Question: Close Windo Moving to another question will save this response. Question 1 of 30 uestion 1 1.5 points Assume that Capital Asset Management Company (CAMC)

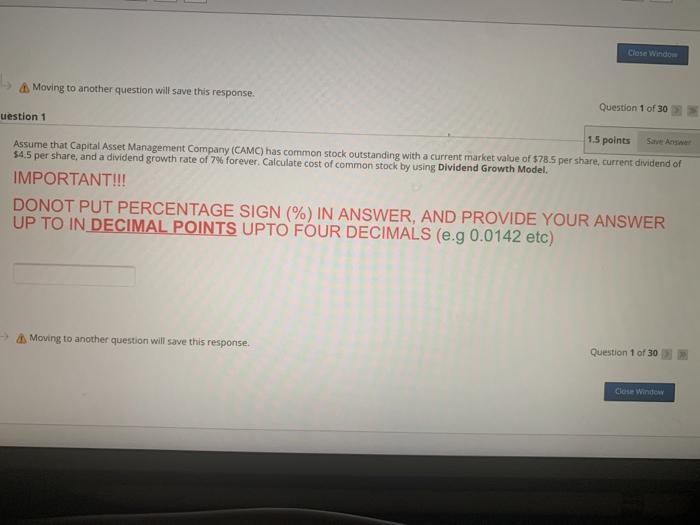

Close Windo Moving to another question will save this response. Question 1 of 30 uestion 1 1.5 points Assume that Capital Asset Management Company (CAMC) has common stock outstanding with a current market value of $78.5 per share, current dividend of 54.5 per share, and a dividend growth rate of 7% forever. Calculate cost of common stock by using Dividend Growth Model IMPORTANT!!! DONOT PUT PERCENTAGE SIGN (%) IN ANSWER, AND PROVIDE YOUR ANSWER UP TO IN DECIMAL POINTS UPTO FOUR DECIMALS (e.g 0.0142 etc) -> Moving to another question will save this response. Question 1 of 30 Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts