Question: Code in java please, i just need the code i can test it on my own 2. Other deductions like Canadian Pension Plan (CPP), Employment

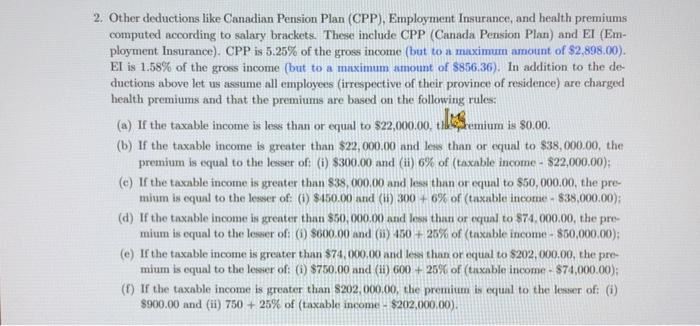

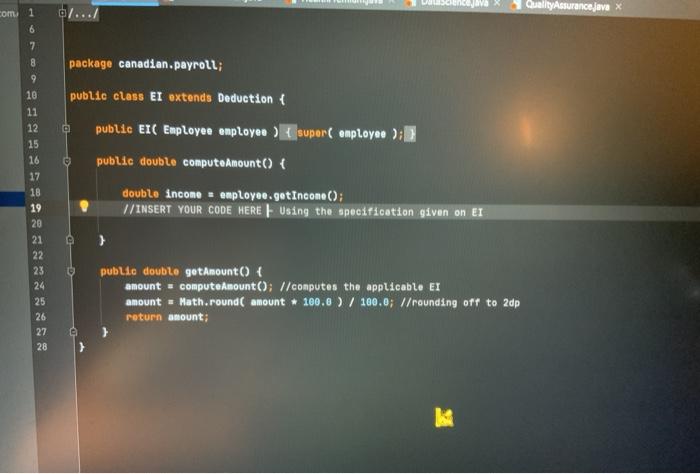

2. Other deductions like Canadian Pension Plan (CPP), Employment Insurance, and health premiums computed according to salary brackets. These include CPP (Canada Pension Plan) and El (Em- ployment Insurance). CPP is 5.25% of the gross income (but to a muximum amount of $2,898.00). El is 1.58% of the gross income (but to a maximum amount of $856.36). In addition to the de ductions above let us assume all employees (irrespective of their province of residence) are charged health premiums and that the premiums are based on the following rules: (a) If the taxable income is less than or equal to $22,000.00 tilsemium is 80.00. (b) If the taxable income is greater than $22,000.00 and less than or equal to $38,000.00, the premium is equal to the lesser of: (i) $300.00 and (ii) 6% of (taxable income - $22,000.00): (e) If the taxable income is greater than $38,000.00 and less than or equal to $50,000.00, the pre- mium is equal to the lesser of: (1) $450.00 and (11) 300 + 6% of (taxable income $38.000.00); (d) If the taxable income is greater than $50,000.00 and less than or equal to $74.000.00, the pre- mium is equal to the lesser of: (1) $600.00 and (ii) 450 +25% of (taxable income - $60,000.00); (e) If the taxable income is greater than $74,000.00 and less than or equal to $202,000.00, the pre- mium is equal to the lesser of: () $750.00 and (ii) 600 + 25% of (taxable income - $74,000.00); (1) If the taxable income is greater than $202,000.00, the premium is equal to the lesser of: (i) $900.00 and (ii) 750 + 25% of (taxable income - $202,000.00). o/.../ Quality Assurance java X package canadian.payroll; 0 com1 6 7 8 9 10 11 12 15 16 17 18 19 20 21 22 23 24 25 26 27 28 public class et extends Deduction { public ETC Employee employee ) { super( employee :) public double computeAmount() { double income = enployee.getIncone(); //INSERT YOUR CODE HERE Using the specification given on EI } public double gotAmount() { amount = computeAmount(); //computes the applicable EI amount = Math.round( amount = 100.0 ) / 100.0; //rounding off to 2dp return arount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts