Question: Close Window Moving to the next question prevents changes to this answer Question 667 Question 6 15 points Saved Transaction Exposure - 15 minutes XYZ

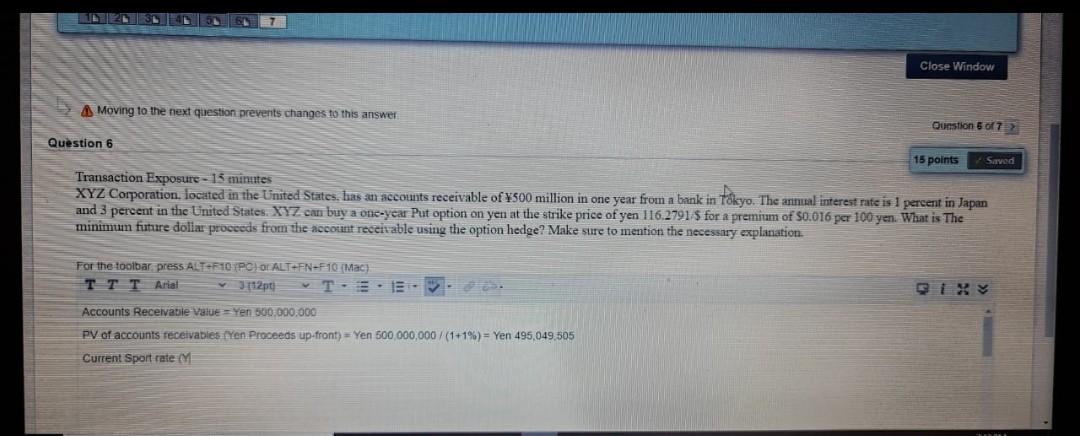

Close Window Moving to the next question prevents changes to this answer Question 667 Question 6 15 points Saved Transaction Exposure - 15 minutes XYZ Corporation, located in the United States, luas an accounts receivable of 500 million in one year from a bank in Tokyo. The annual interest rate is 1 percent in Japan and 3 percent in the United States. XYZ can buy a one-year Put option on yen at the strike price of yen 116.2791 $ for a premium of $0.016 per 100 yen. What is The minimun future dollar proceeds from the account receivable using the option hedge? Make sure to mention the necessary explanation. For the toolbar press ALT-10 (PCI ALT-FN-F10 (Mac) TTT Arial 3112pti Accounts Receivable Value = Yen 500.000.000 PV of accounts receivables (Yen Proceeds up-front) = Yen 500 000,000/(1+1%) = Yen 495,049 505 Current Sport rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts