Question: Cloud Consulting Company Will start using the the Sage 300 Accounts Payable, Bank Services and the Tax Services modules from January 31, 2024. The TD

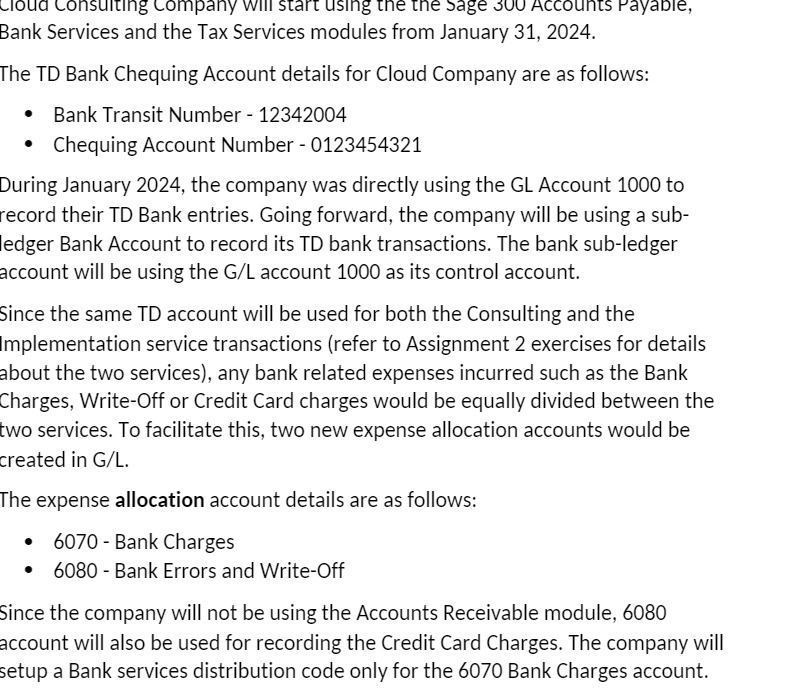

Cloud Consulting Company Will start using the the Sage 300 Accounts Payable, Bank Services and the Tax Services modules from January 31, 2024. The TD Bank Chequing Account details for Cloud Company are as follows: . Bank Transit Number - 12342004 . Chequing Account Number - 0123454321 During January 2024, the company was directly using the GL Account 1000 to ecord their TD Bank entries. Going forward, the company will be using a sub- edger Bank Account to record its TD bank transactions. The bank sub-ledger account will be using the G/L account 1000 as its control account. Since the same TD account will be used for both the Consulting and the Implementation service transactions (refer to Assignment 2 exercises for details about the two services), any bank related expenses incurred such as the Bank Charges, Write-Off or Credit Card charges would be equally divided between the two services. To facilitate this, two new expense allocation accounts would be created in G/L. The expense allocation account details are as follows: . 6070 - Bank Charges . 6080 - Bank Errors and Write-Off Since the company will not be using the Accounts Receivable module, 6080 account will also be used for recording the Credit Card Charges. The company will setup a Bank services distribution code only for the 6070 Bank Charges account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts