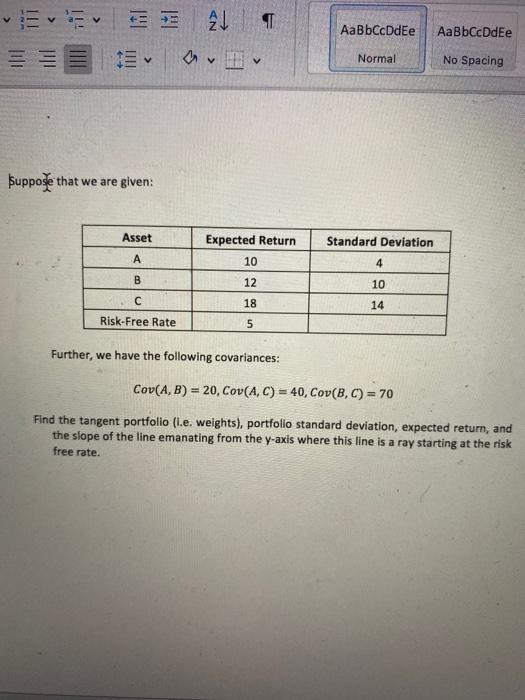

Question: CN AL AaBbCcDdEe AaBbCcDdEe 19 Normal No Spacing Suppose that we are given: Asset Standard Deviation Expected Return 10 4 B 12 10 C 18

CN AL AaBbCcDdEe AaBbCcDdEe 19 Normal No Spacing Suppose that we are given: Asset Standard Deviation Expected Return 10 4 B 12 10 C 18 14 Risk-Free Rate 5 Further, we have the following covariances: Cov(A,B) = 20, Cov(A,C) = 40, Cov(B,C) = 70 Find the tangent portfolio (I.e. weights), portfolio standard deviation, expected return, and the slope of the line emanating from the y-axis where this line is a ray starting at the risk free rate. CN AL AaBbCcDdEe AaBbCcDdEe 19 Normal No Spacing Suppose that we are given: Asset Standard Deviation Expected Return 10 4 B 12 10 C 18 14 Risk-Free Rate 5 Further, we have the following covariances: Cov(A,B) = 20, Cov(A,C) = 40, Cov(B,C) = 70 Find the tangent portfolio (I.e. weights), portfolio standard deviation, expected return, and the slope of the line emanating from the y-axis where this line is a ray starting at the risk free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts