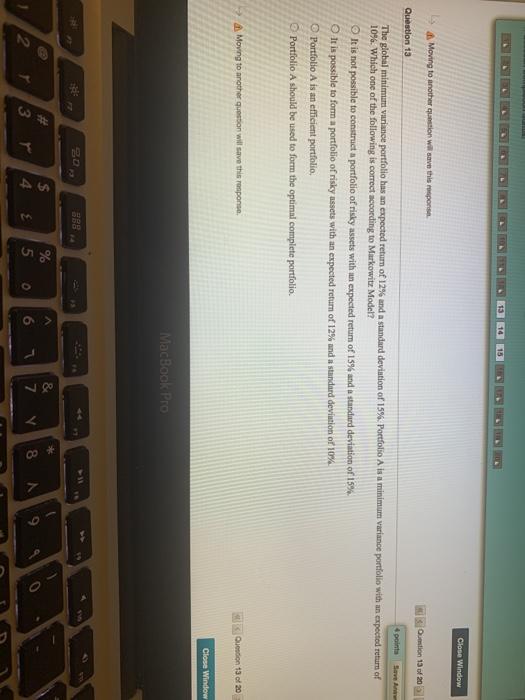

Question: Close Window Moving to another question will save this response. Question 13 of 205 Question 13 point Save The global minimum variance portfolio has an

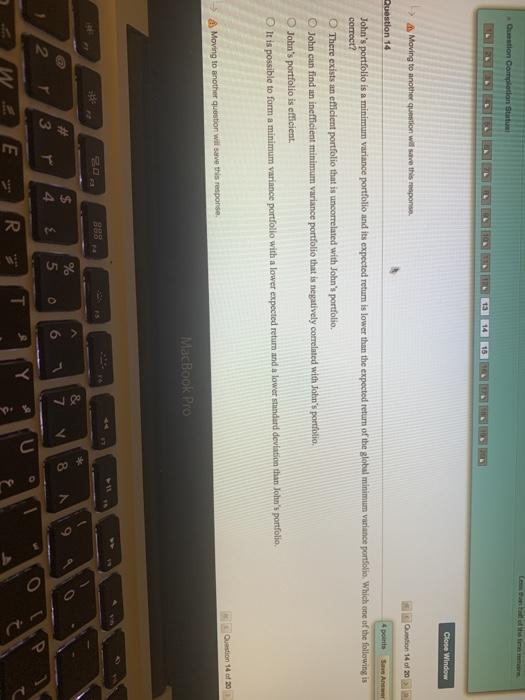

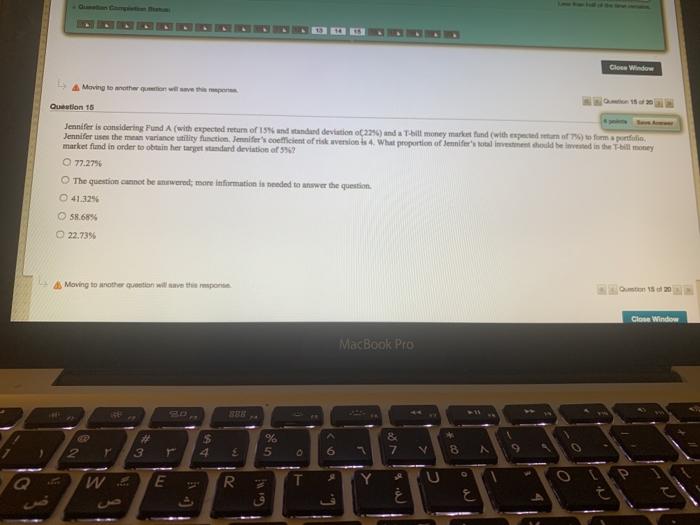

Close Window Moving to another question will save this response. Question 13 of 205 Question 13 point Save The global minimum variance portfolio has an expected return of 12% and a standard deviation of 15% Portfolio A is a minimum variance portfolio with an expected return of 10%. Which one of the following is correct according to Murkowite Model? It is not possible to construct a portfolio of risky assets with an expected retum of 15% and a standard deviation of 15% It is possible to form a portfolio of risky assets with an expected return of 12% und a standard deviation of 10% Portfolio A is an efficient portfolio Portfolio A should be used to form the optimal complete portfolio Moving to another question will save this reponse Question 13 ct 20 Close Window MacBook Pro ERE * $ 4 % 5 a> 3 E T 9 7 8 N Question Completion Close Window -> Moving to another question will save this response Own 14 of 20 Question 14 SA John's portfolio is a minimum variance portfolio and its expected retum is lower than the expected return of the global minimum variance portfolio Which one of the following is correct? There exists an efficient portfolio that is uncorrelated with John's portfolio. John can find an inefficient minimum variance portfolio that is negatively correlated with John's portfolio. John's portfolio is officient, It is possible to form a minimum variance portfolio with a lower expected return and a lower stundard deviation than John's portfolio Question 14 of 20 Moving to another question will see this response. MacBook Pro 30 988 $ 4 % 5 7 8 6 2 P 3 w 0 T E R E Clee Window A Moving to otherwise the per Question 16 Jennifer is considering Fund A (with expected return of 15 und anderd deviation oc22%) and a bit money market and with expected to form portfolio Jennifer uses the mean variance utility function. Jennifer's coefficient of risk in 14. What proportion of Jennifer' limet dould be in the hill money market fund in order to obtain her target standard deviation of 2 77.279 The question cannot be unswered, more information is needed to answer the question 41.325 58.68% 22.7396 Moving to another question will save the pot Oto 20 Clone Window MacBook Pro 11 % 5 UN +00 4 3 6 N O E 70 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts