Question: Coffeemania is considering leasing a coffee making machine for its recently opened store. The lease agreement requires 7 lease payments in the amount of $6,300

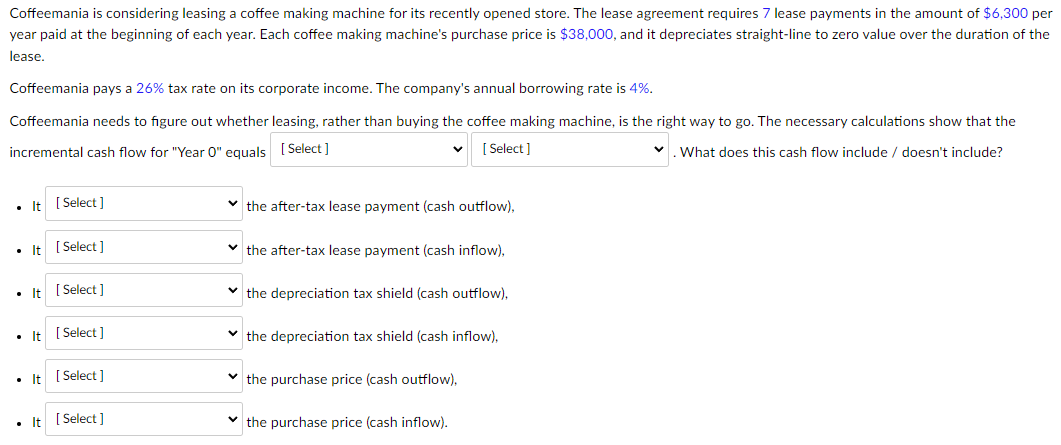

Coffeemania is considering leasing a coffee making machine for its recently opened store. The lease agreement requires 7 lease payments in the amount of $6,300 per year paid at the beginning of each year. Each coffee making machine's purchase price is $38,000, and it depreciates straight-line to zero value over the duration of the lease. Coffeemania pays a 26% tax rate on its corporate income. The company's annual borrowing rate is 4%. Coffeemania needs to figure out whether leasing, rather than buying the coffee making machine, is the right way to go. The necessary calculations show that the incremental cash flow for "Year 0" equals . What does this cash flow include / doesn't include? - It the after-tax lease payment (cash outflow), - It the after-tax lease payment (cash inflow), - It the depreciation tax shield (cash outflow), - It the depreciation tax shield (cash inflow), - It the purchase price (cash outflow), - It the purchase price (cash inflow)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts