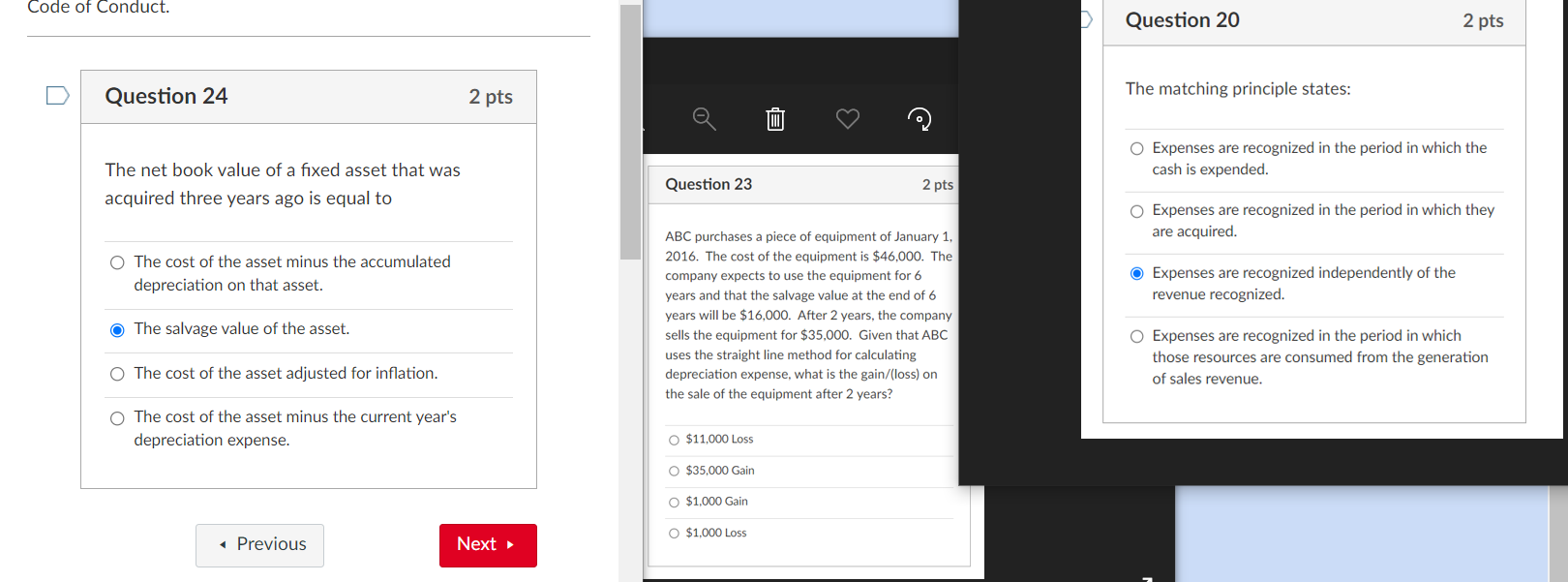

Question: Code of Conduct. Question 24 2 pts 3 D Question 20 The matching principle states: 2 pts The net book value of a fixed

Code of Conduct. Question 24 2 pts 3 D Question 20 The matching principle states: 2 pts The net book value of a fixed asset that was acquired three years ago is equal to The cost of the asset minus the accumulated depreciation on that asset. The salvage value of the asset. The cost of the asset adjusted for inflation. The cost of the asset minus the current year's depreciation expense. Question 23 2 pts ABC purchases a piece of equipment of January 1, 2016. The cost of the equipment is $46,000. The company expects to use the equipment for 6 years and that the salvage value at the end of 6 years will be $16,000. After 2 years, the company sells the equipment for $35,000. Given that ABC uses the straight line method for calculating depreciation expense, what is the gain/(loss) on the sale of the equipment after 2 years? $11,000 Loss $35,000 Gain Expenses are recognized in the period in which the cash is expended. Expenses are recognized in the period in which they are acquired. Expenses are recognized independently of the revenue recognized. Expenses are recognized in the period in which those resources are consumed from the generation of sales revenue. Previous Next $1,000 Gain O $1,000 Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts