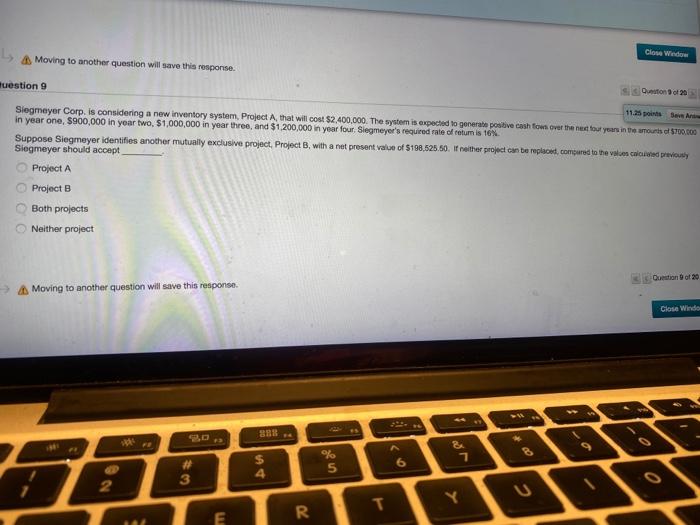

Question: Clone Wieder Moving to another question will save this response. Seston 120 #uestion 9 11.25 Siegmeyer Corp. is considering a new inventory System Project A

Clone Wieder Moving to another question will save this response. Seston 120 #uestion 9 11.25 Siegmeyer Corp. is considering a new inventory System Project A that will cost $2.400,000. The system is expected to generate positive cash for over the new years in the mouth of $700.000 in year one$900,000 in year two. $1,000,000 in year three, and $1.200,000 in year four, Siegmeyer's required rate of retum is 16 Suppose Siegmeyer identifies another mutually exclusive project, Project B, with a net present value of $198,525.50. If nother project can be replaced, compared to the values calculated previously Siegmeyer should accept Project A Project B Both projects Neither project Dunction of 20 Moving to another question will save this response. Close Windo 7 % 5 6 3 4 2 T . Y R TE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts