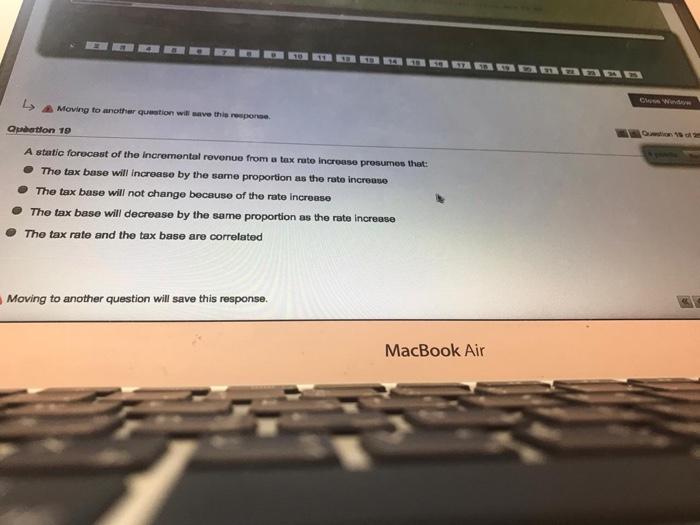

Question: CM Wed Moving to another question will save the response Quadron 19 A static forucast of the incremental revenue from a tax rate increase presumes

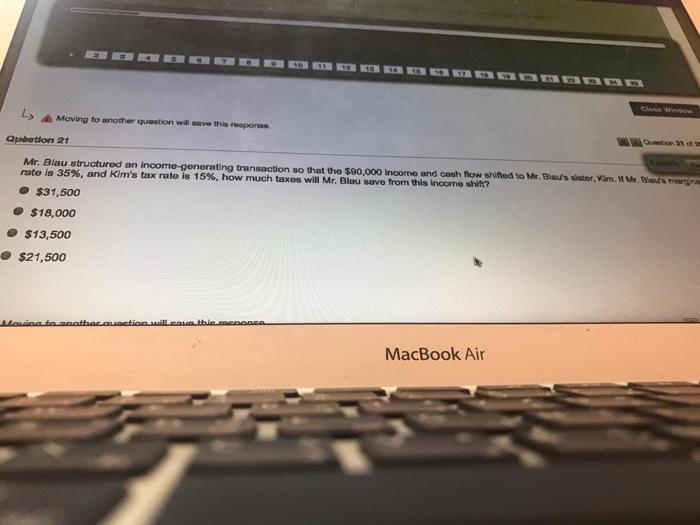

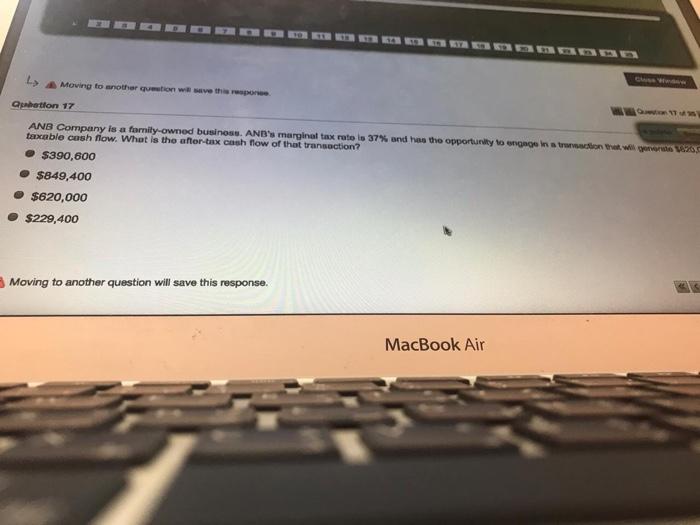

CM Wed Moving to another question will save the response Quadron 19 A static forucast of the incremental revenue from a tax rate increase presumes that: The tax base will increase by the same proportion as the rate increase The tax base will not change because of the rate increase The tax base will decrease by the same proportion as the rate increase The tax rate and the tax base are correlated Moving to another question will save this response. MacBook Air Moving to another question will save the response Qurbation 21 Mr. Blau structured an income-generating transaction so that the $90,000 Income and cash flow shifted to Mr. Blau's, lade rate is 35%, and Kim's tax rate is 15%, how much taxes will Mr. Blou sove from this income shift? $31,500 $18,000 $13,500 $21,500 Mandag.tagnatbarauation will come the DBADDA MacBook Air L> Moving to another Womation was the respons Quatlon 17 ANB Company is a family-owned business. ANB's marginal tax rate is 37% and has the opportunity to wrong is won the wil geword Voz taxable cash flow. What is the after-tax cash flow of that transaction? $390,600 $849,400 $620,000 $229,400 Moving to another question will save this response. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts