Question: Clitk here to read the eBook: Future Values Time Value of Money: Comparing Interest Rates Different compounding perlods, are used for different types of Investments.

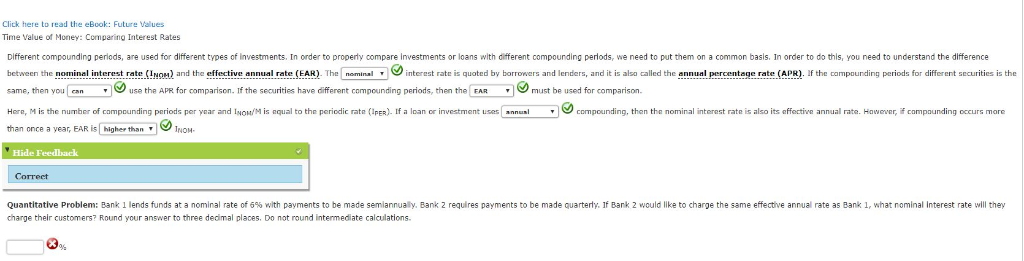

Clitk here to read the eBook: Future Values Time Value of Money: Comparing Interest Rates Different compounding perlods, are used for different types of Investments. In order to properly compare Investments or loans with different compounding perlods, we need to put them on a common basis. In order to do thls, you need to understand the difference between the nominal interest rate te effective annual rate EAR) interest rate is quoted by borrowers and lenders, and it is alsa called the ennual percentage rate (APR) te cmpounding periods for different securities is the same, then you can , se the APR for comparison. Ifthe securities have different compounding periods, then the FAR ust be used for comparison. His the number of compound ng periods per f a loan or investment uses compounding, then the nominal interest rate s also its off ctive annual rate. Ha Here, M is the number of compounding periods per year and INon/M is qual to the pericdic rate (IPER). If a loan or investment uses annus than once a year, EAR SI higher than ar and IN0Mis nqual to the penedic rate IPER compaun ing occurs more nnnus , wever, INON Hide Feedback Correct Quantitative Problem: Bank 1 lends funds at a nominal rate of 6% with payments to be made semiannually, Bank 2 requires payments to be made quarterly, If Bank 2 would like to charge the same effective annual rate as Bank 1, what nominal Interest rate will they charge their customers? Round your answer to three dedimal places. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts