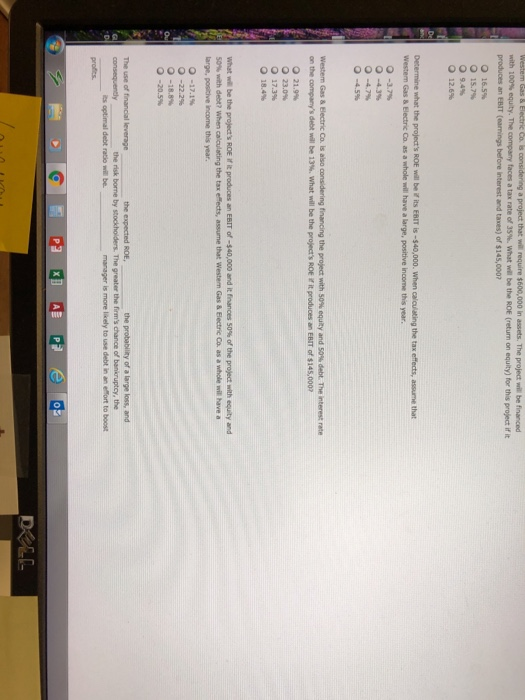

Question: Co. is considering a project that will require $600,000 in assets. The project will be financed with 100% equity. The ompany faces a tax rate

Co. is considering a project that will require $600,000 in assets. The project will be financed with 100% equity. The ompany faces a tax rate of 35%, what w. be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $145,000 o 16.5% 15.7% 9.4% 12.6% the tax Westem Gas & Electric Co as a whole will have a large, positive income this year. 0-17% 0-4.3% 0-47% 0-45% westem Gas & ectric Co. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 13%. what wil' be the project's ROE if it produces an EBIT of $145,000 21.9% 23.0% 17.3% 18.4% what wa be the project's ROE ritproduces an EBIT of-$40,000 and it finances 50% ofthe project with equity and 50% with debt? when aalating the tax efects, assume that westem Gas & Bectre Co. as a whole will have a large, positive income this year. 9-171% -22.2% Q-18.8% the expected ROE the probability of a large loss, and manager is more likely to use debt in an efort to boost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts