Question: CLOSING WORKSHEET EXERCISE Use the following data and attached worksheet to answer the following questions: Closing Date (day belongs to the Buyer): September 1 (day

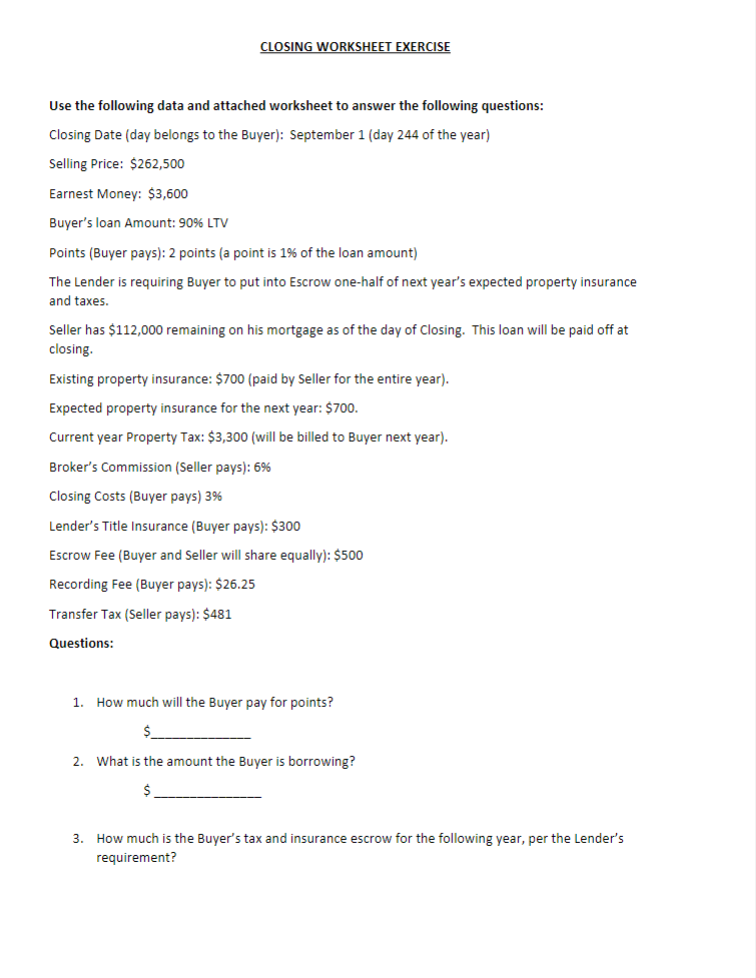

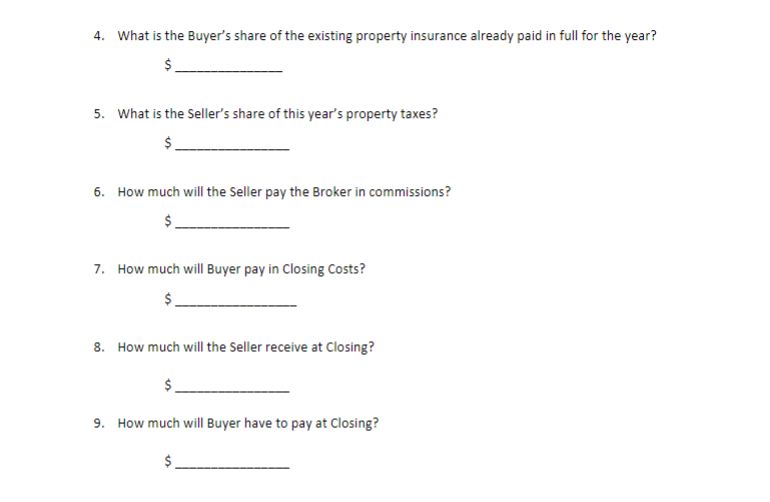

CLOSING WORKSHEET EXERCISE Use the following data and attached worksheet to answer the following questions: Closing Date (day belongs to the Buyer): September 1 (day 244 of the year) Selling Price: $262,500 Earnest Money: $3,600 Buyer's loan Amount: 90\% LTV Points (Buyer pays): 2 points (a point is 1% of the loan amount) The Lender is requiring Buyer to put into Escrow one-half of next year's expected property insurance and taxes. Seller has $112,000 remaining on his mortgage as of the day of Closing. This loan will be paid off at closing. Existing property insurance: $700 (paid by Seller for the entire year). Expected property insurance for the next year: $700. Current year Property Tax: $3,300 (will be billed to Buyer next year). Broker's Commission (Seller pays): 6% Closing Costs (Buyer pays) 3\% Lender's Title Insurance (Buyer pays): $300 Escrow Fee (Buyer and Seller will share equally): \$500 Recording Fee (Buyer pays): \$26.25 Transfer Tax (Seller pays): \$481 Questions: 1. How much will the Buyer pay for points? ! 2. What is the amount the Buyer is borrowing? $ 3. How much is the Buyer's tax and insurance escrow for the following year, per the Lender's requirement? 4. What is the Buyer's share of the existing property insurance already paid in full for the year? 5. What is the Seller's share of this year's property taxes? 6. How much will the Seller pay the Broker in commissions? 7. How much will Buyer pay in Closing Costs? $ 8. How much will the Seller receive at Closing? $ 9. How much will Buyer have to pay at Closing? $ CLOSING WORKSHEET EXERCISE Use the following data and attached worksheet to answer the following questions: Closing Date (day belongs to the Buyer): September 1 (day 244 of the year) Selling Price: $262,500 Earnest Money: $3,600 Buyer's loan Amount: 90\% LTV Points (Buyer pays): 2 points (a point is 1% of the loan amount) The Lender is requiring Buyer to put into Escrow one-half of next year's expected property insurance and taxes. Seller has $112,000 remaining on his mortgage as of the day of Closing. This loan will be paid off at closing. Existing property insurance: $700 (paid by Seller for the entire year). Expected property insurance for the next year: $700. Current year Property Tax: $3,300 (will be billed to Buyer next year). Broker's Commission (Seller pays): 6% Closing Costs (Buyer pays) 3\% Lender's Title Insurance (Buyer pays): $300 Escrow Fee (Buyer and Seller will share equally): \$500 Recording Fee (Buyer pays): \$26.25 Transfer Tax (Seller pays): \$481 Questions: 1. How much will the Buyer pay for points? ! 2. What is the amount the Buyer is borrowing? $ 3. How much is the Buyer's tax and insurance escrow for the following year, per the Lender's requirement? 4. What is the Buyer's share of the existing property insurance already paid in full for the year? 5. What is the Seller's share of this year's property taxes? 6. How much will the Seller pay the Broker in commissions? 7. How much will Buyer pay in Closing Costs? $ 8. How much will the Seller receive at Closing? $ 9. How much will Buyer have to pay at Closing? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts