Question: Close Window Save Moving to another question will save this response. Question 16 of 25 Question 16 5 points Suppose your portfolio consists of only

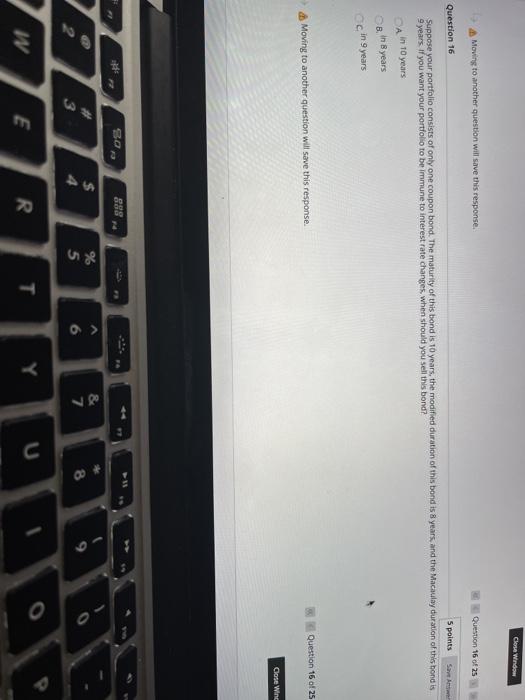

Close Window Save Moving to another question will save this response. Question 16 of 25 Question 16 5 points Suppose your portfolio consists of only one coupon bond. The maturity of this bond is 10 years, the modified duration of this bond is 8 years, and the Macaulay duration of this hond is 9 years. If you want your portfolio to be immune to interest rate changes, when should you sell this bond? A in 10 years B in Byears in 9 years Moving to another question will save this response. Question 16 of 25 Close Wing sos $ 4 % 5 7 6 8 3 R E Y T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts