Question: Close Window A Moving to the next question prevents changes to this answer. Question 4 of 7 Question 4 20 points Save Answer Steinway instrument

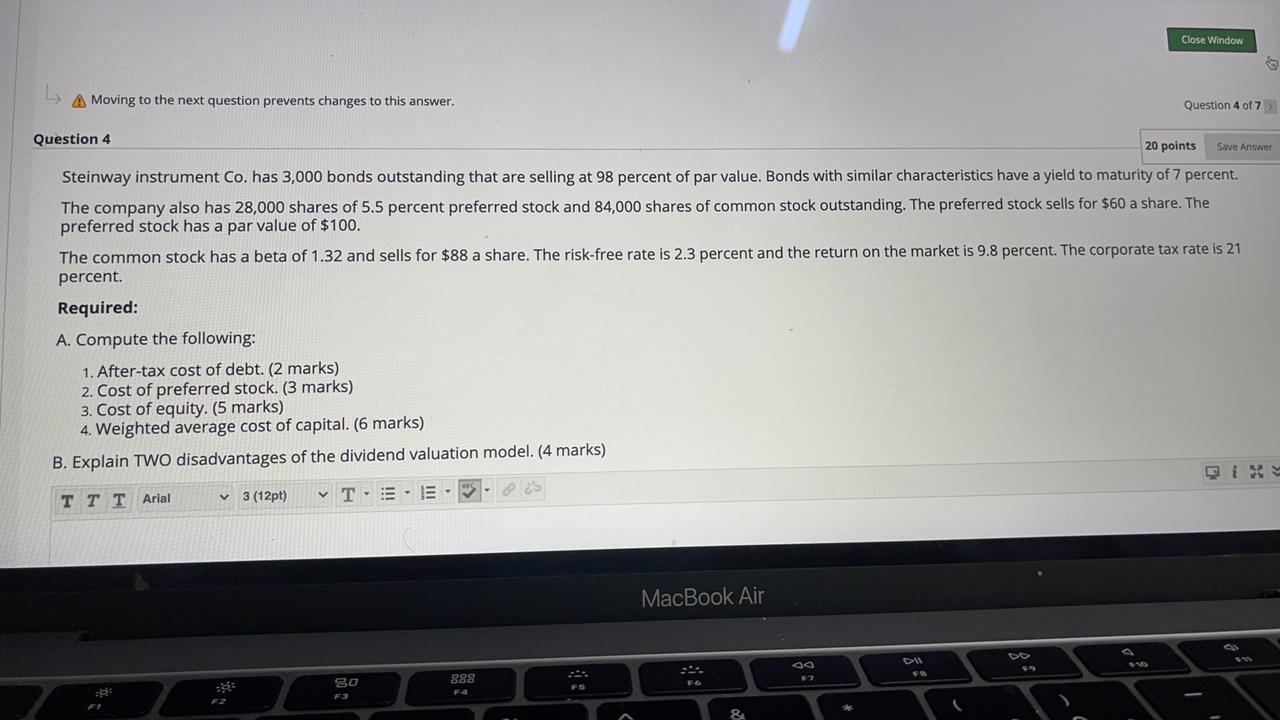

Close Window A Moving to the next question prevents changes to this answer. Question 4 of 7 Question 4 20 points Save Answer Steinway instrument Co. has 3,000 bonds outstanding that are selling at 98 percent of par value. Bonds with similar characteristics have a yield to maturity of 7 percent. The company also has 28,000 shares of 5.5 percent preferred stock and 84,000 shares of common stock outstanding. The preferred stock sells for $60 a share. The preferred stock has a par value of $100. The common stock has a beta of 1.32 and sells for $88 a share. The risk-free rate is 2.3 percent and the return on the market is 9.8 percent. The corporate tax rate is 21 percent. Required: A. Compute the following: 1. After-tax cost of debt. (2 marks) 2. Cost of preferred stock. (3 marks) 3. Cost of equity. (5 marks) 4. Weighted average cost of capital. (6 marks) B. Explain TWO disadvantages of the dividend valuation model. (4 marks) T T T Arial 3 (12pt) TEE MacBook Air BO 888 FB F7 &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts