Question: CLOUD 9 Assignment 2 You are a graduate working for W&S Partners, a Canadian accounting firm with offices located in each of Canada's major cities.

CLOUD 9 Assignment 2

You are a graduate working for W&S Partners, a Canadian accounting firm with offices located in each of Canada's major cities. W&S Partners has just been awarded the December 31, 2023, audit for Cloud 9 Ltd. (Cloud 9). The audit team assigned to this client is:

- Jo Wadley, partner

- Sharon Gallagher, audit manager

- Josh Thomas and Suzie Pickering, audit seniors

- Mark Batten, IT audit manager

- Ian Harper and you, graduates

You will need to have a cover sheet, table of contents, and appendices (if applicable).

Maximum Number of Pages: 20 inc. cover sheet, table of contents

PART 1 Materiality, Analytical Procedures, Sampling

W&S Partners commenced the risk assessment phase of the Cloud 9 audit with procedures to gain an understanding of the client's structure and its business environment. You have completed your research on the key market forces as they relate to Cloud 9's operations. The topics you researched included the general and industry-specific economic trends and conditions; the competitive environment; product, customer, and supplier information; technological advances and the effect of the Internet; and laws and regulatory requirements. The purpose of this research is to identify the inherent risks. The auditor needs to identify which financial statement assertions may be affected by these inherent risks. Identifying the risks will help determine the nature of the audit procedures to be performed. Through your analysis you have determined that the Inherent Risk is High.

Management implicitly or explicitly makes assertions regarding the recognition, measurement, presentation, and disclosure of the various elements of the financial statements. Auditors use assertions for account balances to form a basis for the assessment of risks of material misstatement. That is, assertions are used to identify the types of errors that could occur in transactions that result in the account balance. Consequently, further breaking down the account into these assertions will direct the audit effort to those areas of higher risk. The auditors broadly classify assertions as existence or occurrence; completeness; valuation or allocation; rights and obligations; and presentation and disclosure.

An additional task during the risk assessment phase is to consider the concept of materiality as it applies to the client. The auditor will design procedures in order to identify and correct errors or irregularities that would have a material effect on the financial statements and affect the decision-making of the users of the financial statements. Materiality is used in determining audit procedures and sample selections, and in evaluating differences between client records and audit results. It is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial statements. In selecting the base figure to be used to calculate materiality, an auditor should consider the key drivers of the business and ask, "What are the end users (that is, shareholders, banks, and so on) of the accounts going to be looking at?" For example, will shareholders be interested in profit figures that can be used to pay dividends and increase share price?

W&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. Further, only one basis should be selected?a blended approach or average should not be used. The basis selected is the one determined to be the key driver of the business.

W&S Partners uses the percentages intable 4.12as starting points for the various bases.

These starting points can be increased or decreased by taking into account qualitative client factors, such as:

- the nature of the client's business and industry (for example, rapidly changing through growth or downsizing, or because of an unstable environment)

- whether the client is a public company (or subsidiary of one) that is subject to regulations

- the knowledge of or high risk of fraud

Typically, profit before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent.

When calculating PM based on interim figures, it may be necessary to annualize the results. This allows the auditor to plan the audit properly based on an approximate projected year-end balance. Then, at year end, the figure is adjusted, if necessary, to reflect the actual results.

Table 4.12:

Base Threshold (%)

Profit before tax 5.0

Revenues 1.0

Total Assets 1.0

Equity 3.0

Required

Answer the following questions based on the information presented for Cloud 9 inAppendix Ato this book and in the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapters.

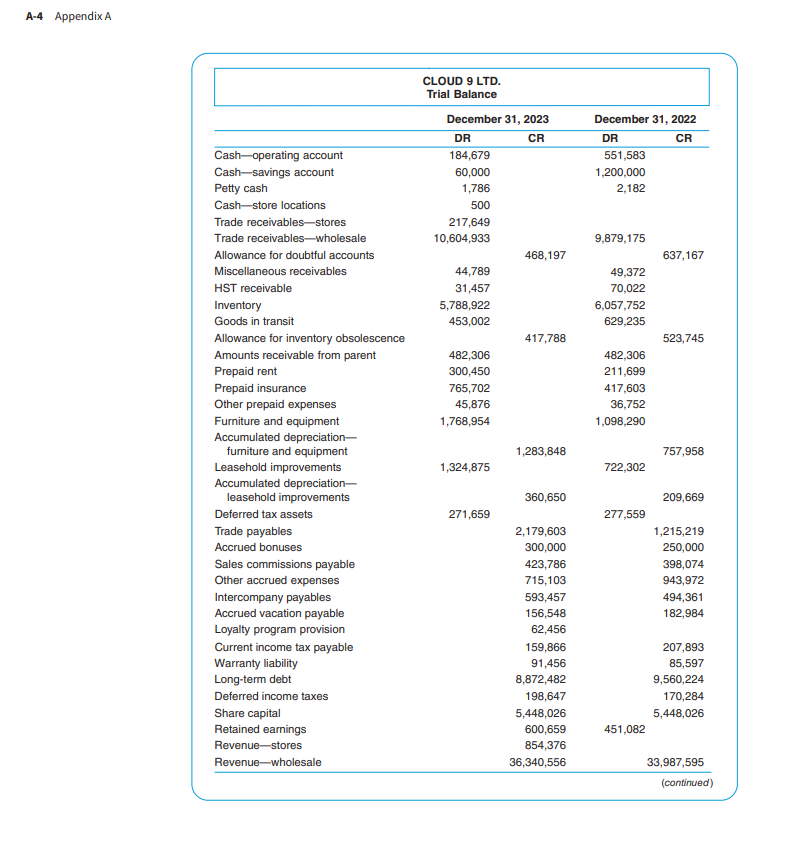

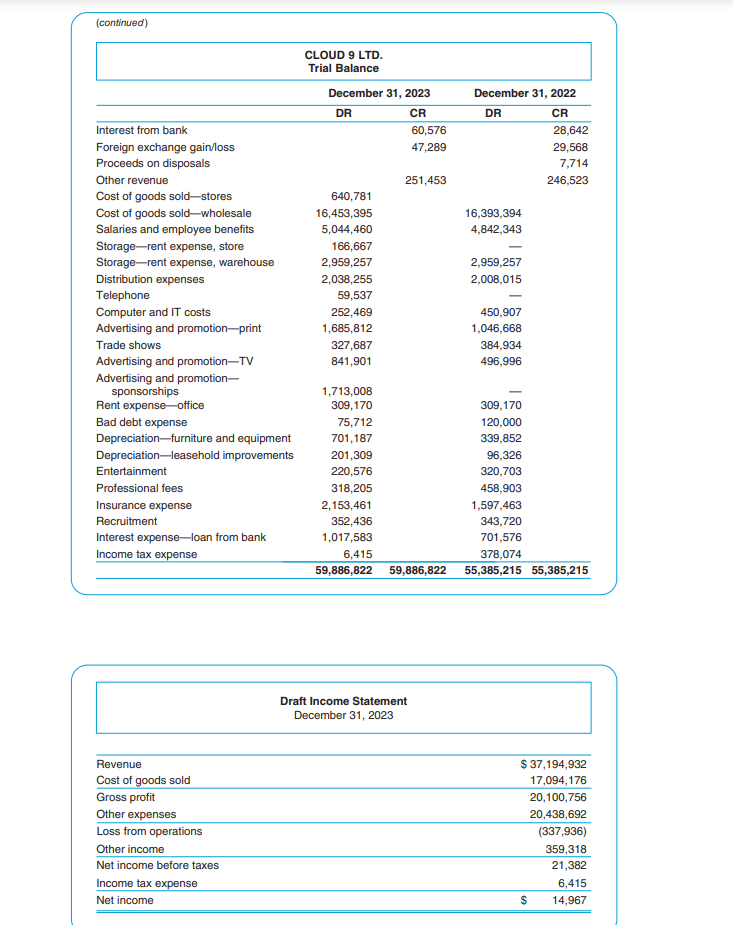

- Using the December 31, 2023, trial balance (inAppendix A), calculate planning materiality and include the justification for the basis that you have used for your calculation.

- Using analytical procedures and the information provided in the appendix, perform preliminary analytics of Cloud 9's financial position and its business risks. Discuss the ratios indicating a significant or an unexpected fluctuation.

- Which specific areas do you believe should receive special emphasis during your audit? Consider your discussion of the results of analytical procedures as well as your preliminary estimate of materiality. Prepare a memorandum to Suzie Pickering outlining potential problem areas (that is, where possible material misstatements in the financial report exist) and any other special concerns (for example, going concern). Specify the relevant accounts and the related risks that would require particular attention.

- Consider and explain the effects that the opening of Cloud 9's first retail store would have on its accounting.

- Describe how this business change would affect the components of audit risk.

- What changes would you expect to see in inventory transactions and balances as Cloud 9 changes from a wholesale-only business to a retail and wholesale business? Be specific in your answer.

- Which inventory balance and transaction assertions would be most affected? Explain.

- Describe the population(s) and suggest a sampling approach for controls and substantive testing for inventory.

PART 2 Control Testing & Data Analytics

Sharon Gallagher and Josh Thomas have assessed the internal controls at Cloud 9 as being effective at an entity level. This means that, at a high level, the company demonstrates an environment where potential material misstatements are prevented or detected.

Required

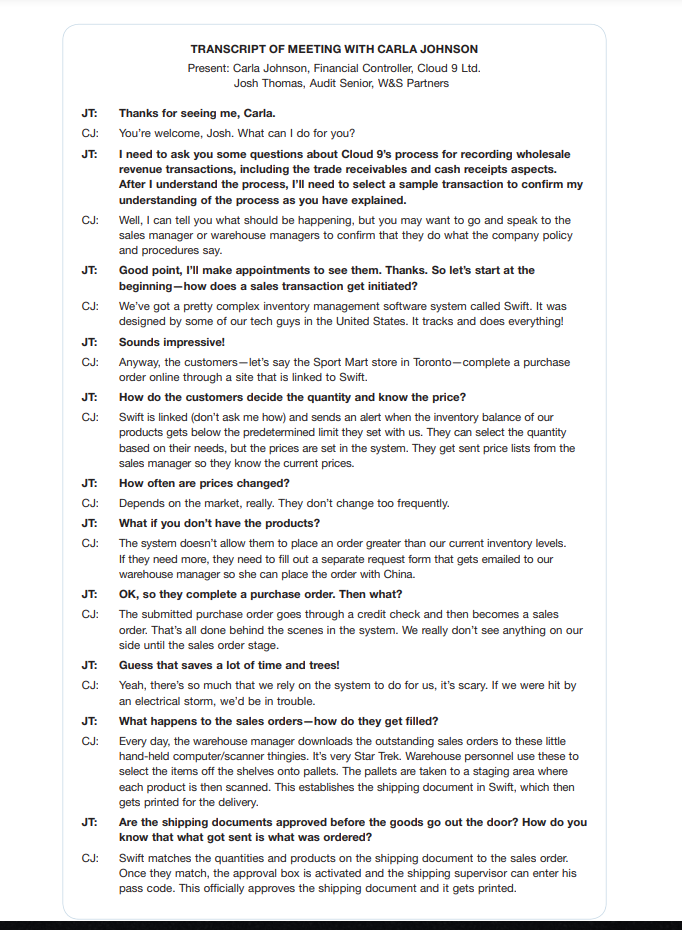

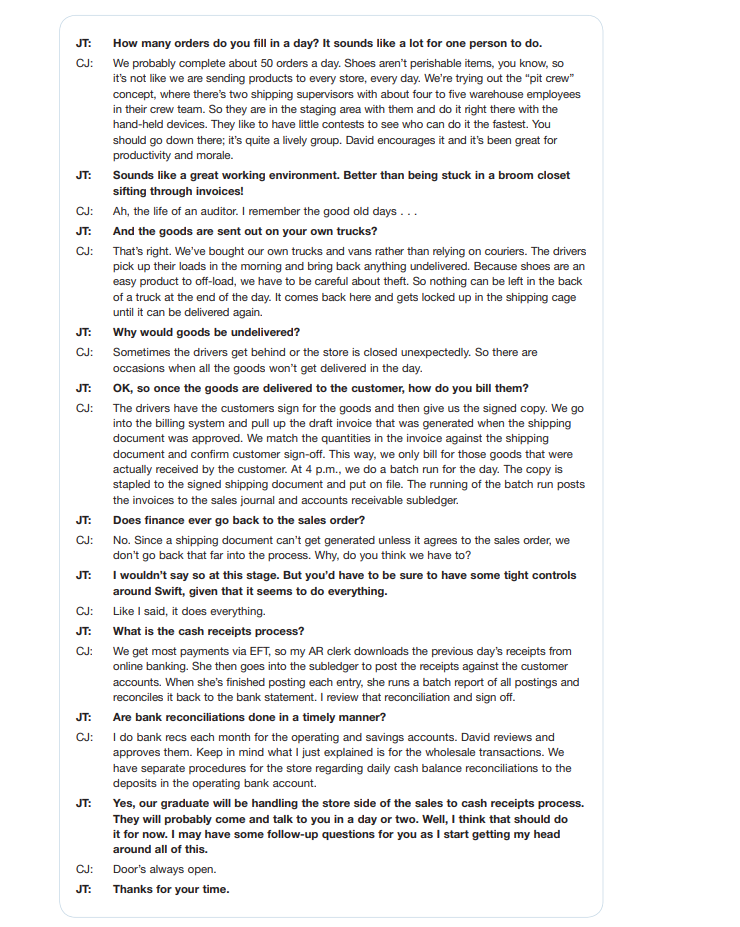

You have been assigned the task of documenting the understanding of the process for recording sales, trade receivables, and cash receipt transactions for wholesale customers. In your absence, Josh met with the Cloud 9 financial controller, Carla Johnson, and received permission to tape the interview, which is provided as a transcript (seeAppendix A). Using this interview transcript and other information presented in the case, you are asked to:

- Prepare a flowchart or narrative documenting your understanding of the sales to cash receipts process for wholesale sales.

- Identify any follow-up questions you would like to ask the client if aspects of the process are not adequately explained. You could address such questions to Carla Johnson or any other employee you deem appropriate.

- Draw up a worksheet using the following format.

Significant process Potential Material Misstatement Assertations Transaction-Level Controls

Use the column "Potential Material Misstatement" and identify the potential material misstatements that could occur in the sales to cash receipts process. Use as many rows as you need. Identify the potential material misstatements that could occur in the sales to cash receipts process for wholesale sales. Using the material misstatements identified, complete the third column "Assertions" to identify the financial statement assertion that is affected for each potential material misstatement. Lastly, in column four, include the transaction-level internal controls Cloud 9 has implemented to prevent and/or detect potential errors.

4 .During discussions with management, Josh asked how often the product prices are changed. Carla Johnson, the Financial Controller, responded that they didn't change that often. Describe a data analytics technique that could be used to corroborate Carla's statement using the five-step approach. Be specific in identifying a logical source that Josh might be able to obtain data from in order to better understand pricing fluctuations

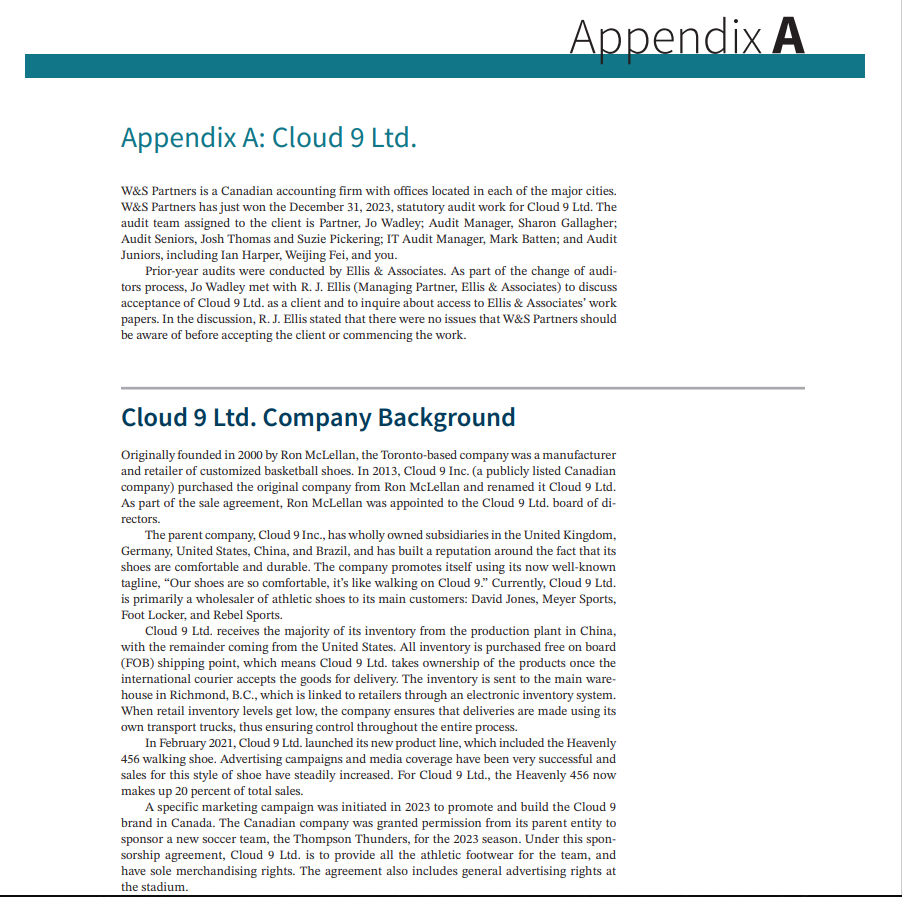

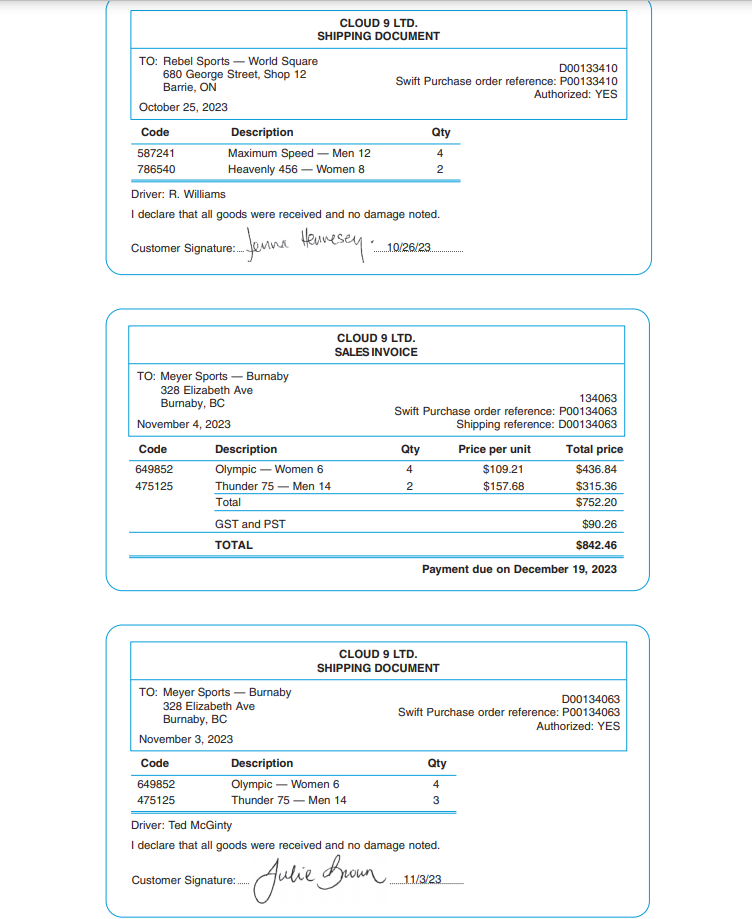

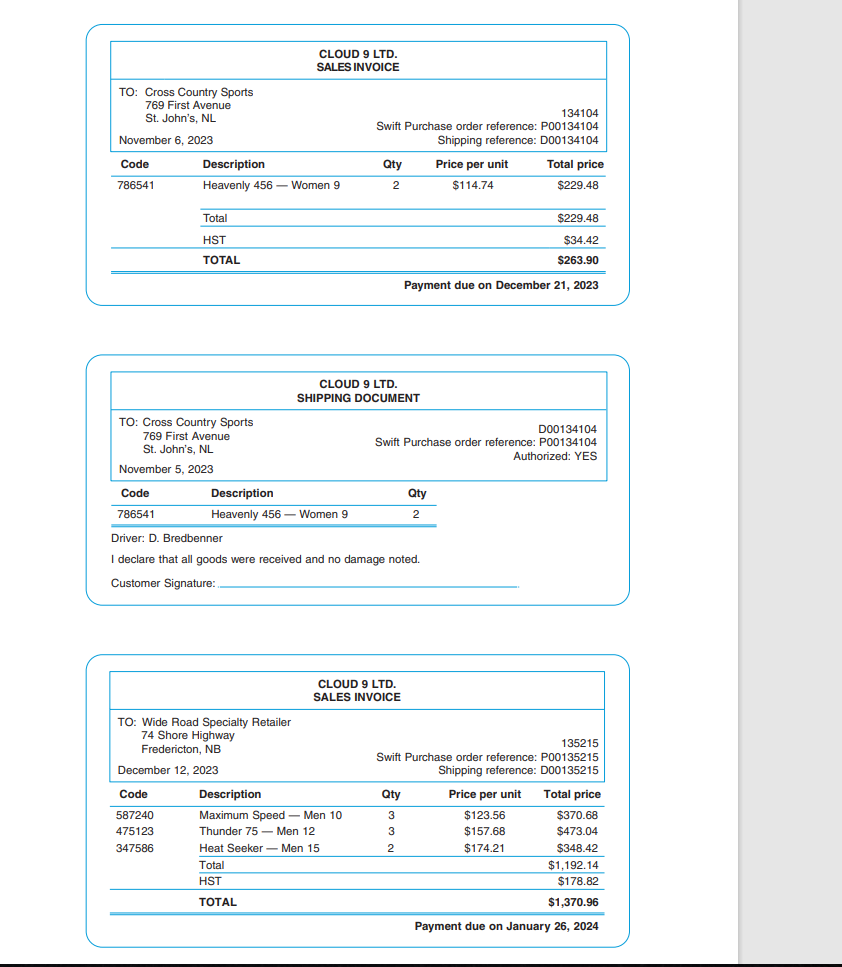

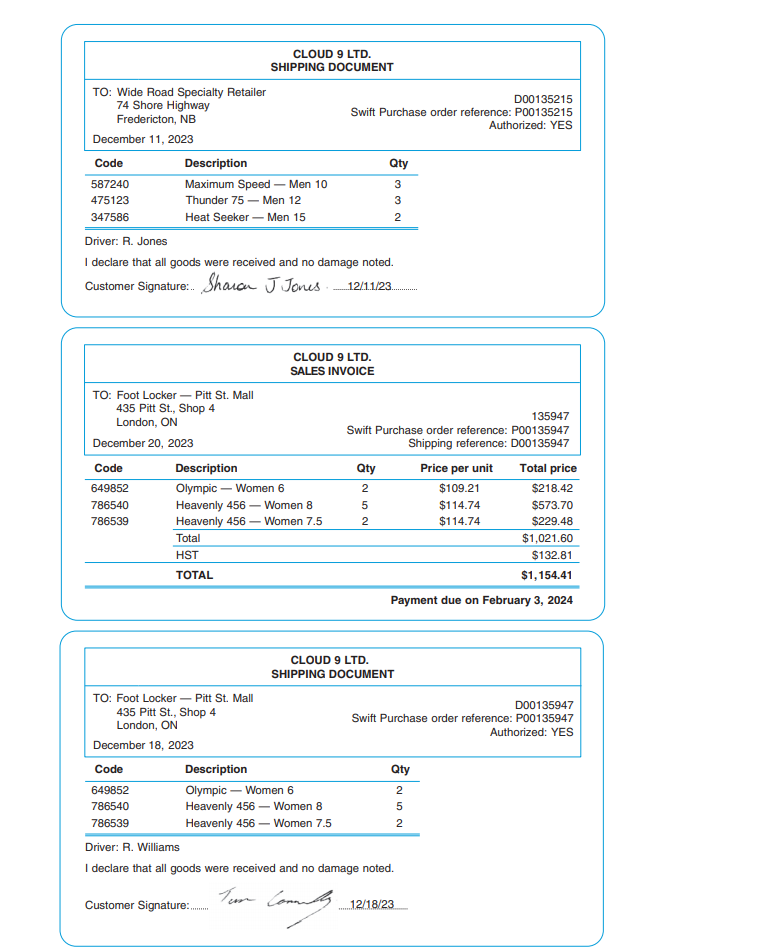

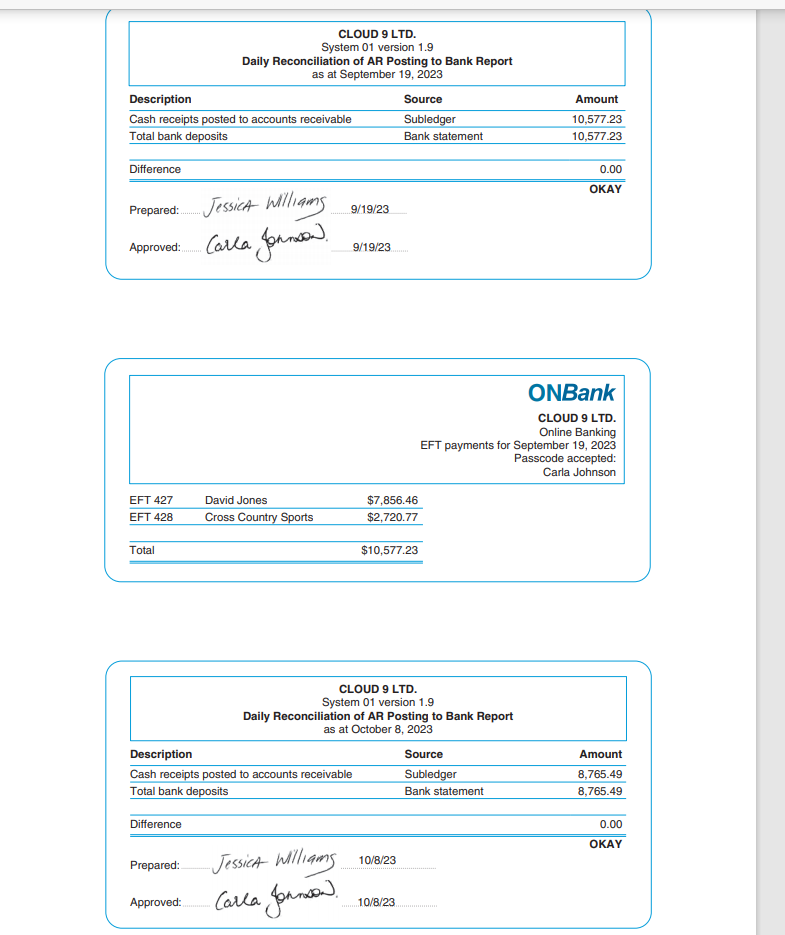

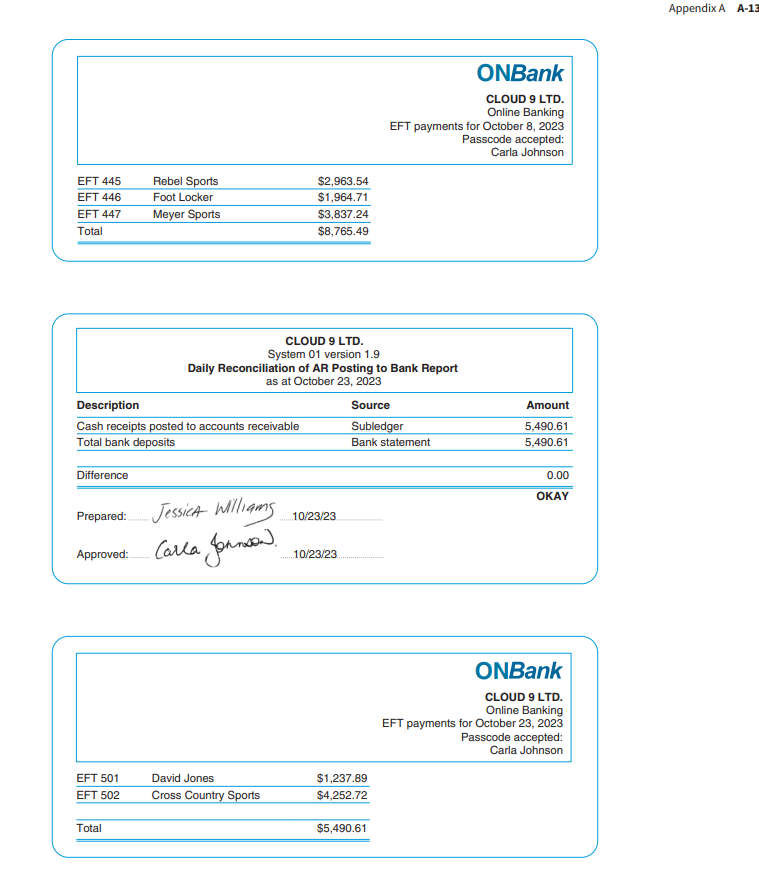

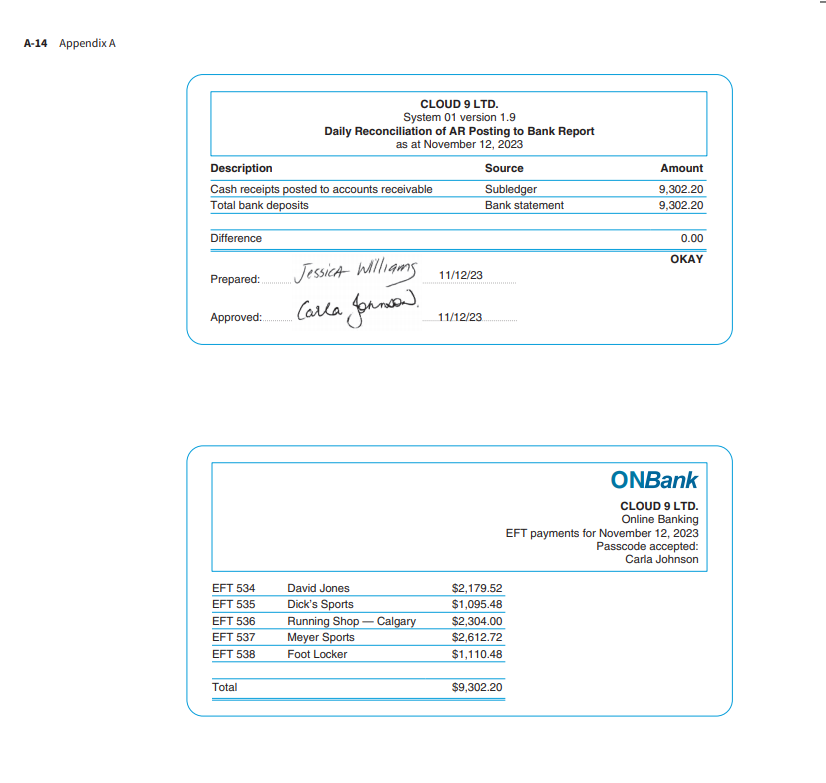

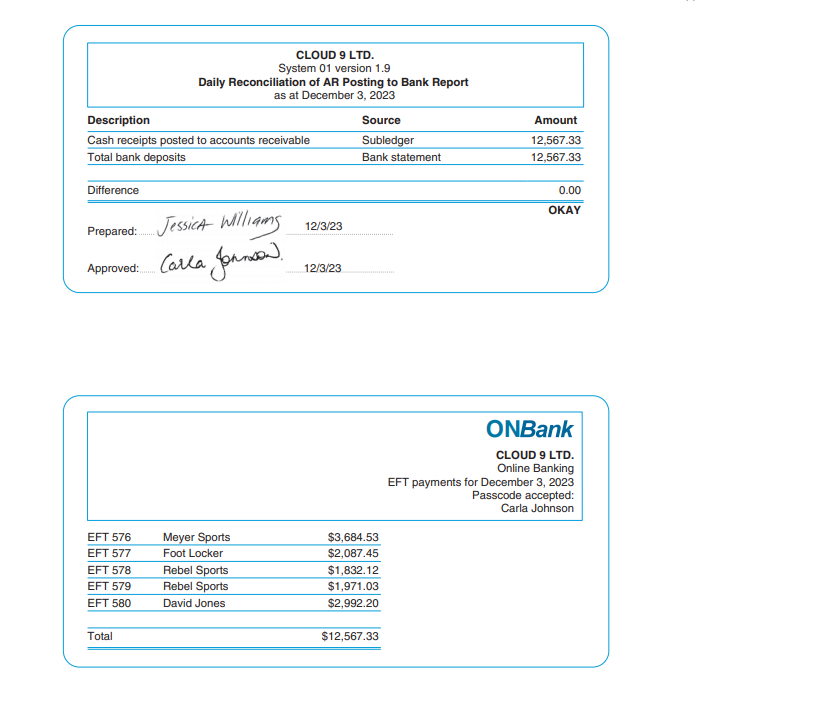

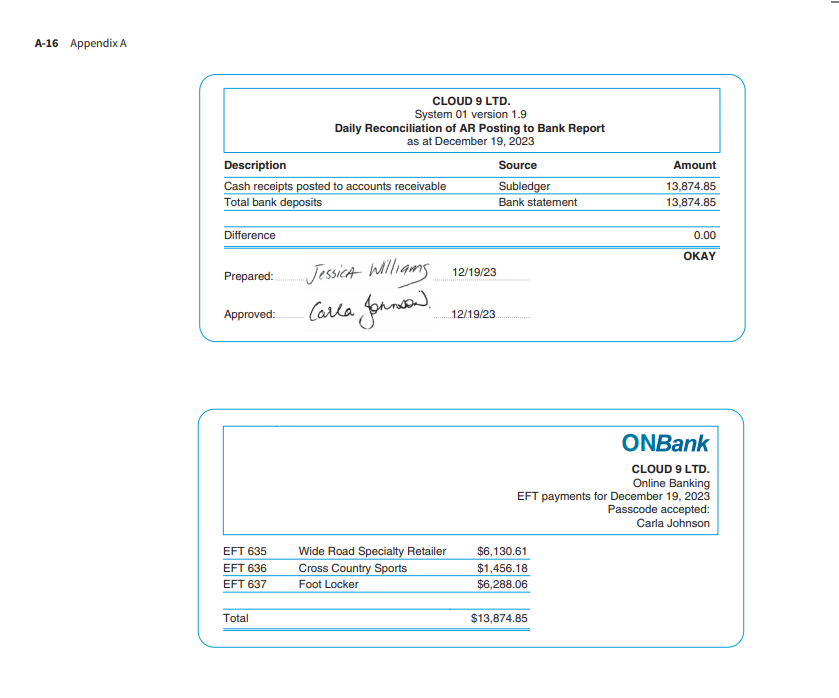

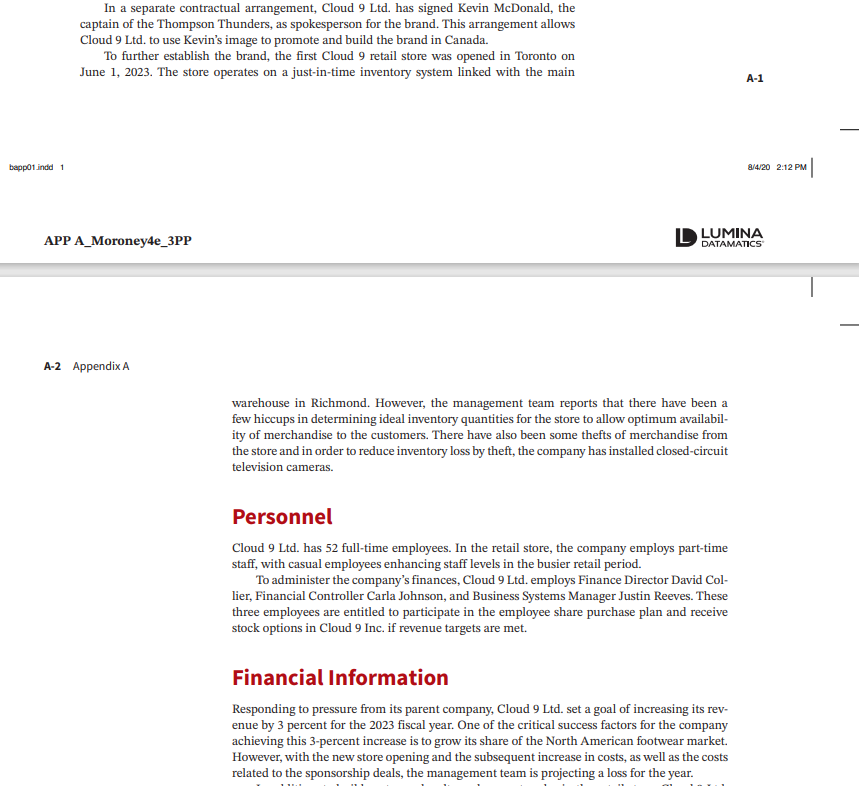

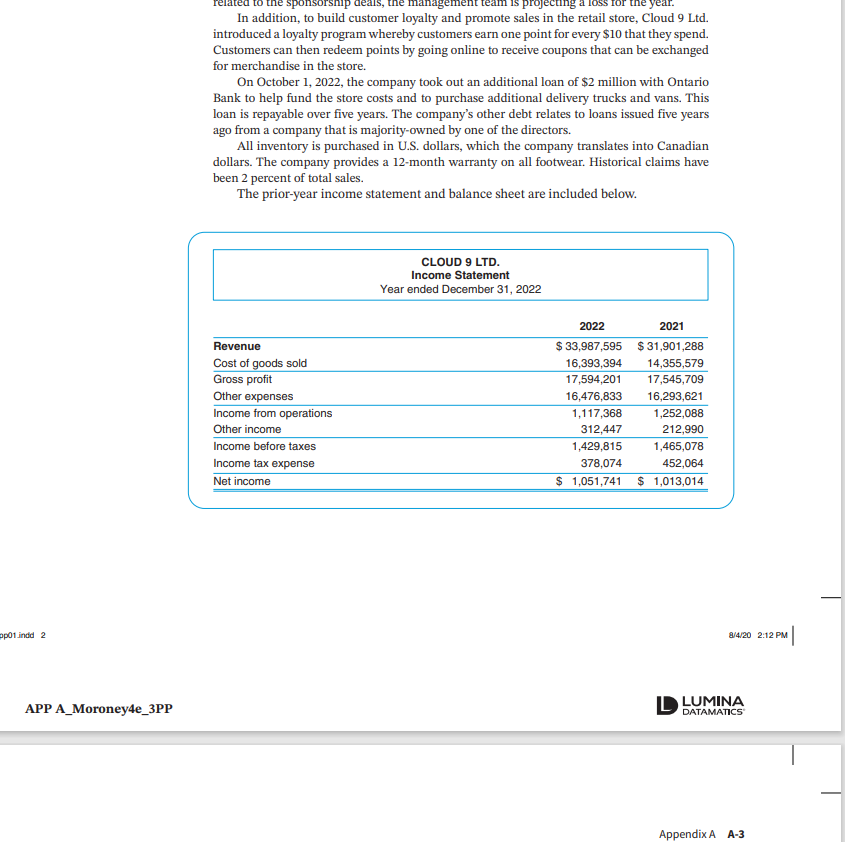

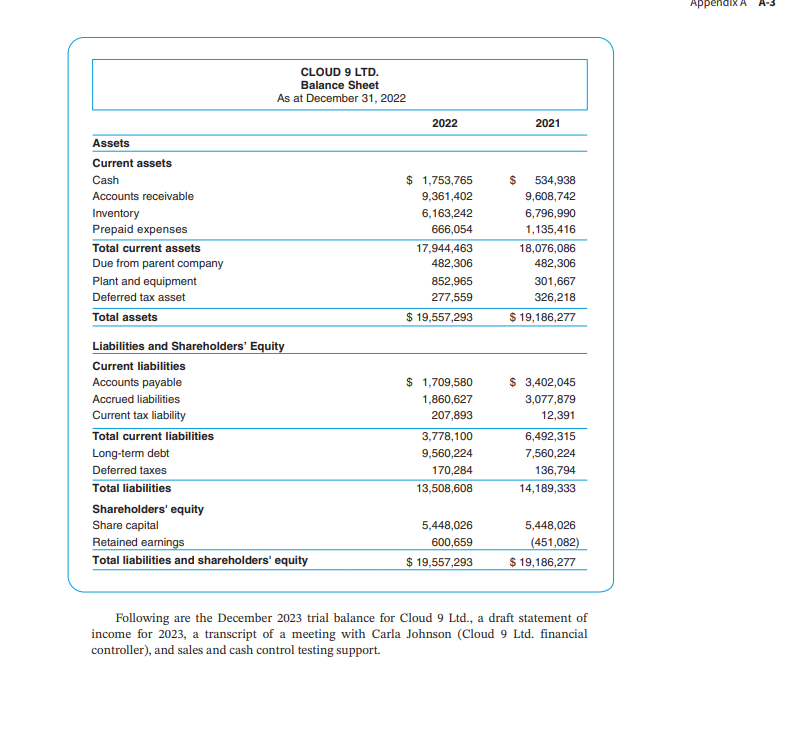

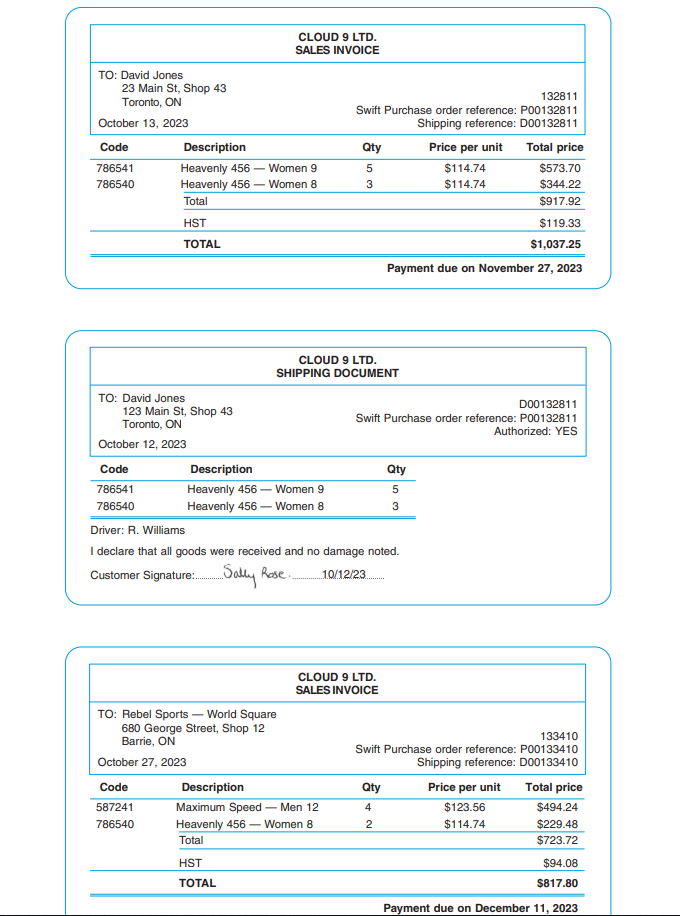

Appendix A Appendix A: Cloud 9 Ltd. W&S Partners is a Canadian accounting firm with offices located in each of the major cities. W&S Partners has just won the December 31, 2023, statutory audit work for Cloud 9 Ltd. The audit team assigned to the client is Partner, Jo Wadley; Audit Manager, Sharon Gallagher; Audit Seniors, Josh Thomas and Suzie Pickering; IT Audit Manager, Mark Batten; and Audit Juniors, including lan Harper, Weijing Fei, and you. Prior-year audits were conducted by Ellis & Associates. As part of the change of audi- tors process, Jo Wadley met with R. J. Ellis (Managing Partner, Ellis & Associates) to discuss acceptance of Cloud 9 Lid. as a client and to inquire about access to Ellis & Associates' work papers. In the discussion, R. J. Ellis stated that there were no issues that W&S Partners should be aware of before accepting the client or commencing the work. Cloud 9 Ltd. Company Background Originally founded in 2000 by Ron Mclellan, the Toronto-based company was a manufacturer and retailer of customized basketball shoes. In 2013, Cloud 9 Inc. (a publicly listed Canadian company) purchased the original company from Ron Mclellan and renamed it Cloud 9 Ltd. As part of the sale agreement, Ron Mclellan was appointed to the Cloud 9 Ltd. board of di- rectors. The parent company, Cloud 9 Inc., has wholly owned subsidiaries in the United Kingdom, Germany, United States, China, and Brazil, and has built a reputation around the fact that its shoes are comfortable and durable. The company promotes itself using its now well-known tagline, "Our shoes are so comfortable, it's like walking on Cloud 9." Currently, Cloud 9 Ltd. is primarily a wholesaler of athletic shoes to its main customers: David Jones, Meyer Sports, Foot Locker, and Rebel Sports. Cloud 9 Led. receives the majority of its inventory from the production plant in China, with the remainder coming from the United States. All inventory is purchased free on board (FOB) shipping point, which means Cloud 9 Led. takes ownership of the products once the international courier accepts the goods for delivery. The inventory is sent to the main ware- house in Richmond, B.C., which is linked to retailers through an electronic inventory system. When retail inventory levels get low, the company ensures that deliveries are made using its own transport trucks, thus ensuring control throughout the entire process. In February 2021, Cloud 9 Led. launched its new product line, which included the Heavenly 456 walking shoe. Advertising campaigns and media coverage have been very successful and sales for this style of shoe have steadily increased. For Cloud 9 Ltd., the Heavenly 456 now makes up 20 percent of total sales. A specific marketing campaign was initiated in 2023 to promote and build the Cloud 9 brand in Canada. The Canadian company was granted permission from its parent entity to sponsor a new soccer team, the Thompson Thunders, for the 2023 season. Under this spon- sorship agreement, Cloud 9 Lid. is to provide all the athletic footwear for the team, and have sole merchandising rights. The agreement also includes general advertising rights at he stadium.CLOUD 9 LTD. SHIPPING DOCUMENT TO: Rebel Sports - World Square DO0133410 680 George Street, Shop 12 Barrie, ON Swift Purchase order reference: P00133410 Authorized: YES October 25, 2023 Code Description Qty 587241 Maximum Speed - Men 12 786540 Heavenly 456 - Women 8 Driver: R. Williams I declare that all goods were received and no damage noted. Customer Signature:. Jovi Hennesey .10/26/23. CLOUD 9 LTD. SALES INVOIC TO: Meyer Sports - Burnaby 328 Elizabeth Ave Burnaby, BC 134063 Swift Purchase order reference: P00134063 November 4, 2023 Shipping reference: D00134063 Code Description Qty Price per unit Total price 649852 Olympic - Women 6 $109.21 $436.84 475125 Thunder 75 - Men 14 $157.68 $315.36 Total $752.20 GST and PST $90.26 TOTAL $842.46 Payment due on December 19, 2023 OUD 9 LTD. SHIPPING DOCUMENT TO: Meyer Sports - Burnaby DO0134063 328 Elizabeth Ave Swift Purchase order reference: P00134063 Burnaby, BC Authorized: YES November 3, 2023 Code Description Qty 649852 Olympic - Women 6 475125 Thunder 75 - Men 14 Driver: Ted McGinty I declare that all goods were received and no damage noted. Customer Signature: .. Julie Brown. .1.1/3/23CLOUD 9 LTD. SALES INVOICE TO: Cross Country Sports 769 First Avenue 134104 St. John's, NL Swift Purchase order reference: P00134104 November 6, 2023 Shipping reference: D00134104 Code Description Qty Price per unit Total price 786541 Heavenly 456 - Women 9 2 $114.74 $229.48 Total $229.48 HST $34.42 TOTAL $263.90 Payment due on December 21, 2023 CLOUD 9 LTD. SHIPPING DOCUMENT TO: Cross Country Sports DO0134104 769 First Avenue Swift Purchase order reference: P00134104 St. John's, NL Authorized: YES November 5, 2023 Code Description Qty 786541 Heavenly 456 - Women 9 2 Driver: D. Bredbenner I declare that all goods were received and no damage noted. Customer Signature: CLOUD 9 LTD. SALES INVOICE TO: Wide Road Specialty Retailer 74 Shore Highway 135215 Fredericton, NB Swift Purchase order reference: P00135215 December 12, 2023 Shipping reference: D00135215 Code Description Qty Price per unit Total price 587240 Maximum Speed - Men 10 $123.56 $370.68 475123 Thunder 75 - Men 12 $157.68 $473.04 347586 Heat Seeker - Men 15 $174.21 $348.42 Total $1,192.14 HST $178.82 TOTAL $1,370.96 Payment due on January 26, 2024CLOUD 9 LTD. SHIPPING DOCUMENT TO: Wide Road Specialty Retailer 74 Shore Highway DO0135215 Swift Purchase order reference: P00135215 Fredericton, NB Authorized: YES December 11, 2023 Code Description Qty 587240 Maximum Speed - Men 10 475123 Thunder 75 - Men 12 N GO 347586 Heat Seeker - Men 15 Driver: R. Jones I declare that all goods were received and no damage noted. Customer Signature:.. Sharon J Jones . _12/1.1/23.. CLOUD 9 LTD. SALES INVOICE TO: Foot Locker - Pitt St. Mall 435 Pitt St., Shop 4 London, ON 135947 Swift Purchase order reference: P00135947 December 20, 2023 Shipping reference: D00135947 Code Description Qty Price per unit Total price 649852 Olympic - - Women 6 $109.21 $218.42 786540 Heavenly 456 - - Women 8 $114.74 $573.70 786539 Heavenly 456 - - Women 7.5 $114.74 $229.48 Total $1,021.60 HST $132.81 TOTAL $1, 154.41 Payment due on February 3, 2024 CLOUD 9 LTD. SHIPPING DOCUMENT TO: Foot Locker - Pitt St. Mall DO0135947 435 Pitt St., Shop 4 London, ON Swift Purchase order reference: P00135947 Authorized: YES December 18, 2023 Code Description Qty 649852 Olympic - Women 6 786540 Heavenly 456 - Women 8 No a No 786539 Heavenly 456 - Women 7.5 Driver: R. Williams I declare that all goods were received and no damage noted. Customer Signature:.. .12/18/23CLOUD 9 LTD. System 01 version 1.9 Daily Reconciliation of AR Posting to Bank Report as at September 19, 2023 Description Source Amount Cash receipts posted to accounts receivable Subledger 10,577.23 Total bank deposits Bank statement 10,577.23 Difference 0.00 OKAY Prepared: . Jessica williams .9/19/23 Approved:. Calla Johnson). 9/19/23 ONBank CLOUD 9 LTD. Online Banking EFT payments for September 19, 2023 Passcode accepted: Carla Johnson EFT 427 David Jones $7,856.46 EFT 428 Cross Country Sports $2,720.77 Total $10,577.23 CLOUD 9 LTD. System 01 version 1.9 Daily Reconciliation of AR Posting to Bank Report as at October 8, 2023 Description Source Amount Cash receipts posted to accounts receivable Subledger 8,765.49 Total bank deposits Bank statement 8,765.49 Difference 0.00 OKAY Prepared: Jessica Williams 10/8/23 Approved: Calla fornow). .10/8/23.Appendix A A-13 ONBank CLOUD 9 LTD. Online Banking EFT payments for October 8, 2023 Passcode accepted: Carla Johnson EFT 445 Rebel Sports $2,963.54 EFT 446 Foot Locker $1,964.71 EFT 447 Meyer Sports $3,837.24 Total $8,765.49 CLOUD 9 LTD. System 01 version 1.9 Daily Reconciliation of AR Posting to Bank Report as at October 23, 2023 Description Source Amount Cash receipts posted to accounts receivable Subledger 5,490.61 Total bank deposits Bank statement 5,490.61 Difference 0.00 OKAY Prepared:. Jessica williams 10/23/23 Approved: Calla borrow). 10/23/23. ONBank CLOUD 9 LTD. Online Banking EFT payments for October 23, 2023 Passcode accepted: Carla Johnson EFT 501 David Jones $1,237.89 EFT 502 Cross Country Sports $4,252.72 Total $5,490.61A-14 Appendix A CLOUD 9 LTD. System 01 version 1 Daily Reconciliation of AR Posting to Bank Report as at November 12, 2023 Description Source Amount Cash receipts posted to accounts receivable Subledger 9,302.20 Total bank deposits Bank statement 9,302.20 Difference 0.00 OKAY Prepared:. Jessica williams 11/12/23 Calla Johnson). Approved:. 11/12/23. ONBank CLOUD 9 LTD. Online Banking EFT payments for November 12, 2023 Passcode accepted: Carla Johnson EFT 534 David Jones $2,179.52 EFT 535 Dick's Sports $1,095.48 EFT 536 Running Shop - Calgary $2,304.00 EFT 537 Meyer Sports $2,612.72 EFT 538 Foot Locker $1,110.48 Total $9,302.20CLOUD 9 LTD. System 01 version 1.9 Daily Reconciliation of AR Posting to Bank Report as at December 3, 2023 Description Source Amount Cash receipts posted to accounts receivable Subledger 12,567.33 Total bank deposits Bank statement 12,567.33 Difference 0.00 OKAY Prepared:. Jessica williams 12/3/23 Approved:. Calla Johnson). 12/3/23 ONBank CLOUD 9 LTD. Online Banking EFT payments for December 3, 2023 Passcode accepted: Carla Johnson EFT 576 Meyer Sports $3,684.53 EFT 577 Foot Locker $2,087.45 EFT 578 Rebel Sports $1,832.12 EFT 579 Rebel Sports $1,971.03 EFT 580 David Jones $2,992.20 Total $12,567.33A-16 AppendixA CLOUD 9 LTD. System 01 version 1.9 Daily Reconciliation of AR Posting to Bank Report as at December 19, 2023 Description Source Amount Cash receipts posted to accounts receivable Subledger 13,874.85 Total bank deposits Bank statement 13,874.85 Difference 0.00 OKAY Prepared:. Jessica williams 12/19/23 Approved: Calla Johnson). .12/19/23. ONBank CLOUD 9 LTD. Online Banking EFT payments for December 19, 2023 Passcode accepted: Carla Johnson EFT 635 Wide Road Specialty Retailer $6, 130.61 EFT 636 Cross Country Sports $1,456.18 EFT 637 Foot Locker $6,288.06 Total $13,874.85In a separate contractual arrangement, Cloud 9 Ltd. has signed Kevin McDonald, the captain of the Thompson Thunders, as spokesperson for the brand. This arrangement allows Cloud 9 Ltd. to use Kevin's image to promote and build the brand in Canada. To further establish the brand, the first Cloud 9 retail store was opened in Toronto on June 1, 2023. The store operates on a just-in-time inventory system linked with the main A-1 bapp01 indd 1 8/4/20 2:12 PM APP A_Moroney4e_3PP L LUMINA DATAMATICS A-2 AppendixA warehouse in Richmond. However, the management team reports that there have been a few hiccups in determining ideal inventory quantities for the store to allow optimum availabil ity of merchandise to the customers. There have also been some thefts of merchandise from the store and in order to reduce inventory loss by theft, the company has installed closed-circuit television cameras. Personnel Cloud 9 Ltd. has 52 full-time employees. In the retail store, the company employs part-time staff, with casual employees enhancing staff levels in the busier retail period. To administer the company's finances, Cloud 9 Ltd. employs Finance Director David Col- lier, Financial Controller Carla Johnson, and Business Systems Manager Justin Reeves. These three employees are entitled to participate in the employee share purchase plan and receive stock options in Cloud 9 Inc. if revenue targets are met. Financial Information Responding to pressure from its parent company, Cloud 9 Lid. set a goal of increasing its rev- enue by 3 percent for the 2023 fiscal year. One of the critical success factors for the company achieving this 3-percent increase is to grow its share of the North American footwear market. However, with the new store opening and the subsequent increase in costs, as well as the costs related to the sponsorship deals, the management team is projecting a loss for the year.In addition, to build customer loyalty and promote sales in the retail store, Cloud 9 Ltd. introduced a loyalty program whereby customers earn one point for every $10 that they spend. Customers can then redeem points by going online to receive coupons that can be exchanged for merchandise in the store. On October 1, 2022, the company took out an additional loan of $2 million with Ontario Bank to help fund the store costs and to purchase additional delivery trucks and vans. This loan is repayable over five years. The company's other debt relates to loans issued five years ago from a company that is majority-owned by one of the directors. All inventory is purchased in U.S. dollars, which the company translates into Canadian dollars. The company provides a 12-month warranty on all footwear. Historical claims have been 2 percent of total sales. The prior-year income statement and balance sheet are included below. CLOUD 9 LTD. Income Statement Year ended December 31, 2022 2022 2021 Revenue $ 33,987,595 $ 31,901,288 Cost of goods sold 16,393,394 14,355,579 Gross profi 17,594,201 17,545,709 Other expenses 16,476,833 16,293,621 Income from operations 1,117,368 1,252,088 Other income 312,447 212,990 Income before taxes 1,429,815 1,465,078 Income tax expense 378,074 452,064 Net income $ 1,051,741 $ 1,013,014 pp01 indd 2 8/4/20 2:12 PM APP A_Moroney4e_3PP L LUMINA DATAMATICS Appendix A A-3CLOUD 9 LTD. Balance Sheet As at December 31, 2022 2022 2021 Assets Current assets Cash $ 1,753,765 $ 534,938 Accounts receivable 9,361,402 9,608,742 Inventory 6,163,242 6,796,990 Prepaid expenses 666,054 1, 135,416 Total current assets 17,944,463 18,076,086 Due from parent company 482,306 482,306 Plant and equipment 852,965 301,667 Deferred tax asset 277,559 326,218 Total assets $ 19,557,293 $ 19,186,277 Liabilities and Shareholders' Equity Current liabilities Accounts payable 1,709,580 $ 3,402,045 Accrued liabilities 1,860,627 3,077,879 Current tax liability 207,893 12,391 Total current liabilities 3,778, 100 6,492,315 Long-term debt 9,560,224 7,560,224 Deferred taxes 170,284 136,794 Total liabilities 13,508,608 14,189,333 Shareholders' equity Share capital 5,448,026 5,448,026 Retained earnings 600.659 (451,082) Total liabilities and shareholders' equity $ 19,557,293 $ 19,186,277 Following are the December 2023 trial balance for Cloud 9 Lid., a draft statement of income for 2023, a transcript of a meeting with Carla Johnson (Cloud 9 Ltd. financial controller), and sales and cash control testing support.A-4 AppendixA CLOUD 9 LTD. Trial Balance December 31, 2023 December 31, 2022 DR CR DR CR Cash-operating account 184,679 551,583 Cash-savings account 60,000 1,200,000 Petty cash 1,786 2,182 Cash-store locations 500 Trade receivables-stores 217,649 Trade receivables-wholesale 10,604,933 9,879,175 Allowance for doubtful accounts 468,197 637, 167 Miscellaneous receivables 44,789 49,372 HST receivable 31,457 70,022 Inventory 5,788,922 6,057,752 Goods in transit 453,002 629,235 Allowance for inventory obsolescence 417,788 523,745 Amounts receivable from parent 482,306 482,306 Prepaid rent 300,450 211,699 Prepaid insurance 765,702 417,603 Other prepaid expenses 45,876 36,752 Furniture and equipment 1,768,954 1,098,290 Accumulated depreciation- furniture and equipment 1,283,848 757,958 Leasehold improvements 1,324,875 722,302 Accumulated depreciation- leasehold improvements 360,650 209,669 Deferred tax assets 271,659 277,559 Trade payables 2,179,603 1,215,219 Accrued bonuses 300,000 250,000 Sales commissions payable 423,786 398,074 Other accrued expenses 715,103 943,972 Intercompany payables 593,457 494,361 Accrued vacation payable 156,548 182,984 Loyalty program provision 62,456 Current income tax payable 159,866 207,893 Warranty liability 91,456 85,597 Long-term debt 8,872,482 9,560,224 Deferred income taxes 198,647 170,284 Share capital 5,448,026 5,448,026 Retained earnings 600,659 451,082 Revenue-stores 854,376 Revenue-wholesale 36,340,556 33,987,595 (continued)(continued) CLOUD 9 LTD. Trial Balance December 31, 2023 December 31, 2022 DR CR DR CR Interest from bank 60,576 28,642 Foreign exchange gain/loss 47.289 29,568 Proceeds on disposals 7,714 Other revenue 251,453 246,523 Cost of goods sold-stores 640,781 Cost of goods sold-wholesale 16,453,395 16,393,394 Salaries and employee benefits 5,044,460 4,842,343 Storage-rent expense, store 166,667 Storage-rent expense, warehouse 2,959,257 2,959,257 Distribution expenses 2,038,255 2,008,015 Telephone 59,537 Computer and IT costs 252,469 450,907 Advertising and promotion-print 1,685,812 1,046,668 Trade shows 327,687 384,934 Advertising and promotion-TV 841,901 496,996 Advertising and promotion- sponsorships 1,713,008 Rent expense-office 309,170 309, 170 Bad debt expense 75,712 120,000 Depreciation-furniture and equipment 701,187 339,852 Depreciation-leasehold improvements 201,309 96,326 Entertainment 220,576 320,703 Professional fees 318,205 458,903 Insurance expense 2,153,461 1,597,463 Recruitment 352,436 343,720 Interest expense-loan from bank 1,017,583 701,576 Income tax expense 6,415 378,074 59,886,822 59,886.822 55,385,215 55,385,215 Draft Income Statement December 31, 2023 Revenue $ 37,194,932 Cost of goods sold 17,094, 176 Gross profit 20,100,756 Other expenses 20,438,692 Loss from operations (337,936) Other income 359,318 Net income before taxes 21,382 Income tax expense 6,415 Net income $ 14,967TRANSCRIPT OF MEETING WITH CARLA JOHNSON Present: Carla Johnson, Financial Controller, Cloud 9 Ltd. Josh Thomas, Audit Senior, W&S Partners JT: Thanks for seeing me, Carla. CJ: You're welcome, Josh. What can I do for you? JT: I need to ask you some questions about Cloud 9's process for recording wholesale revenue transactions, including the trade receivables and cash receipts aspects. After I understand the process, I'll need to select a sample transaction to confirm my understanding of the process as you have explained. CJ: Well, I can tell you what should be happening, but you may want to go and speak to the sales manager or warehouse managers to confirm that they do what the company policy and procedures say. JT Good point, I'll make appointments to see them. Thanks. So let's start at the beginning-how does a sales transaction get initiated? CJ: We've got a pretty complex inventory management software system called Swift. It was designed by some of our tech guys in the United States. It tracks and does everything! JT: Sounds impressive! CJ: Anyway, the customers-let's say the Sport Mart store in Toronto-complete a purchase order online through a site that is linked to Swift. JT: How do the customers decide the quantity and know the price? CJ: Swift is linked (don't ask me how) and sends an alert when the inventory balance of our products gets below the predetermined limit they set with us. They can select the quantity based on their needs, but the prices are set in the system. They get sent price lists from the sales manager so they know the current prices. JT: How often are prices changed? CJ: Depends on the market, really. They don't change too frequently. JT: What if you don't have the products? CJ: The system doesn't allow them to place an order greater than our current inventory levels. If they need more, they need to fill out a separate request form that gets emailed to our warehouse manager so she can place the order with China. JT: OK, so they complete a purchase order. Then what? CJ: The submitted purchase order goes through a credit check and then becomes a sales order. That's all done behind the scenes in the system. We really don't see anything on our side until the sales order stage. JT: Guess that saves a lot of time and trees! CJ: Yeah, there's so much that we rely on the system to do for us, it's scary. If we were hit by an electrical storm, we'd be in trouble. JT: What happens to the sales orders-how do they get filled? CJ: Every day, the warehouse manager downloads the outstanding sales orders to these little hand-held computer/scanner thingies. It's very Star Trek. Warehouse personnel use these to select the items off the shelves onto pallets. The pallets are taken to a staging area where each product is then scanned. This establishes the shipping document in Swift, which then gets printed for the delivery. JT Are the shipping documents approved before the goods go out the door? How do you know that what got sent is what was ordered? CJ: Swift matches the quantities and products on the shipping document to the sales order. Once they match, the approval box is activated and the shipping supervisor can enter his pass code. This officially approves the shipping document and it gets printed.JT: How many orders do you fill in a day? It sounds like a lot for one person to do. CJ: We probably complete about 50 orders a day. Shoes aren't perishable items, you know, so it's not like we are sending products to every store, every day. We're trying out the "pit crew" concept, where there's two shipping supervisors with about four to five warehouse employees in their crew team. So they are in the staging area with them and do it right there with the hand-held devices. They like to have little contests to see who can do it the fastest. You should go down there; it's quite a lively group. David encourages it and it's been great for productivity and morale. JT: Sounds like a great working environment. Better than being stuck in a broom closet sifting through invoices! CJ: Ah, the life of an auditor. I remember the good old days . . . JT: And the goods are sent out on your own trucks? CJ: That's right. We've bought our own trucks and vans rather than relying on couriers. The drivers pick up their loads in the morning and bring back anything undelivered. Because shoes are an easy product to off-load, we have to be careful about theft. So nothing can be left in the back of a truck at the end of the day. It comes back here and gets locked up in the shipping cage until it can be delivered again. JT: Why would goods be undelivered? CJ: Sometimes the drivers get behind or the store is closed unexpectedly. So there are occasions when all the goods won't get delivered in the day. JT: OK, so once the goods are delivered to the customer, how do you bill them? CJ: The drivers have the customers sign for the goods and then give us the signed copy. We go into the billing system and pull up the draft invoice that was generated when the shipping document was approved. We match the quantities in the invoice against the shipping document and confirm customer sign-off. This way, we only bill for those goods that were actually received by the customer. At 4 p.m., we do a batch run for the day. The copy is stapled to the signed shipping document and put on file. The running of the batch run posts the invoices to the sales journal and accounts receivable subledger. JT: Does finance ever go back to the sales order? CJ: No. Since a shipping document can't get generated unless it agrees to the sales order, we don't go back that far into the process. Why, do you think we have to? JT: I wouldn't say so at this stage. But you'd have to be sure to have some tight controls around Swift, given that it seems to do everything. CJ: Like I said, it does everything. JT: What is the cash receipts process? CJ: We get most payments via EFT, so my AR clerk downloads the previous day's receipts from online banking. She then goes into the subledger to post the receipts against the customer accounts. When she's finished posting each entry, she runs a batch report of all postings and reconciles it back to the bank statement. I review that reconciliation and sign off. JT: Are bank reconciliations done in a timely manner? CJ: I do bank recs each month for the operating and savings accounts. David reviews and approves them. Keep in mind what I just explained is for the wholesale transactions. We have separate procedures for the store regarding daily cash balance reconciliations to the deposits in the operating bank account. JT: Yes, our graduate will be handling the store side of the sales to cash receipts process. They will probably come and talk to you in a day or two. Well, I think that should do it for now. I may have some follow-up questions for you as I start getting my head around all of this. CJ: Door's always open. JT: Thanks for your time.CLOUD 9 LTD. SALES INVOICE TO: David Jones 23 Main St, Shop 43 Toronto, ON 132811 Swift Purchase order reference: P00132811 October 13, 2023 Shipping reference: D00132811 Code Description Qty Price per unit Total price 786541 Heavenly 456 - Women 9 $114.74 $573.70 786540 Heavenly 456 - Women 8 $114.74 $344.22 Total $917.92 HST $119.33 TOTAL $1,037.25 Payment due on November 27, 2023 CLOUD 9 LTD. SHIPPING DOCUMENT TO: David Jones DO0132811 123 Main St, Shop 43 Toronto, ON Swift Purchase order reference: P00132811 Authorized: YES October 12, 2023 Code Description Qty 786541 Heavenly 456 - Women 9 786540 Heavenly 456 - Women 8 Driver: R. Williams I declare that all goods were received and no damage noted. Customer Signature:... Sally Rose .. 10/12/23. CLOUD 9 LTD. SALES INVOICE TO: Rebel Sports - World Square 680 George Street, Shop 12 Barrie, ON 133410 Swift Purchase order reference: P00133410 October 27, 2023 Shipping reference: D00133410 Code Description Qty Price per unit Total price 587241 Maximum Speed - Men 12 $123.56 $494.24 786540 Heavenly 456 - Women 8 $114.74 $229.48 Total $723.72 HST $94.08 TOTAL $817.80 Payment due on December 11, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts