDA in cell C25 . 27 28 29 30 31 32 33 34 35 36 27 Done! Go to next question Clipboard Font 5 Alignment Number Styles C29 fac A B D E F F G H 1 J K Question 15 Directions: Credit analysis Loan amount sought as multiple of EBITDA Input the coverage ratio Input the leverage ratio Select an industry 4.0x ... 2.0x needs to exceed 1x 6.0x needs to exceed 5x Industrials fintech, technology and biotech are exceptions . Average EBITDA Multiple 11.4x 11.0x 12.0x 13.1x 7.4x 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Industry Biotech Technology Fintech Telecom Asset Management Commercial Banking Industrials Consumer Products Food Retail Drug Retail Broadlines Aerospace Medical Devices Pharma 11.2x 14.7x You are a lender tasked with analyzing a company's loan request. To meet your loan criteria, the company must have: Coverage ratio and leverage ratio in excess of 1x and 5x, respectively. The exceptions are Fintech, Technology and Biotech firms, which qualify for a loan regardless of the coverage and leverage ratios. If the loan amount requested (expressed as a multiple of EBITDA) is greater than 25% of the company's industry EV/EBITDA, the approved loan amount will be limited to 25% of the company's industry EV/EBITDA. If the criteria for a loan are not met, output "Dont lend!" The formula should work even if new rows or columns are added to the worksheet . For any industry selected, calculate the amount of approved loan expressed as a multiple of EBITDA in cell C25 When you're done with this question, click the done button below . 9.1x 9.Ox 9.0x 8.6x 7.9x 13.6x 8.4x For any industry selected, calculate the amount of approved loan expressed as a multiple of EBITDA in cell C25 . 27 28 29 30 31 32 33 34 35 36 27 Done! Go to next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts