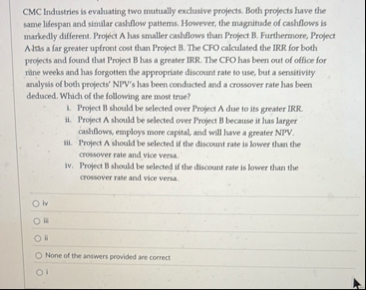

Question: CMC Industries is evaluating two mutually exchaive projects. Both projects have the tame lifespant and stmflar cahflow patterns. However, the magnitude of cashflows is markedly

CMC Industries is evaluating two mutually exchaive projects. Both projects have the tame lifespant and stmflar cahflow patterns. However, the magnitude of cashflows is markedly different. Project A has smaller calhlows than Profect B Furthermore, Project Alas a far greater upfront cost than Project B The CFO calculated the IRR for both profects and found that Project B has a greater IRR. The CFO has been out of office for rine weeks and has forgotien the appropriate discount rate to use, but a sensitivity analysis of both profects' NPVs has been conducted and a crossover rate has been deduced. Which of the following are most true?

i Project B should be selected over Profect A due to its greater IRR.

ii Project A should be selected over Profect B because it has larger cashflows, employs more capital, and will have a greater NPV

iii. Project A should be selected if the discount rate is lower than the crossover rate and vice vers.

iv Project B should be selected if the discount rate is lower than the crossover rate and vice versa.

iv

Fif

Hone of the answers provided are correct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock