Question: CO U 38 Chrome File Edit View History Bookmarks Profiles Tab Window Quiz: [Homework] Week 9B X M Inbox - jobany99@gmail.com - X utah.instructure.com/courses/834235/quizzes/2900020/take

![Quiz: [Homework] Week 9B X M Inbox - jobany99@gmail.com - X utah.instructure.com/courses/834235/quizzes/2900020/take](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/01/65b77cd4cd46f_86065b77cd499f9e.jpg)

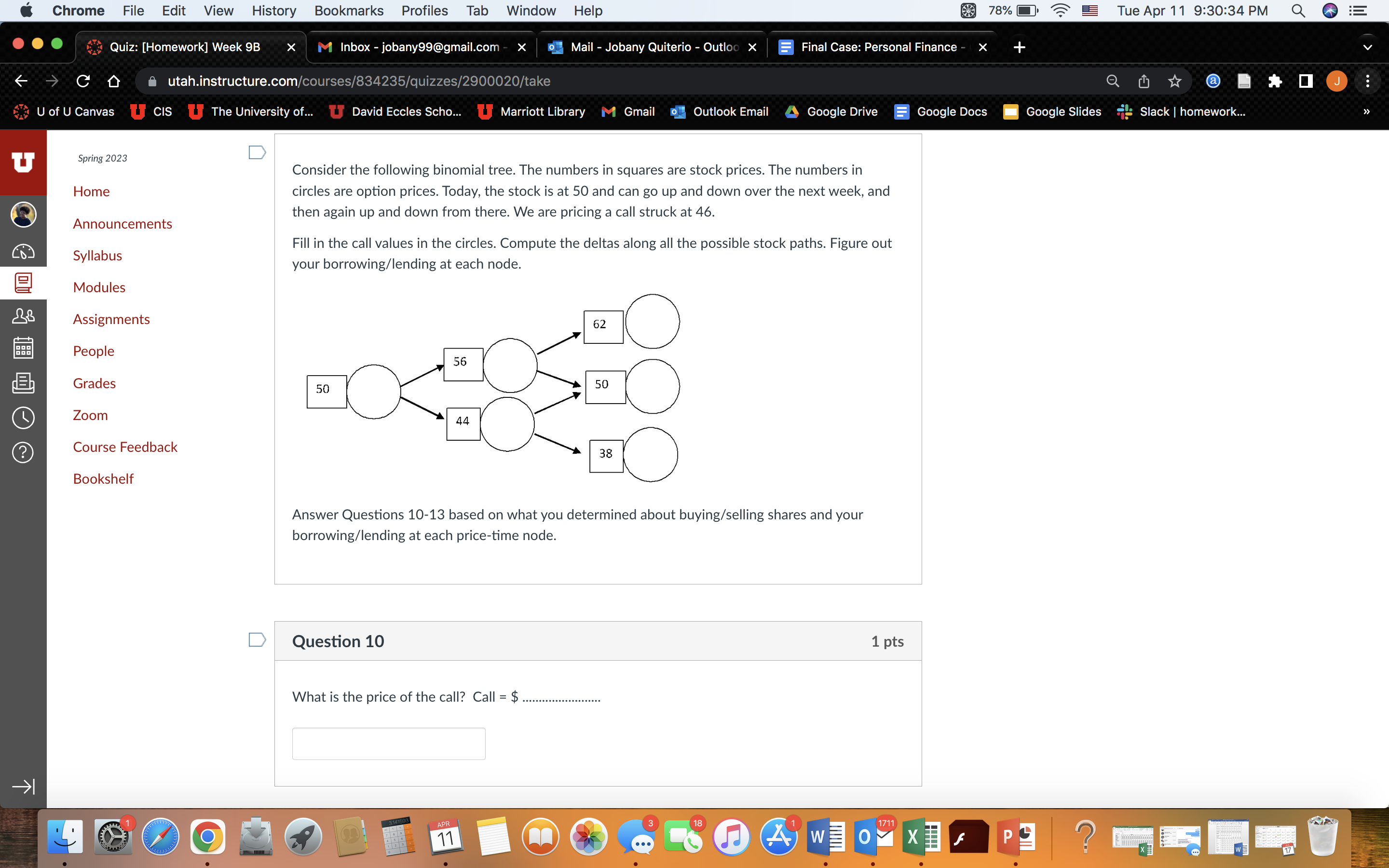

CO U 38 Chrome File Edit View History Bookmarks Profiles Tab Window Quiz: [Homework] Week 9B X M Inbox - jobany99@gmail.com - X utah.instructure.com/courses/834235/quizzes/2900020/take The University of... U David Eccles Scho... U of U Canvas Spring 2023 Home Announcements Syllabus Modules Assignments People Grades Zoom CIS Course Feedback Bookshelf www delald O. 50 Question 10 Consider the following binomial tree. The numbers in squares are stock prices. The numbers in circles are option prices. Today, the stock is at 50 and can go up and down over the next week, and then again up and down from there. We are pricing a call struck at 46. 3141593 Fill in the call values in the circles. Compute the deltas along all the possible stock paths. Figure out your borrowing/lending at each node. 56 789 456 1 2 3 Help 44 What is the price of the call? Call = $ APR 11 Mail - Jobany Quiterio - Outloo X U Marriott Library Gmail 62 50 38 O Answer Questions 10-13 based on what you determined about buying/selling shares and your borrowing/lending at each price-time node. Outlook Email O Final Case: Personal Finance - 3 Google Drive 18 A W 1 pts 1711 Google Docs X H f 78% X P Google Slides Tue Apr 11 9:30:34 PM (a) Slack | homework... 17 III J : >>> CO U 38 Chrome File Edit View History Bookmarks Profiles Tab Window Quiz: [Homework] Week 9B X M Inbox - jobany99@gmail.com - X utah.instructure.com/courses/834235/quizzes/2900020/take The University of... U David Eccles Scho... U of U Canvas Spring 2023 Home Announcements Syllabus Modules Assignments People Grades Zoom CIS Course Feedback Bookshelf www delald O. Question 11 Question 12 Question 13 Help 3141593 Mail - Jobany Quiterio- Outloo X 789 456 1 2 3 Marriott Library You sold a call on one share. Your delta hedge will cause you to borrow $...................... net of the premium you received. APR 11 Gmail Outlook Email One period later when the stock drops to $44, you adjust your delta hedge. After the re-hedging, your net borrowing is $............ Final Case: Personal Finance - 71 Google Drive One period later, the stock goes up to $56 instead. At that time, your delta will change. To cover the change in the delta, you will borrow additional $ to spend it on buying more shares. 18 1 pts 1 pts AW 1 pts 1711 Google Docs X H f 78% X P Google Slides Tue Apr 11 9:30:43 PM (a) Slack | homework... 17 III J : >>>

Step by Step Solution

There are 3 Steps involved in it

The value of a call option at expiry max ST K 0 where ST is the stock price at expiry at K strike pr... View full answer

Get step-by-step solutions from verified subject matter experts