Question: CN Now explore the variables that we will use when we go to the calculator. Match each of the Time Value of Money Calculator buttons

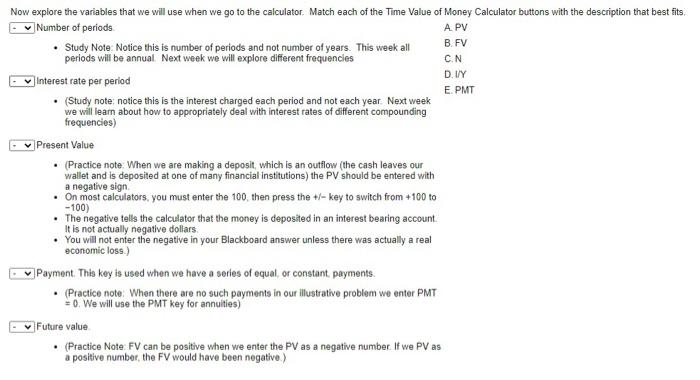

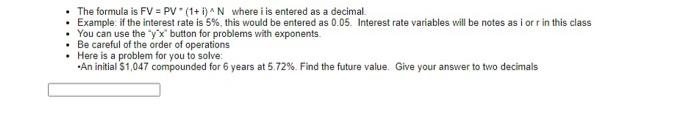

CN Now explore the variables that we will use when we go to the calculator. Match each of the Time Value of Money Calculator buttons with the description that best fits Number of periods APV Study Note: Notice this is number of periods and not number of years. This week all B.FV periods will be annual Next week we will explore different frequencies DIY Interest rate per period E. PMT . (Study note notice this is the interest charged each period and not each year. Next week we will learn about how to appropriately deal with interest rates of different compounding frequencies) Present Value (Practice note: When we are making a deposit, which is an outflow (the cash leaves our wallet and is deposited at one of many financial institutions) the PV should be entered with a negative sign . On most calculators, you must enter the 100, then press the +/- key to switch from +100 to -100) The negative tells the calculator that the money is deposited in an interest bearing account. It is not actually negative dollars. You will not enter the negative in your Blackboard answer unless there was actually a real economic loss) Payment. This key is used when we have a series of equal, or constant, payments Practice note. When there are no such payments in our illustrative problem we enter PMT +0. We will use the PMT key for annuities) Future value (Practice Note: FV can be positive when we enter the PV as a negative number. If we PV as a positive number, the FV would have been negative.) The formula is FV = PV (1+i)-N where i is entered as a decimal Example if the interest rate is 5%, this would be entered as 0.05. Interest rate variables will be notes as i orr in this class You can use theyx button for problems with exponents Be careful of the order of operations Here is a problem for you to solve: An initial $1,047 compounded for 6 years at 5.72%. Find the future value. Give your answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts