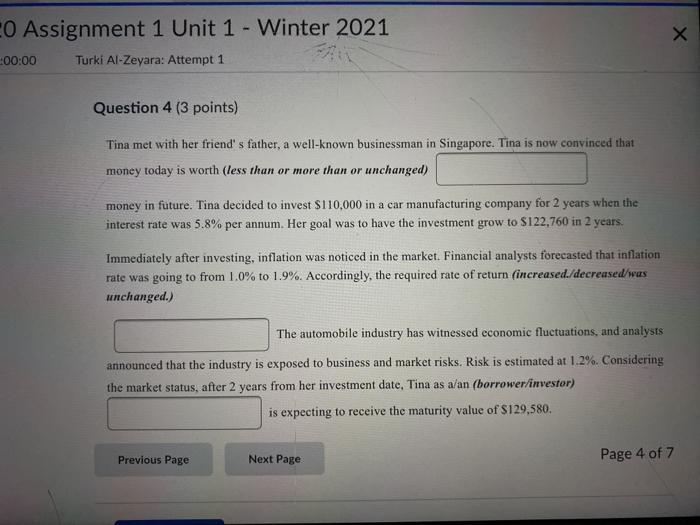

Question: CO Assignment 1 Unit 1 - Winter 2021 00:00 Turki Al-Zeyara: Attempt 1 Question 4 (3 points) Tina met with her friend's father, a well-known

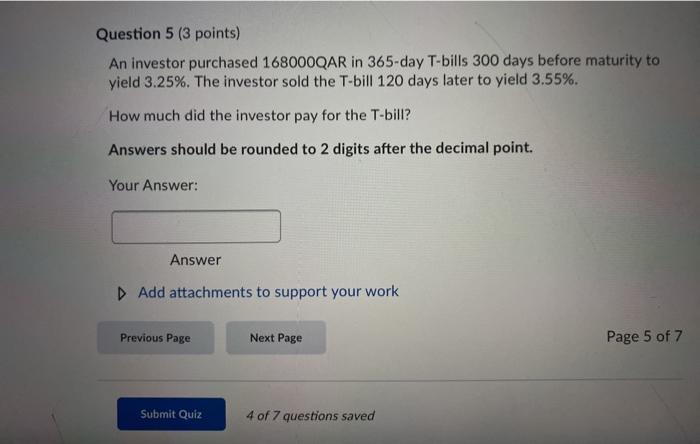

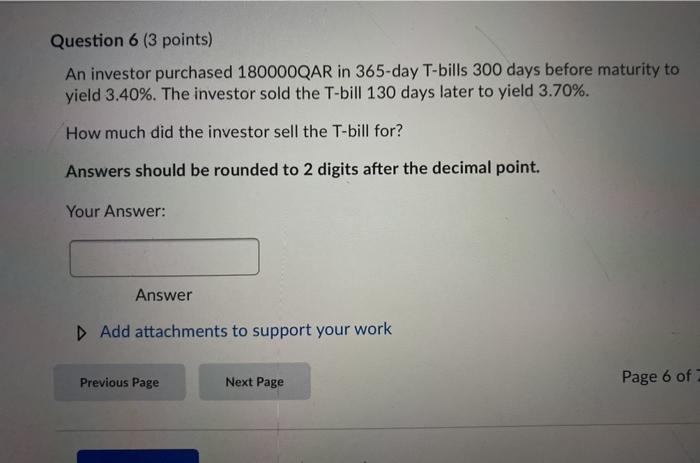

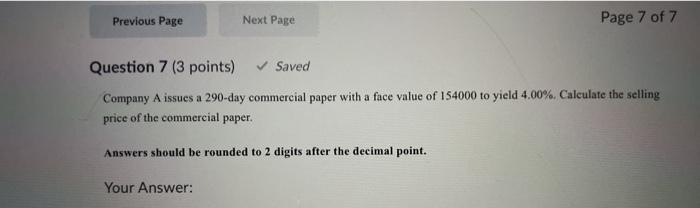

CO Assignment 1 Unit 1 - Winter 2021 00:00 Turki Al-Zeyara: Attempt 1 Question 4 (3 points) Tina met with her friend's father, a well-known businessman in Singapore. Tina is now convinced that money today is worth (less than or more than or unchanged) money in future. Tina decided to invest $110,000 in a car manufacturing company for 2 years when the interest rate was 5.8% per annum. Her goal was to have the investment grow to $122,760 in 2 years. Immediately after investing, inflation was noticed in the market. Financial analysts forecasted that inflation rate was going to from 1.0% to 1.9%. Accordingly, the required rate of return (increased./decreased was unchanged.) The automobile industry has witnessed economic fluctuations, and analysts announced that the industry is exposed to business and market risks. Risk is estimated at 1.2%. Considering the market status, after 2 years from her investment date, Tina as a/an (borrower/investor) is expecting to receive the maturity value of $129.580. Previous Page Next Page Page 4 of 7 Question 5 (3 points) An investor purchased 168000QAR in 365-day T-bills 300 days before maturity to yield 3.25%. The investor sold the T-bill 120 days later to yield 3.55%. How much did the investor pay for the T-bill? Answers should be rounded to 2 digits after the decimal point. Your Answer: Answer Add attachments to support your work Previous Page Next Page Page 5 of 7 Submit Quiz 4 of 7 questions saved Question 6 (3 points) An investor purchased 180000QAR in 365-day T-bills 300 days before maturity to yield 3.40%. The investor sold the T-bill 130 days later to yield 3.70%. How much did the investor sell the T-bill for? Answers should be rounded to 2 digits after the decimal point. Your Answer: Answer Add attachments to support your work Previous Page Next Page Page 6 of Previous Page Next Page Page 7 of 7 Question 7 (3 points) Saved Company A issues a 290-day commercial paper with a face value of 154000 to yield 4.00%. Calculate the selling price of the commercial paper. Answers should be rounded to 2 digits after the decimal point. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts