Question: . CNN, FOX cal - Sid deviatico o to E Question 2 15 pts Alpha Inc. currently has a target capital structure of 60% equity

.

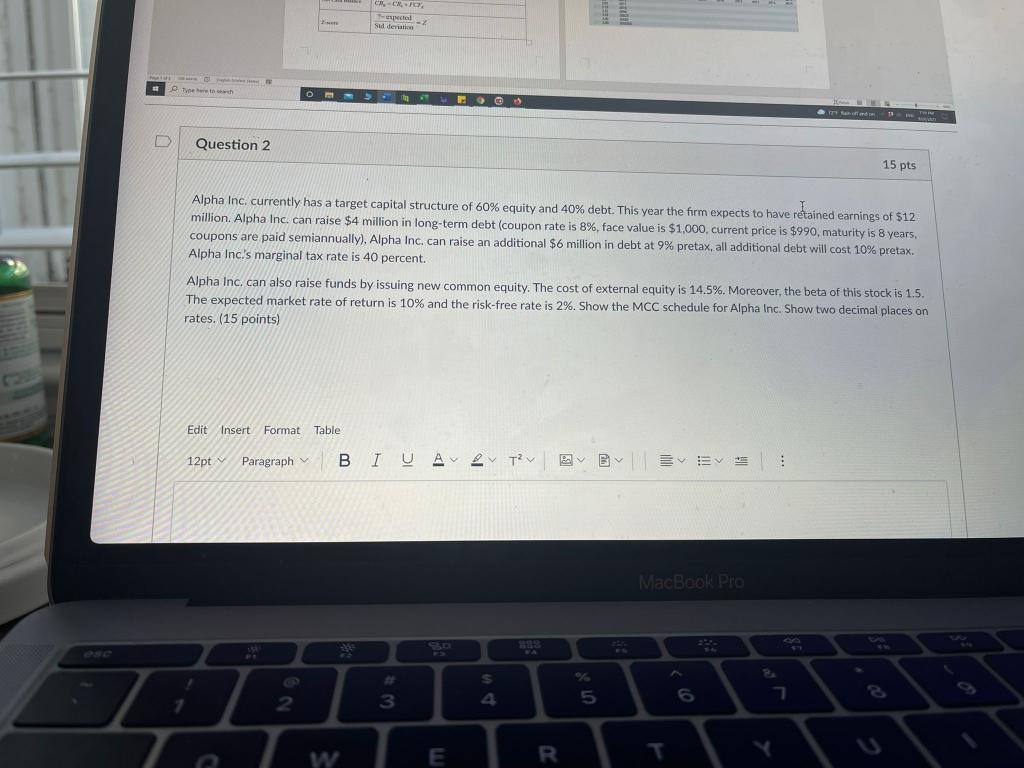

CNN, FOX cal - Sid deviatico o to E Question 2 15 pts Alpha Inc. currently has a target capital structure of 60% equity and 40% debt. This year the firm expects to have retained earnings of $12 million. Alpha Inc. can raise $4 million in long-term debt (coupon rate is 8%, face value is $1,000, current price is $990, maturity is 8 years, coupons are paid semiannually), Alpha Inc. can raise an additional $6 million in debt at 9% pretax, all additional debt will cost 10% pretax. Alpha Inc.'s marginal tax rate is 40 percent. Alpha Inc. can also raise funds by issuing new common equity. The cost of external equity is 14.5%. Moreover, the beta of this stock is 1.5. The expected market rate of return is 10% and the risk-free rate is 2%. Show the MCC schedule for Alpha Inc. Show two decimal places on rates. (15 points) Edit Insert Format Table 12pt Paragraph BI V A2 TV A B vs : MacBook Pro SEE S 4 2 3 5 T w E R T CNN, FOX cal - Sid deviatico o to E Question 2 15 pts Alpha Inc. currently has a target capital structure of 60% equity and 40% debt. This year the firm expects to have retained earnings of $12 million. Alpha Inc. can raise $4 million in long-term debt (coupon rate is 8%, face value is $1,000, current price is $990, maturity is 8 years, coupons are paid semiannually), Alpha Inc. can raise an additional $6 million in debt at 9% pretax, all additional debt will cost 10% pretax. Alpha Inc.'s marginal tax rate is 40 percent. Alpha Inc. can also raise funds by issuing new common equity. The cost of external equity is 14.5%. Moreover, the beta of this stock is 1.5. The expected market rate of return is 10% and the risk-free rate is 2%. Show the MCC schedule for Alpha Inc. Show two decimal places on rates. (15 points) Edit Insert Format Table 12pt Paragraph BI V A2 TV A B vs : MacBook Pro SEE S 4 2 3 5 T w E R T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts