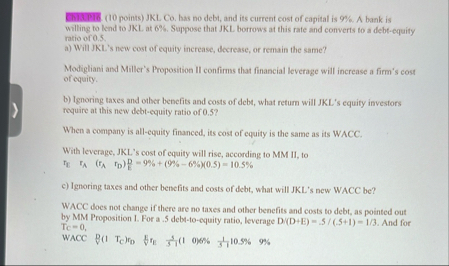

Question: CMAEPR ( 1 0 points ) JKL . Co . has no debt, and its current cost of capital is 9 % , A bank

CMAEPR points JKL Co has no debt, and its current cost of capital is A bank is willing to kend to JKL at Suppose that JKL borrows at this rate and converts to a debtequity natio of

a Will JKLs new cost of equity increase, decrease, or remain the same?

Modigliani and Miller's Proposition II confirms that financial leverage will increase a firm's cost of equity.

b Ignoring taxes and other benefits and costs of debt, what return will JKLs equity investors require at this new debtequity ratio of

When a company is allequity financed, its cost of equity is the same as its WACC.

With leverage, JKLs cost of equity will rise, according to MM II to

c Ignoring taxes and other benefits and costs of debt, what will JKLs new WACC be

WACC does not change if there are no taxes and other benefits and costs to debt, as pointed out by MM Proposition I. For a debttoequity ratio, leverage And for

WACC

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock